July 08, 2016

On June 30, 2016, Cook County Board President Toni Preckwinkle issued a preliminary budget for fiscal year 2017, which begins December 1, 2016 and ends November 30, 2017. The report also provided end of year estimates for fiscal year 2016.

A public hearing on the preliminary FY2017 budget is scheduled for July 19, 2016 at 6:00 p.m. in the Cook County Board Room. Board President Preckwinkle plans to present her final budget proposal for FY2017 in October 2016.

Preliminary FY2017 Budget Forecast

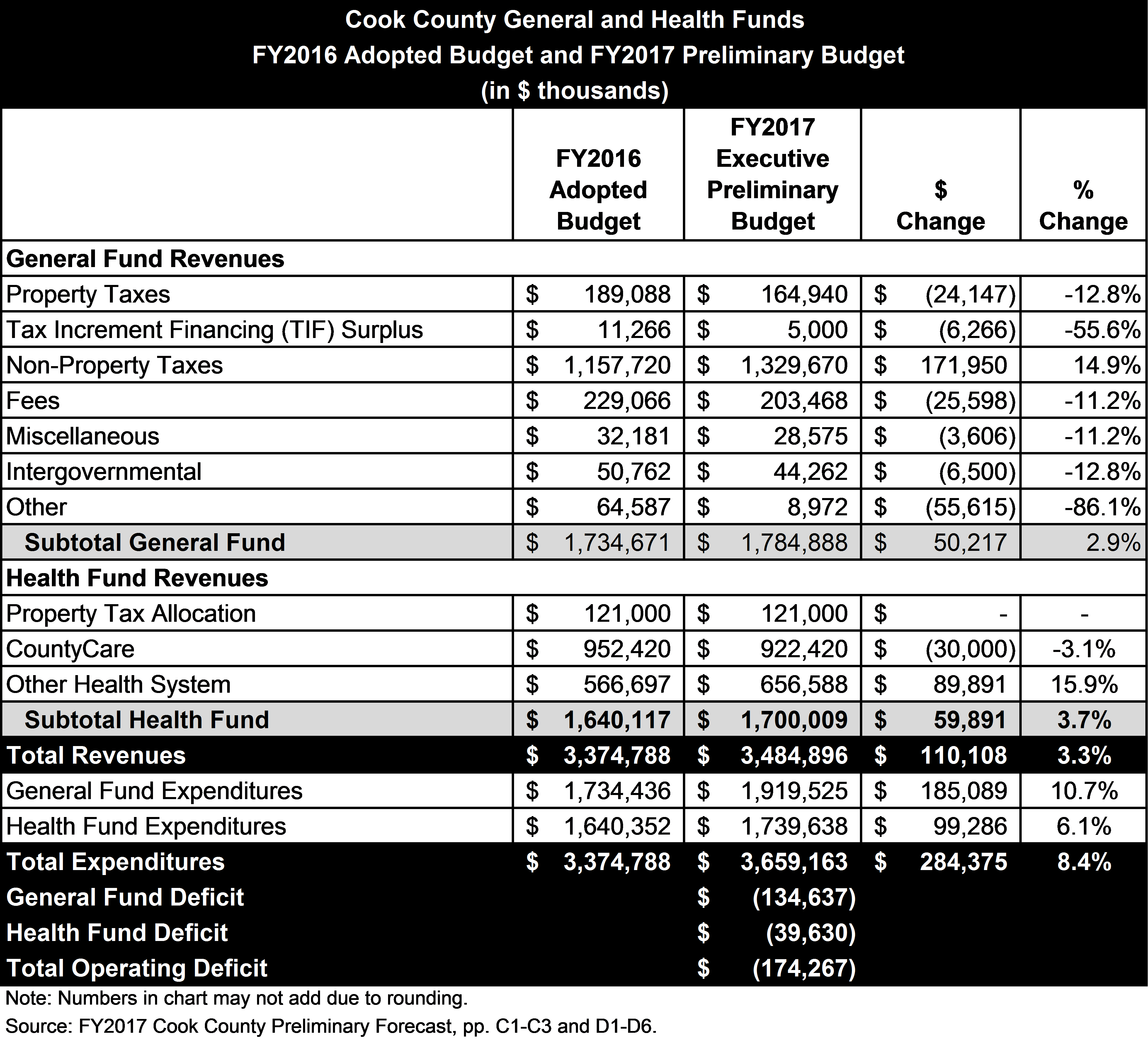

The following exhibit compares the adopted FY2016 budget with the preliminary FY2017 budget forecast.

The preliminary FY2017 budget forecast for Cook County’s General Fund and Health Fund shows revenues of $3.484 billion and expenditures of $3.659 billion, resulting in a deficit of approximately $174.3 million. This includes a projected deficit in the General Fund of $134.6 million and a $39.6 million deficit in the Health Fund. The increase in expenditures in the overall preliminary FY2017 budget are driven by increased funding for highway construction of $54.5 million and increased contributions of $350.4 million towards the County Employee’s and Officer’s Annuity and Benefit Fund of Cook County. These increases in expenditures were part of a plan tied to the increase in the sales tax by one percentage point. You can read more on the spending plan tied to the increase in the sales tax here. The General and Health Funds account for approximately 75 percent of the County’s total operating budget, which also includes special purpose funds and grants. The projected FY2017 deficit of $174.3 million is smaller than the preliminary budget gap of $208.8 million for FY2016.

