April 09, 2025

By Lily Padula

The Civic Federation has long advocated for the abolition of unnecessary, duplicative, and unaccountable units of local government, including townships. These proliferate in greater number in Illinois, which has 8,506 units of government,1 more than anywhere in the country. Examples include the Federation’s successful three-year campaign that in 2006 resulted in the dissolution of the Cook County Suburban Tuberculosis Sanitarium District, a once important government function that evolved into a historically inefficient anachronism with questionable fiscal management. Recently, the Civic Federation issued a report recommending the absorption of the four Cook County Mosquito Abatement Districts into the Cook County government. These are important public health functions but inefficient and comparatively unaccountable.

In February, Governor JB Pritzker proposed legislation, SB2504, that would lower the procedural hurdles for consolidation or elimination of Illinois’ townships, one of the larger categories of redundant, inefficient and tax-burdening governance in Illinois. Disappointingly, the initiative, which appears to be an obvious win for government cost-savings and efficiency, failed to gain traction. However, Senate President Harmon has recently signed on as the lead sponsor of the bill, indicating that the initiative may move forward this session. This comes at a time of serious fiscal challenges at all levels of government in the Chicago Region and the State.

This report follows the 2021 Civic Federation Inventory of Local Governments and is intended to elevate to the legislature and public attention, this potentially important opportunity for streamlining government to the benefit of the tax-paying public.

Legislation Introduced to Streamline Township Elimination and Consolidation Process

As part of his FY2026 Budget Proposal, Governor JB Pritzker announced an initiative that would simplify the process for eliminating or consolidating townships in Illinois. The legislation, introduced as SB2504, proposes amending the Township Code to lower the referendum petition threshold from 10% to 5% of registered voters in the township or allow a county board to pass a resolution referring for referendum a proposed dissolution or consolidation of a townships. The legislation also would mandate the elimination of the township assessor’s office in counties with a population of less than 50,000.

Under existing law, formal authorization from the Illinois General Assembly is needed in order to proceed with township dissolution or consolidation. Such authorization was previously given to Evanston Township, DuPage County, McHenry County, Lake County, and Bellville County.

In 2014, Evanston voters elected to dissolve their coterminous township, which shared the same geographic boundaries as the City of Evanston. Evanston was unique in that the City Council and Township Board were composed of the same individuals serving dual roles but acting through separate taxing bodies. Dissolving Evanston Township reduced the tax burden through saving residents $779,668 in 2015 alone. The dissolution also enhanced services that were previously provided by the Township by integrating them into the City’s services. The Civic Federation supported the dissolution of Evanston Township and will continue to support the dissolution or consolidation of townships in the future.

What are Townships?

Townships are units of local government in Illinois that provide a limited number of services. These services include:

- General assistance (food, shelter, and emergency relief)

- Real estate assessment assistance

- Maintenance of township-owned roads and bridges

- Youth and senior services

- Zoning

- Police and fire protection

- Other services

Townships are governed by elected boards, which include a supervisor and four at-large members. In addition, townships may have separately elected officials, such as highway commissioners, assessors, and clerks.

Townships are independent taxing bodies with the authority to levy property taxes and issue bonds to fund operations and services. Many township powers and responsibilities overlap with those of municipalities and counties, routinely leading to duplication of services and expenditures. Because of this overlap, a majority of revenue for Townships comes from property taxes.

How many townships are there in Illinois?

This report utilizes data from the 2022 U.S. Census Bureau and the FY2023 Illinois Comptroller’s Fiscal Responsibility Report Card, which identity a total of 1,425 townships in the state of Illinois. In 2021, the Civic Federation identified 2,826 general purpose governments, which include counties, townships, and municipalities authorized to provide a wide variety of services. Of that total, 50.4% are townships.2 In Illinois, townships, counties, and municipalities often provide overlapping services, such as road maintenance, property assessment, and public assistance programs, leading to redundant spending, operational inefficiencies and needlessly increased tax burdens on residents. Consequently, there is a strong case for eliminating townships and consolidating their functions into the operations of existing counties or municipalities as needed. By streamlining government structures, Illinois could reduce administrative overhead, improve service coordination, and lower taxpayer costs. Additionally, consolidation could lead to economies of scale, more effective resource allocation, modernized service delivery, and greater fiscal accountability by eliminating unnecessary layers of government.

