February 12, 2026

by Lily Padula

Download the Executive Summary

The State of Illinois (Illinois or ‘the State’) enters the FY2027 budget process at a pivotal moment. After several years of improved fiscal stability, marked by the reduction of the State’s bill backlog, incremental reserve building, and progress toward mitigating chronic structural deficits, the long-standing baseline fiscal pressures are tightening the State’s finances. While recent federal tax law changes initially raised concerns about substantial revenue losses, the State has taken steps to partially mitigate those impacts through decoupling from portions of the federal tax code to preserve corporate income tax revenues. Most of those effects are felt in the current 2026 fiscal year. Revenue performance this fiscal year has also been better than anticipated, which will help offset the revenue impacts associated with federal policy changes in the current year.

However, the fiscal outlook heading into FY2027 is shaped by slowing revenue growth, rising costs, the phase-out of one-time federal pandemic aid, and increasing uncertainty surrounding federal funding for core state programs. The Governor’s Office in the fall projected an FY2027 operating budget gap of $2.2 billion, driven by a structural imbalance between recurring revenues and largely fixed costs (pensions and debt), as well as federal impacts, including increased costs to administer SNAP food assistance. Together, these pressures leave the State with limited budgetary flexibility.

The FY2027 budget warrants close attention, given heightened economic uncertainty and increasing exposure to factors beyond the State’s direct control. Federal policy changes, enacted in H.R. 1, passed by Congress last summer, along with emerging federal funding reductions, delays, and cost-shifting, will affect tax revenues, healthcare financing, and safety-net programs in future years. With fixed costs continuing to consume a significant share of General Funds, discretionary choices remain constrained, amplifying the consequences of forecasting errors or policy missteps.

Where the State Stands Entering the FY2027 Budget Process

Overview of Illinois’ Current Fiscal Position and Revenue Performance

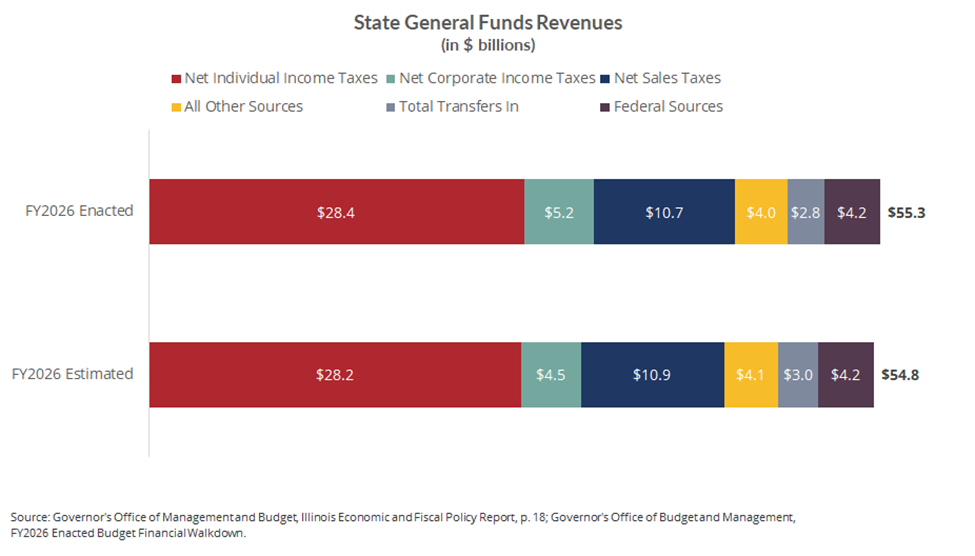

According to the Governor’s Office of Management and Budget’s (GOMB) October estimates, Illinois faces a modest but material general funds deficit of $267 million in the current fiscal year. Higher-than-expected expenditures on pensions and debt service slightly contribute to the gap, but revised revenue projections stemming from the impacts of H.R. 1 are the principal factor. Specifically, changes to the federal tax code and other corporate income tax changes will reduce income tax revenues by $981 million in FY2026. These factors have reduced expected general funds resources to $54.8 billion, down nearly $450 million, or 0.8%, from expected levels reflected in the balanced budget passed last year, despite better-than-expected sales tax revenues and other sources that increased revenues by $532 million.

Federal Policy Impacts and Revenue Risks

H.R. 1 (July 2025)

Illinois’ revenue base is particularly sensitive to federal tax policy changes due to its reliance on income taxes. As a result, federal actions under H.R. 1 have had outsized impacts on State revenues. Several H.R. 1 tax-related provisions, most notably expanded business expensing and changes to the treatment of international income, reduce the amount of income subject to taxation. Because Illinois’ income tax base is closely tied to federal definitions of taxable income, these federal changes flow through to the State absent legislative action, reducing Illinois’ expected income tax revenues by more than $830 million in FY2026 alone.

In response, GOMB recommended targeted “decoupling” from the most impactful federal provisions, including bonus depreciation and updates related to the transition from Global Intangible Low-Taxed Income (GILTI) to Net Controlled Tested Income (NCTI). During the 2025 Veto Session, the Illinois General Assembly enacted legislation to partially decouple the State’s income tax base from federal changes related to NCTI and the expensing of certain structural investments. This action reduced the projected revenue loss by more than $230 million, or 28.0%, lowering the estimated income tax revenue reduction to about $600 million in FY2026.

