December 09, 2025

by Roland Calia

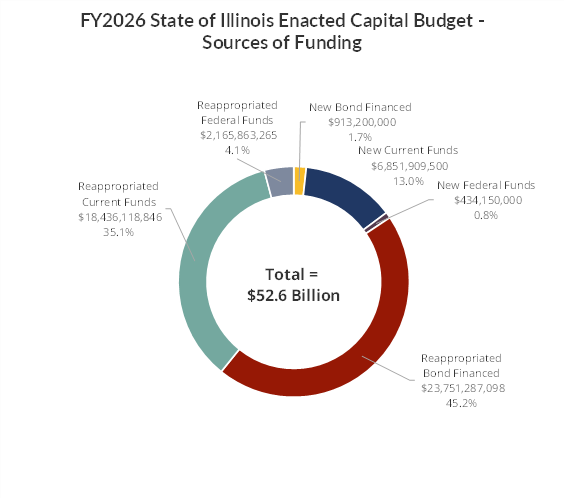

The State of Illinois (Illinois or the 'State') enacted a multi-year $52.6 billion FY2026 capital budget on June 16, 2025 The budget is a 1.5% decrease from FY2025 due to lower spending on new projects. The following are some capital budget highlights:

- Transportation-related projects for road and bridge construction, mass transit, rail, aeronautics, and port projects make up the largest portion of the capital budget, accounting for over 50% of total capital spending, or $28.8 billion.

- Capital Development Board infrastructure projects, such as state facilities, schools, and other public buildings, will account for $9.7 billion in funding.

- Funding for Department of Commerce and Economic Opportunity projects that support economic development, business incentives, and community infrastructure will total $6.7 billion.

- Smaller amounts of funding will support environmental, natural resource, and other projects.

Nearly half of the multi-year capital budget is funded through bonds—about 46.9%, or $24.7 billion. The other half is funded through state sources such as motor fuel taxes (also referred to as “current” or “pay-as-you-go” funds), totaling 48.1%, or $25.3 billion of the capital budget. The remaining 4.9%, or $2.6 billion, comes from federal funds.

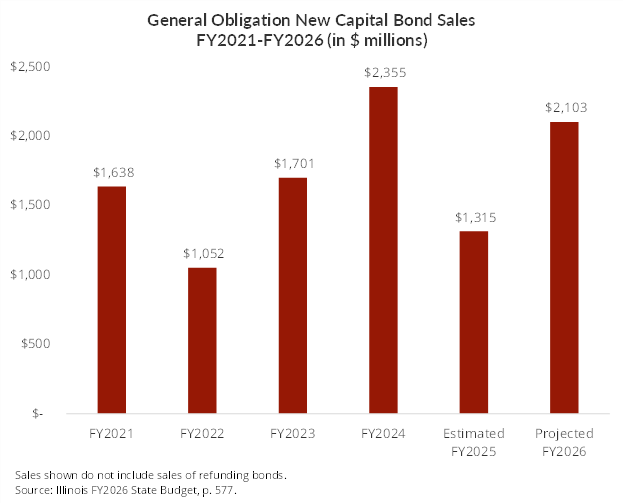

Illinois plans to issue $2.1 billion in new general obligation bonds in FY2026 to advance projects moving into construction.

In recent years, Illinois has made significant progress in managing its finances, leading to multiple credit rating upgrades. For example, the state has paid off major debts, including COVID-related and interfund borrowing and money owed to the Unemployment Insurance Trust Fund. It has also increased pension contributions, built up its reserves, and kept up a normal bill payment schedule. As a result of the improved fiscal management, the State of Illinois has received 10 credit upgrades since 2019, when Governor Pritzker took office, the most recent being a rating upgrade from Moody’s to A3 in October 2025. However, Illinois still has the lowest credit rating of any state. The State continues to face fiscal challenges, with enormous unfunded pension liabilities of approximately $143.5 billion as of November 2025.

Since 2005, the capital budget has been produced as a separate document from the State’s operating budget and goes through a separate approval process through the state legislature. A Civic Federation review of the FY2026 State of Illinois enacted operating budget can be found here.