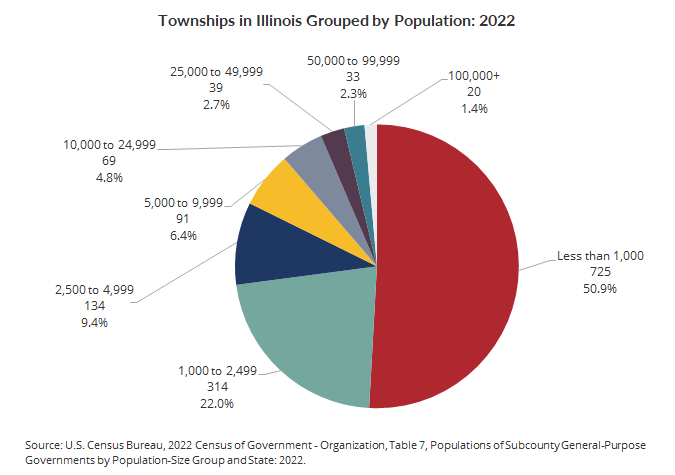

Of the 1,425 townships identified by the U.S. Census Bureau in 2022, nearly 51%, or 725 townships, have fewer than 1,000 residents. Nearly 25%, or 314 townships, have between 1,000 and 2,499 residents. There are 33 townships with a population between 50,000 and 99,999, and 20 townships with a population greater than 100,000 residents. The remaining 333 townships have a population of between 2,500 and 49,999 residents. It is important to note that the City of Chicago and 17 counties do not operate under the township form of government and their residents are therefore not present in the data.

How are townships funded?

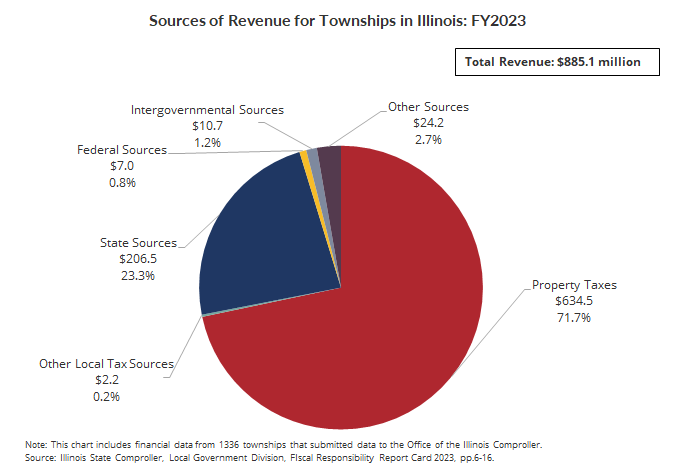

The next chart provides an overview of the various sources of revenue that townships in Illinois rely on to fund operations. The data included in this chart was obtained from the Illinois Comptroller.

Excluding the approximately 89 townships that were delinquent in filing their financial reports, the Illinois Comptroller’s FY2023 Fiscal Responsibility Report Card reflects that 1,336 townships collected a total of $885.1 million in revenue.

Townships rely heavily on property taxes to fund operations. Collectively, they received $634.5 million, or 71.7% of their funding from property taxes in FY2023. Townships and Road Districts accounted for 2.3%, or $865.9 million, of the $38.5 billion in property taxes levied statewide in 2023, according to the Illinois Department of Revenue.

State sources made up the second largest revenue source at $206.5 million or 23.3%. State sources of revenue include state income tax and local share of the state sales tax, taxes on gaming, motor fuel tax, and the state personal property replacement tax (an income tax on businesses). Intergovernmental revenues, which are funds received from other government entities such as counties, contributed $10.7 million, or 1.2%.

Illinois Townships also received $7.0 million from the federal government, a fraction of the total federal amount distributed to Illinois counties ($509.4 million) and municipalities ($370.2 million). Other revenues, which include other local tax sources and other sources, totaled $26.4 million, or 2.9%, of revenue in FY2023.

How do townships spend their funds?