The projected FY2017 deficit in the General Fund is driven by expenditure growth of $185.4 million outpacing revenue growth of $50.2 million. FY2017 General Fund expenditure increases are primarily due to an $80 million increase in supplemental pension appropriations, a $52.2 million increase in wages and labor agreements, a $14.3 million increase in technology and system maintenance spending, an increase of $14.3 million related to benefits, a $2 million rise related to labor negotiations and other expenditure increases.[1]

General Fund revenues are forecast to increase slightly in FY2017 by $50.2 million. This is due to an increase in sales tax revenue of $169.2 million and a $15.6 million increase in the Hotel Accommodations tax revenue. These increases in revenue are due to a full year of collections. The Cook County Board of Commissioners voted to increase its Home Rule Sales Tax by 1 percentage point on July 15, 2015. The Hotel Accommodations Tax was approved as part of the FY2016 budget. However, these revenue increases are offset due to the County having to appropriate $30 million in additional funding for legacy[2] debt service payments in FY2017, which reduces the funding available in the General Fund. There is also a forecast decrease of $12 million in revenue as a result of the change in timing for the Annual Tax Sale.[3]

The forecast deficit in the Health Fund for FY2017 is driven by expenditures outpacing revenues by nearly $40 million. Health Fund expenditures are projected to increase by $99.3 million, or 6.1%, above the FY2016 adopted budget. The increase in expenditures in the Health Fund are primarily the result of increased personnel expenditures and the allocation of $11 million in the operating budget to purchase medical equipment rather than borrowing for capital equipment purchases.[4]

Revenues in the Health Fund are projected to increase by $59.9 million in FY2017. The increase in revenue in the Health Fund is primarily due to an $89.9 million increase in revenues as a result of improved billing efforts and the renegotiation of Medicaid health plans.[5] However, the increase in revenues in the Health Fund is offset by a $30 million decline in CountyCare revenues due to a decline in enrollment. The property tax allocation from the General Fund to the Health Fund is currently projected to remain flat from the previous year at $121 million.

FY2016 Year-End Estimates

The Cook County FY2017 Preliminary Forecast also includes end of year estimates for FY2016, which ends November 30, 2016.

The exhibit below compares the adopted FY2016 budget with the preliminary end of year estimates for FY2016. The County currently predicts an FY2016 shortfall of $47.5 million. This includes a projected deficit in the General Fund of $23.1 million and a deficit of $24.4 million in the Health Fund.

General Fund revenues are forecast to be $29.8 million, or 1.7%, below the adopted FY2016 budget. The decline in General Fund revenues are primarily the result of a decline in fee revenues related to court filings, the delay and lack of full reimbursements from the Administrative Office of Illinois Courts (AOIC) due to the lack of State appropriations, a decline in tobacco taxes due to the City of Chicago increasing its taxes on tobacco and slower than anticipated growth in the Home Rule Sales Tax revenue.[6]

Health Fund revenues are projected to be $21.2 million, or 1.3%, above FY2016 adopted appropriations. Revenues from CountyCare are expected to be approximately $46.3 million below budget due to a decline in enrollment. However, the decline in CountyCare revenues are offset by a projected increase in patient fees.[7]

General Fund expenditures for FY2016 are forecast to be below the FY2016 adopted appropriations while Health Fund expenditures are forecast at $45.3 million above the FY2016 adopted appropriations. The increase in Health Fund expenditures from the adopted FY2016 budget is primarily due to expenditures in the CountyCare Managed Care Program and overtime costs at Stroger Hospital. The County limited the increase in expenditures by better managing non-personnel related expenditures by $23 million.[8]

The Civic Federation will continue to monitor budgetary actions taken by Cook County and will release its annual analysis of President Preckwinkle’s final FY2017 executive budget recommendations once released to the public in Fall 2016.

Helpful Links:

Cook County FY2016 Executive Budget Recommendation: Analysis and Recommendations

Cook County Board President to Propose New Hotel Tax Instead of Eliminating Amusement Tax Exemptions

Cook County Increases Its Sales Tax by One Percentage Point

[1] Cook County FY2017 Preliminary Forecast, p. 4.

[2] Legacy debt service payments are defined by Cook County as debt issued prior to December 6, 2010.

[3] Cook County FY2017 Preliminary Forecast, p. 4.

[4] Cook County FY2017 Preliminary Forecast, p. 15.

[5] Cook County FY2017 Preliminary Forecast, p. 13.

[6] Cook County FY2017 Preliminary Forecast, pp. 2-3.

[7] Cook County FY2017 Preliminary Forecast, p. 3.

[8] Cook County FY2017 Preliminary Forecast, p. 3.