How the Timing of the Capital Budget Works

The State of Illinois capital budget provides multi-year legal authorization for both current year and future year spending for infrastructure projects, including roads, mass transit, facilities, and water and sewer improvements. The amount varies from year to year as new debt or projects are authorized, and some old debt is retired or projects are completed.

Unlike the State’s annual General Funds budget, which covers only the cost of operations for the current fiscal year, capital appropriations are reauthorized over multiple years as project planning, engineering and construction can take several years to complete. Funds for multi-year projects are reappropriated each year as part of the next year’s capital budget as the project continues. The capital budget therefore includes both new spending and reappropriated spending authority.

The current multi-year capital budget was initially approved in 2019 as the $45 billion Rebuild Illinois capital plan. This was the first state capital plan since the Illinois Jobs Now! capital plan in 2010 under the administration of Governor Pat Quinn. Information about the Rebuild Illinois capital plan can be found here and here.

Transportation accounts for the vast majority of all capital spending. As part of the capital budget, the Illinois Department of Transportation regularly prepares and publishes 6-year plans for various transportation-related projects. The projects outlined in the 6-year plan are integrated into the capital budget. On October 1, 2025, the State issued its most recent plan for fiscal years 2026 – 2031 for transit, rail, aeronautics, and ports. The plan is projected to provide approximately $50.6 billion in funding over the multi-year period. The multi-year road and bridge program alone is expected to total $32.5 billion.

How Multi-Year Capital Projects are Funded

Capital projects in Illinois are funded in three major ways:

- Current funds from State of Illinois tax and fee resources, such as the motor fuel tax, motor vehicle registration, and vehicle operator’s license fees. These are also referred to as “pay-as-you-go” funds.

- Bond financing from debt issuances. Annual appropriations for debt service, which include payments for principal and interest on bonds issued, are accounted for in the annual operating budget and are paid for with general tax revenues, such as income and sales taxes. A more detailed look specifically at Illinois’s debt structure and burden can be found here.

- Federal funds.

The following chart shows the total FY2026 enacted multi-year $52.6 billion capital budget by the type of project funding, including new funds, federal funds, and multi-year funds from the original 2019 capital plan that are being reappropriated for the coming year.

Reappropriated funds make up 84.4% of the capital budget, while new appropriations make up 15.6%. Of the $44.4 billion in reappropriated funds, $23.8 billion is reappropriated bond proceeds, $18.4 billion is reappropriated current (pay-as-you-go) funds, and $2.2 billion comes from federal funds. Of the approximately $8.2 billion in new appropriations, $6.9 billion is funded by current funds, $913.2 million is from bond funds, and $434.2 million is from federal funds.

