May 22, 2025

By Daniel Vesecky

Please note: This report reflects the most current information available as of May 22, 2025. For updated information on the impact of the bill signed into law on July 4, 2025, please refer to our Medicaid Cuts Enacted report.

Medicaid Overview

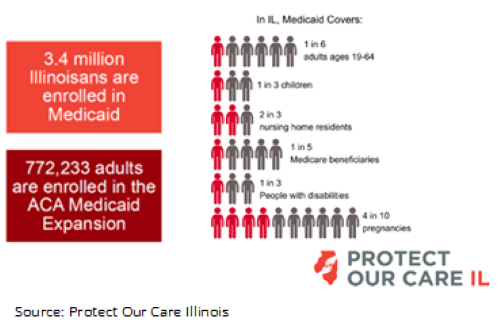

Over 3.4 million Illinois residents were enrolled in Medicaid healthcare coverage in Fiscal Year 2024 (FY2024). Of those, 44% were children, 9% seniors, and 7% adults with disabilities. Of those 3.4 million, over 772,000 (23%) are adults who received coverage through the Affordable Care Act.

How Medicaid is Funded

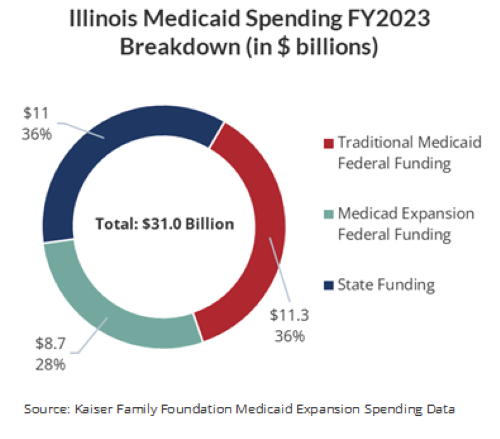

Medicaid is a federal program that funds healthcare coverage for low-income individuals. The funding comes from both federal and state government through a cost-sharing model. In FY2023, Illinois spent approximately $31 billion on Medicaid. About $20 billion of that $31 billion, or 65%, was funded by the federal government. Of that $20 billion, Medicaid spending is apportioned between traditional Medicaid, established in 1965, and the Affordable Care Act (ACA) Medicaid Expansion, established in 2010. Traditional Medicaid covers low-income parents, children, seniors, and people with disabilities. The ACA expanded coverage eligibility to include non-elderly adults without dependent children who earn up to 138% of the federal poverty line—currently $15,060 annually for an individual. Federal funding for traditional Medicaid is apportioned based on the amount of Medicaid spending and the income per capita in a state.

In Illinois, the federal government covers 51% of Medicaid costs for recipients of traditional Medicaid (the floor is 50%). This is known as the Federal Medical Assistance Percentage, or FMAP contribution. However, the FMAP contribution covers 90% of the costs associated with recipients of the ACA Medicaid Expansion. Of the $20 billion in federal Medicaid funding that the state received in FY2023, about $8.7 billion came through the ACA Medicaid Expansion, with the remainder provided through traditional Medicaid.

Potential Medicaid Cuts Under Consideration

Congress has considered a wide variety of potential cuts to Medicaid since the new federal administration took office in January 2025, including:

- Reducing the FMAP contributions for traditional Medicaid and/or the ACA expansion;

- Instituting work requirements for Medicaid enrollees;

- Instituting per capita limits on reimbursements spending growth;

- Limiting taxes on healthcare providers, which states typically use to generate their share of Medicaid funding.

