March 11, 2015

Under Governor Bruce Rauner’s proposed FY2016 budget, one of the largest sources of state funding for local governments in Illinois would be reduced by half. The reduction is part of more than $4 billion in spending cuts and $2.2 billion in estimated pension savings recommended by the Governor to close a projected budget gap of over $6 billion in fiscal year 2016.

Local governments in Illinois are not allowed to levy income taxes. Instead, they receive a share of State income tax proceeds from the Local Government Distributive Fund (LGDF). A certain percentage of individual and corporate income tax revenues are set aside each year as a legislatively required transfer from the State’s General Funds. Per Illinois State statute, the Illinois Comptroller then distributes the funds to local governments based on population.

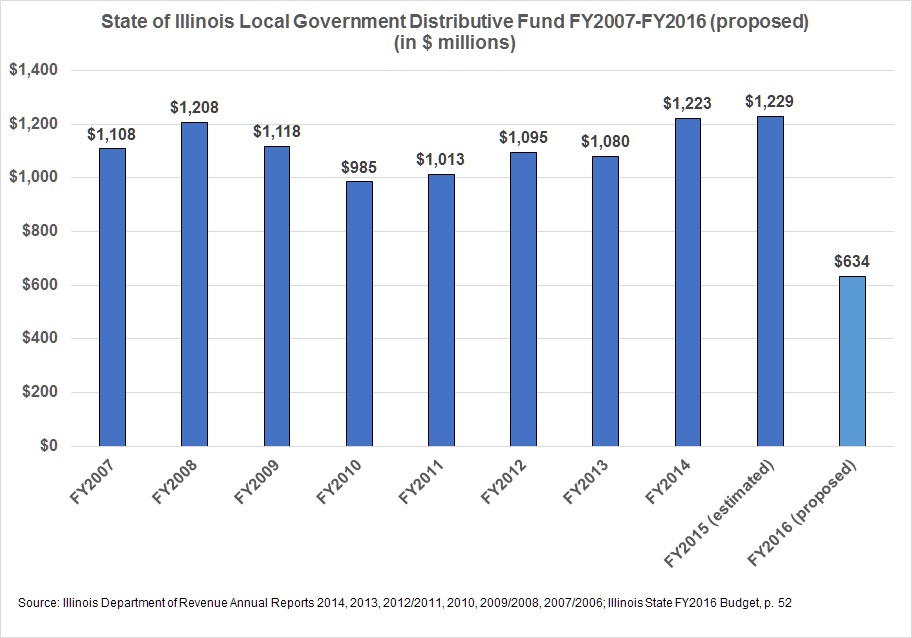

While the percentage of State income tax revenues given to local governments has varied in the last decade due to changes in the overall income tax rate, the resulting total level of funding has remained fairly consistent. The State has kept the local share equivalent to 10% of the first 3 percentage points of the individual income tax and the first 4.8 percentage points of the corporate income tax. The chart below shows the total assistance provided by the State of Illinois to local governments through the Local Government Distributive Fund from FY2007 to FY2014, estimated totals for FY2015 and the proposed reduction in Governor Rauner’s FY2016 budget.

Prior to 2011, local governments received 10% of State income tax proceeds through the LGDF. Income tax rates were temporarily increased in 2011 from 3% to 5% for individuals and from 4.8% to 7% for corporations[1]. While the higher rates were in effect, the income tax revenue share distributed to local governments was reduced so the State could get the full benefit of the higher rates. From January 1, 2011 through December 31, 2014, local governments received 6% of individual income tax revenues and 6.86% of corporate income tax revenues.

The LGDF share was adjusted again on January 1, 2015 when individual income tax rates declined to 3.75% and corporate income tax rates declined to 5.25%. According to the Illinois Department of Revenue, local governments currently receive 8% of net individual income tax revenues and 9.14% of all corporate income tax revenues. The Governor is proposing to cut this distribution by half in FY2016 to 4% of net individual income taxes. This cut would reduce LGDF funding to local governments by $567 million, or 47.2%, from an estimated $1.2 billion in FY2015 to $634 million in the proposed FY2016 budget.

While the Local Government Distributive Fund is one of the largest sources of state funding for local governments in Illinois, it is not the only source. Other funding transfers from the state to local governments include the Personal Property Replacement Tax levied on corporations by the State and distributed to local governments, the local share of the sales and use taxes and sales tax transfers for local transportation. The State of Illinois also collects various taxes for local governments including taxes on automobile rentals, vehicle use, soft drinks and hotels.[2]

Municipal leaders from across the state expressed concern about the impact of the funding cut at a joint hearing this week of the Illinois Senate Appropriation Committees. Many local governments in Illinois, including the City of Chicago, are facing ongoing financial pressure due to severely underfunded pensions and other long-term liabilities. The City of Chicago receives approximately 21% of LGDF funding and estimates that it would have received more than $400 million in total additional revenues if local governments had not been excluded from sharing in the increased income tax revenues since 2011.[3]

[1] In addition to these rates, corporations pay a Personal Property Replacement Tax (PPRT) of 2.5%.

[2] Illinois Department of Revenue, Annual Report of Collections and Distributions Fiscal Year 2011 and Fiscal Year 2012, http://tax.illinois.gov/publications/annualreport/annual-report-2011-2012.pdf.

[3] City of Chicago, Annual Financial Analysis 2013, p. 16. The City of Chicago estimates that it would have received additional revenue of more than $50 per resident per year beginning in 2011.