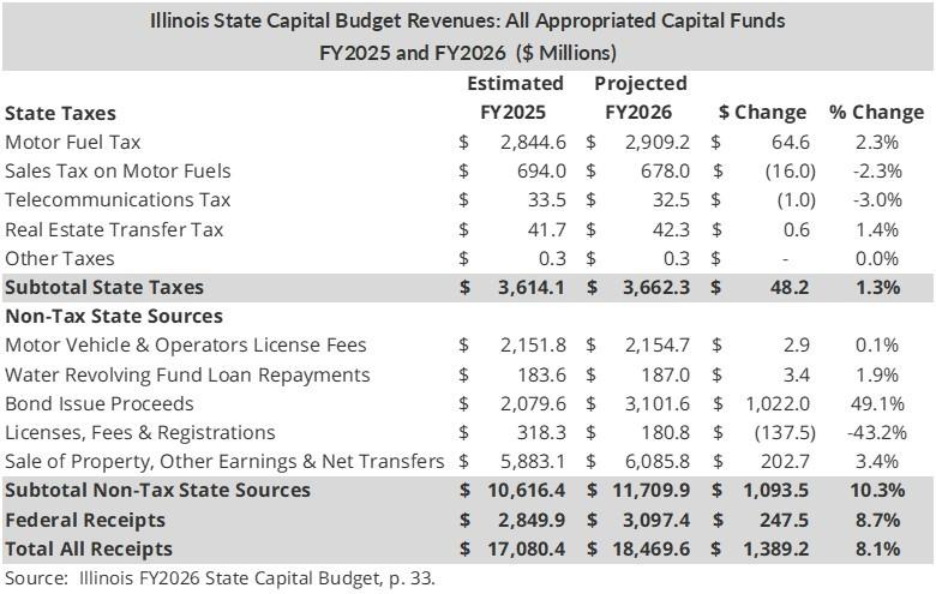

Capital Budget Revenues in Year One

The State appropriates a multi-year capital plan annually. The State only plans to use a portion of those appropriations in the first year—FY2026. The total revenues planned for use in FY2026 are $18.5 billion, which represents an increase of 8.1% from the previous fiscal year, from an estimated $17.1 billion in FY2025. Roughly 63.4% of FY2026 revenues, or $11.7 billion, come from non-tax sources, 19.8% or nearly $3.7 billion from state tax receipts, and 16.8% or another $3.1 billion from federal receipts.

State tax revenues in FY2026 will increase by 1.3% from FY2025, rising from $3.6 billion to nearly $3.7 billion. Nearly 79% of all state tax revenues in both years derive from motor fuel taxes, with an additional 19% coming from the sales tax on motor fuels.

State non-tax resources include motor vehicle and operator’s license fees, bond issue proceeds, the sale of property, transfers and other fees, and repayments. They will increase by 10.3%, from $10.6 billion to $11.7 billion. Most of this increase will be driven by a $1.0 billion, or 49.1%, increase in bond issue proceeds.

Federal receipts will increase by 8.7%, or $247.5 million, to $3.1 billion.

Where Does Multi-Year Capital Funding Go?

Total multi-year capital appropriations in FY2026 are $52.6 billion. This is an increase of 7.9% or $3.9 billion, from $48.7 billion in FY2024.

New appropriations during this three-year period increase by 28.6%, or $1.8 billion, most of which is a $1.7 billion increase in appropriations for the Department of Transportation. That funding will be used for a variety of projects, including multi-modal spending on mass transit downstate and Regional Transportation Authority infrastructure, freight and passenger rail projects, aeronautics projects, and ports.

Reappropriations over that same period will increase by $2.0 billion or 4.8%. Most of the reappropriated funds will be allocated to projects overseen by the Illinois Environmental Protection Agency and the Department of Commerce and Economic Opportunity.

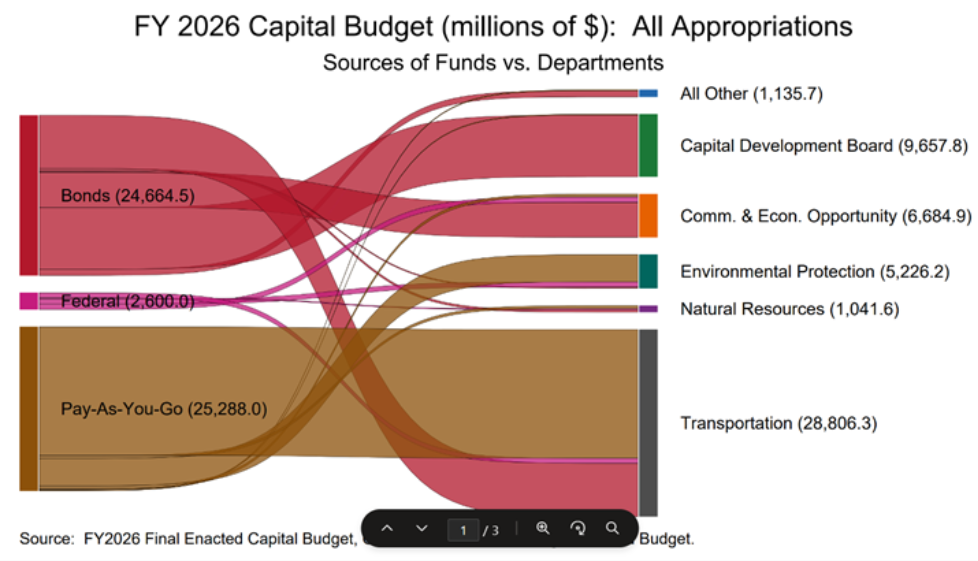

The next exhibit shows FY2026 capital budget spending by funding source and department.

The multi-year capital budget is funded through three sources:

- Pay-as-you-go funding from current revenues will account for 48.1% of all capital spending, or $25.3 billion.