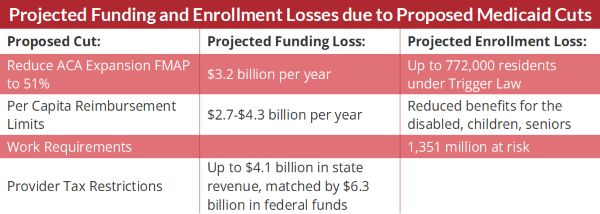

Any of the above proposed measures would immediately cause a significant number of Illinoisans to lose Medicaid coverage. Of particular concern is the threat of reducing the FMAP contributions for both traditional Medicaid and ACA Medicaid Expansion. Illinois’ “Trigger Law,” passed in 2013, mandates that the State end the Medicaid ACA expansion program if the federal government’s share of funding (FMAP contribution) falls below 90%. This means that reduction to the ACA Medicaid FMAP contribution would result in the shuttering of Illinois’ Affordable Care Act coverage, which insures over 772,000 adults. If, on the other hand, the State repeals this law and then funds the ACA Expansion beneficiaries at the lower traditional Medicaid FMAP (from 90% to 51%), to keep these individuals covered would cost $3.2 billion annually. The State of Illinois presently lacks the revenue stream to meet this additional cost.

The second potential change, work requirements for non-senior adults, would not directly reduce federal Medicaid funding to the state, but it would cause many currently insured people to lose their coverage, either by not meeting the requirement or due to administrative burdens. The Center on Budget and Policy Priorities estimates that up to 1.35 million Illinoisans would be required to fulfill work requirements and could be at risk of losing Medicaid coverage. Previous implementations of work requirements in other states suggest that many of those enrollees who meet the work requirements—meaning enrollees who are actually working—nevertheless lose their coverage simply due to burdensome and confusing administrative requirements.

Turning to potential per capita caps, Congress has discussed proposals to cap federal reimbursements for Medicaid spending growth per enrollee at medical inflation. This would cause states to incur increasing costs over time as spending diverges from the reimbursement caps. Medicaid spending increases during periods of high unemployment or as state policymakers add healthcare benefits that Medicaid will cover. The Illinois Department of Healthcare and Family Services estimates that under such caps, it would lose between $24 and $39 billion in Medicaid funding from 2026 through 2034, which comes to $2.7-$4.3 billion annually. To compensate for funding losses due to these caps, the State would likely be forced to reduce benefits for the most vulnerable beneficiaries of Medicaid, including the disabled, seniors, children, and pregnant women.

Finally, provider taxes, which Congress is considering limiting, currently generate about $4.1 billion in annual revenue for Illinois’ Medicaid program. This revenue comes from taxes on hospitals, nursing facilities, and other healthcare providers. The State then uses this tax revenue to fund Medicaid services, sending payments back to the same institutions it taxed in order to generate additional federal support. Importantly, it also uses the tax revenue, with the federal match, to increase the notoriously low reimbursement rates paid to the taxed healthcare entities, making it more possible for healthcare providers to offer their services to Medicaid beneficiaries. Because of how the FMAP contribution structure works, the $4.1 billion the State receives in tax revenue on providers then generates over $6 billion in additional federal funding. In total, this leads to a maximum of approximately $10.4 billion in Medicaid spending made possible in Illinois by provider tax revenue. If these taxes are restricted or eliminated, the State will not only lose the $4.1 billion in tax revenue, but also the associated federal matching funds—resulting in even more significant cuts to funding.

A Refined Outlook: What’s Likely to Move Forward (as of May 22, 2025)

Which forms of Medicaid cuts will ultimately move forward in Congress remains to be seen. On May 22, 2025, the House of Representatives passed a budget reconciliation bill aimed at reducing the federal deficit by as much as $880 billion over a ten-year period, including cutting Medicaid spending by $625 billion by 2034. The Medicaid spending reductions would be specifically related to work requirements, eligibility requirements, and provider taxes. It is estimated that 7.6 million people nationally could lose Medicaid coverage.

The 2025 Reconciliation Bill, if passed as currently written, would require Medicaid enrollees to re-certify their eligibility every six months starting in 2027, up from once a year under current law. It would also implement Medicaid work requirements by the end of 2026, with an option for states to implement them earlier. Both of these provisions are expected to create red tape that would reduce overall Medicaid enrollment. Additionally, the bill bars states from increasing provider taxes past current levels. This will reduce provider tax revenue over time, as tax revenue and its respective FMAP contribution would otherwise likely slowly be increased by the state legislature as opposed to remaining at current levels.