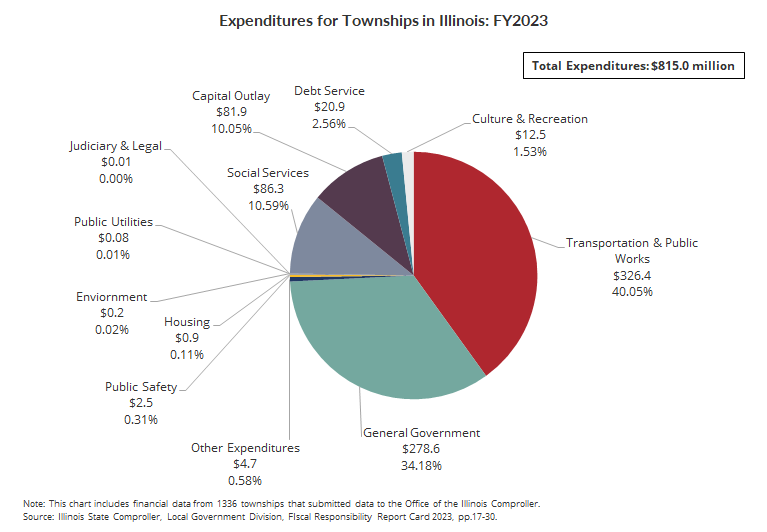

Excluding the 89 townships that were delinquent in filing their financial reports with the Illinois Comptroller in FY2023, townships spent a total of $815.0 million in FY2023, $70 million less than their total revenue. The greatest portion was devoted to transportation and public works, which in the aggregate was $326.5 million, or 40.05% of total expenditures.

The next largest expenditure category was general government, consisting of the day-to-day administrative costs, which collectively constituted $278.6 million, or 34.18% of total spending. Townships collectively spent $81.9 million on capital-related projects. Social Services accounted for $86.3 million, or 10.59% of total spending, while culture and recreation accounted for 1.53%.

In FY2023, the 1,336 reporting Illinois Townships collectively spent $2.5 million, or 2.57%, on debt service, a tiny fraction of the amount spent by counties ($186.6 million) and municipalities ($849.5 million). Other expenditures account for $8.4 million, or 1.03% of FY2023 expenditures.

What is the impact of the Governor’s proposal?

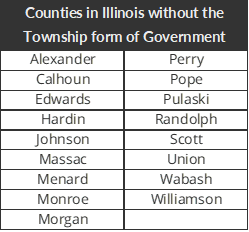

The Governor’s proposal would allow the 85 of the total 102 Illinois counties to more easily consolidate or dissolve the townships within their geographic boundaries. The 17 Illinois counties that do not have a township form of government and therefore would not be impacted by this proposal are:

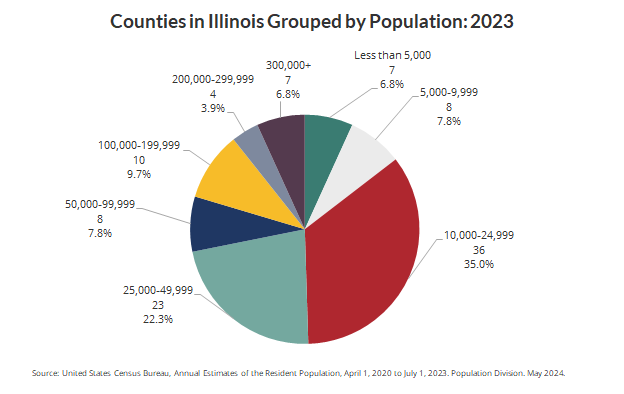

Fifty-one of the 102 counties in Illinois have a population of less than 50,000. Out of these 51, only 35 counties have a township form of government and therefore would be impacted by the latter part of this legislation that mandates the elimination of the township assessor’s office.

References

1 In the Civic Federation’s Inventory of Local Government report, we identified 8,923 units of government in Illinois. For the purposes of this report, we will be utilizing data based on the most recent Illinois Comptroller report. This report identifies 8,506 units of government in Illinois.

2 In the Civic Federation’s Inventory of Local Government report, we identified 1,426 townships in Illinois. For the purposes of this report, we will be utilizing data based on the most recent Illinois Comptroller report. This report identifies 1,425 townships in Illinois.