- Bond funding will be used to support $24.7 billion, or 46.9%, of the entire capital budget.

- Federal funding will cover $2.6 billion, or 4.9% of spending.

Departmental appropriations for capital projects include:

- $26.8 billion for transportation-related projects, 54.8% of total appropriations. This includes the annual road program for ongoing surface transportation improvements such as roads, bridges and mass transit.

- Nearly $9.7 billion is earmarked for Capital Development Board projects. This represents 18.4% of all appropriations.

- Approximately $6.7 billion, 12.7% of the total, will be appropriated for projects overseen by the Department of Commerce and Economic Opportunity.

- Smaller amounts have been appropriated for projects in the Illinois Environmental Protection Agency, the Department of Natural Resources, and a variety of other agencies.

New General Obligation Debt Issuances in FY2025 and FY2026

Much of Illinois’s capital plan is funded with debt. The FY2026 State Operating Budget announced that the State planned to issue $2.1 billion in new GO bonds to fund capital projects during the course of FY2026, compared to $1.3 billion in new bonds issued in FY2025. The new bond issues will be used to finance capital projects that have progressed from the planning and design stages to the construction phase. The bond issues from FY2021 through FY2026 will support projects in the State’s Rebuild Illinois capital plan, which was approved in June 2019.

Bond Ratings

Bond ratings are one of the factors that weigh heavily in determining the interest rates the State must pay to issue debt. In recent years, the State has received a number of credit upgrades as its financial situation has improved. In 2023, Fitch Ratings, Moody’s Investors Services, and Standard and Poor’s all upgraded the State of Illinois' general obligation bond ratings. They cited the State’s increased reserves, the significant paydown of outstanding accounts payable, and increased sales tax collections as the reasons for the upgrades. The rating agencies continued to warn, however, that the State still faces large long-term liability pressures, particularly from pensions, that constrain its fiscal flexibility. In 2025, Fitch upgraded Illinois’s bonds again. Despite the improved credit outlook, Illinois still has the lowest credit rating of any state in the U.S.

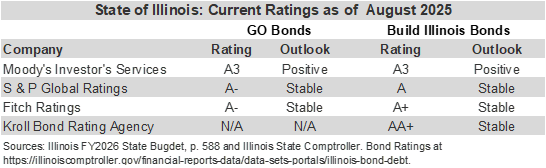

The following chart shows the current ratings for Illinois’ General Obligation Bonds and Build Illinois special revenue bonds. The current State of Illinois bond ratings are all investment grade.

Recent Rating Agency Actions

Illinois has received 10 bond rating upgrades since 2019. The most recent actions taken over the past year are detailed below.

In October 2025, Moody’s Investors Services raised the State’s credit rating for general obligation and Build Illinois sales tax revenue bonds to A3, up from the previous rating of A2, with a stable outlook. The rating upgrade was due to the State’s increases in its reserves, the maintenance of balanced budgets, and continued improvement in the State’s financial management practices. Moody’s indicated a further upgrade could be possible if the State released its audited financial statements in a timely manner, further increased its reserves, and made additional pension contributions to reduce liability.

In July 2025, Fitch Ratings assigned the State an A- rating with a stable outlook on a total of $1.7 billion in general obligation bonds. The rating is a reaffirmation of previous ratings. Fitch cited Illinois’ reduction in outstanding liabilities and strong revenue stream as factors in this decision.

In February 2025, Kroll Bond Rating Agency assigned an AA+ rating with a stable outlook to Build Illinois junior lien sales tax bonds issued in March 2025 and also affirmed that rating on outstanding Build Illinois bonds. The rationale for the rating was that the State’s sales tax revenues have historically been robust, and there are strong non-impairment protections on these bonds.

In 2024, Moody’s Investors Services affirmed its A3 rating of the State of Illinois and revised the State's outlook to positive from stable. It has also affirmed the A3 rating on the State's previously issued general obligation debt and the A3 rating on the State's outstanding Build Illinois sales tax bonds. The reason for the outlook change was the State’s increased fund balance and budget reserves, and other financial management decisions that have improved the State’s fiscal health. The rating agency cautioned that downside risk remains due to the large size of the State’s unfunded pension liabilities.