The bill does not seek to implement per-capita caps or a reduction in ACA expansion FMAP. However, it does stipulate that states that provide healthcare coverage for undocumented immigrants would see their expansion FMAP contributions reduced from 90% to 80%, effective starting in October 2027. This poses a problem for Illinois, as the state currently provides healthcare to undocumented immigrants. If Illinois’ FMAP is reduced to 80% under this rule, the Trigger Law would automatically eliminate the ACA expansion unless the state legislature interferes. The bill also stipulates that FMAP funds cannot be used for gender-affirming care. Finally, the bill would require states to impose cost minimums on doctor visits and other services for ACA expansion adults with incomes above the poverty line, starting in October 2028.

What Medicaid Cuts Could Mean for Healthcare Coverage in Illinois

The loss of federal Medicaid revenue could impact the lives of hundreds of thousands of Illinoisans and result in the loss of potentially billions of dollars, which would trickle down to public and private healthcare providers throughout the state. According to the Illinois Department of Healthcare and Family Services, in FY2024, Illinois paid $10.8 billion to hospitals, $3.8 billion to long-term care facilities, and $4.5 billion to pharmacies. “Safety Net Hospitals”, or institutions that provide healthcare services to vulnerable populations regardless of their ability to pay, in particular, could face collapse in the absence of additional state or philanthropic funding. Crain’s Chicago Business finds eight such hospitals in Illinois with a more than 75% rate of Medicaid usage among patients. Rural hospitals would also face significant strain, as rural areas tend to have high rates of Medicaid coverage and many rural hospitals already operate on very narrow margins.

Safety net hospitals and healthcare providers are particularly at risk in terms of financial uncertainty. Cook County Health (CCH), for example, benefits significantly from increased Medicaid coverage through the ACA. The ACA Medicaid expansion vastly increased the number of Cook County residents who were insured, which in turn significantly reduced the amount of uncompensated care provided by CCH. As more care was covered by insurance, revenue to the CCH Hospital System nearly doubled between FY2013 and FY2014, from $674 million to $1.3 billion, a change driven almost entirely by managed care funding through Medicaid. The Cook County Health System expects that if the ACA Expansion FMAP is reduced and Illinois’ Trigger Law comes into play, more than 100,000 Cook County residents currently covered by CCH’s CountyCare managed care plan could lose coverage. This could result in $200 million in healthcare spending within the County Health and Hospital System shifting to charity care, for which the hospital does not receive payment. This will put a significant strain on the County as it struggles to make up the revenue or reduce healthcare services. Other safety net providers would face similar financial challenges.

In addition to traditional providers such as hospitals and pharmacies, many other programs that receive Medicaid support would also be at risk if funding is cut. Many public schools receive Medicaid funding as a reimbursement for care provided by school nurses and counsellors. Long-term care for seniors and mental health centers that serve marginalized populations are disproportionately reliant on Medicare to cover the people they serve. With reduced Medicaid funding, the State will likely not be able to cover as many services for enrollees, a change which could have serious implications for these organizations and put further strain on emergency rooms, local service providers, and other institutions that would feel the ripple effects of a reduction in care.

Conclusion

Illinois received $20 billion in federal funding for Medicaid in FY2023—support that is essential to both the State’s budget and residents’ access to healthcare. Any changes or cuts to Medicaid, whether through reduced contributions or structural changes, would significantly cut into this support. Without new revenue sources, State leaders would be forced to make major cuts to Medicaid or risk insolvency, increased debt, and reductions in Illinois’ credit rating, which is already the lowest of any state in the nation. The state will face difficult decisions about where to pick up federal spending and where to cut costs by removing enrollees from Medicaid coverage and reducing reimbursements to providers. Individuals without health insurance are more likely to delay or forgo seeking care. This can lead to increased costs over the long run as uninsured people are forced to seek emergency care or incur other costs due to illness or disability. These costs often go uncompensated, creating a broader strain on public health systems and safety net providers. In short, any changes to federal spending on Medicaid would certainly reduce Illinoisans’ healthcare access, leading to negative health outcomes statewide.