In addition to the revenue impacts of H.R. 1, Illinois’ share of SNAP administrative costs will increase sharply beginning in FY2027 as the federal match declines from 50% to 25%, adding roughly $80 million in annual state costs.

In FY2028, the State may also be required to fund a portion of SNAP benefit costs if payment error rates remain above federal thresholds. And on the healthcare front, new federal limits on Medicaid provider taxes are scheduled to phase in beginning in FY2028, reducing Medicaid-related revenues.

Most Recent Federal Funding Freeze (January 2026)

In early January 2026, the U.S. Department of Health and Human Services announced the freezing of $10 billion in social service and child care funding across five states, including Illinois. This action affects funds for the Child Care and Development Block Grant, Temporary Assistance for Needy Families (TANF) program, and the Social Services Block Grant. These programs collectively support childcare services, low-income families, and human services providers.

While the duration and scope of the freeze remain uncertain, the action underscores Illinois’ growing exposure to federal funding volatility. The governor’s office estimates that about $1 billion in federal funding could be withheld from state programs, though the actual impacts will depend on subsequent federal decisions and program-specific guidance.

Although this action has not yet been incorporated into official State revenue or expenditure forecasts, it highlights a broader fiscal risk facing Illinois and other states: federal funding reductions, delays, or policy changes that are difficult to predict and challenging to offset with State resources. Given the limited discretionary capacity within the General Funds budget, even temporary disruptions in federal support for healthcare and human services could strain State operations and funding priorities.

Recent Progress and Remaining Structural Constraints

Over the past several years, the State has made sustained progress in stabilizing its finances, including normalizing the bill payment cycle, reducing outstanding debt, and partially rebuilding reserves. While higher reserves improve resilience to short-term shocks, they are a buffer rather than a solution. These gains improve liquidity and reduce near-term risk but do not meaningfully change the share of the budget committed to statutorily required expenditures. Roughly 64% of projected General Funds expenditures in FY2027 will be devoted to fixed or largely nondiscretionary costs.

While the FY2026 enacted budget remains balanced on paper, it relied in part on targeted revenue increases and one-time or temporary measures, such as fund sweeps, to close emerging gaps. Such tools can preserve near-term balance but do not address the underlying mismatch between recurring revenues and expenditure growth.

Spending Pressures and Cost Drivers

Increases in spending in FY2026 and projected outyears are concentrated in pensions, healthcare, education, and other required costs. Growth in healthcare spending, particularly Medicaid, is a key driver of projected expenditure growth, driven by underlying cost trends and federal policy changes. Education funding commitments further contribute to baseline spending growth. Within human services, recent federal policy changes affecting SNAP increase state administrative and fiscal exposure. The FY2026 enacted budget shows notable increases in human services and healthcare spending, signaling baseline cost growth likely to carry into FY2027.

Long-Term Fiscal Outlook

GOMB Multi-Year Projections

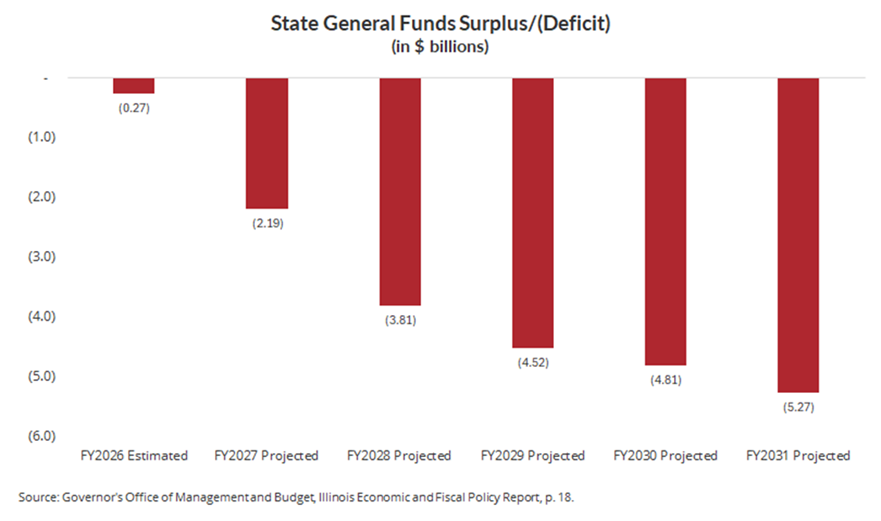

GOMB’s five-year outlook projects that—excluding the decoupling measured passed in October 2025 and absent additional policy adjustments—Illinois’ fiscal position will experience significant budget gaps over time as revenue growth fails to keep pace with expenditure demands. The October 2025 projected imbalance of revenues and expenditures is projected to be $2.2 billion in FY2027, which will continue to expand in subsequent years, reaching $5.3 billion by FY2031.

The $2.2 billion budget deficit estimated by GOMB for FY2027 is due to the federal tax code changes and the start of the reduced funding and increased costs for SNAP. Although GOMB’s official projections do not incorporate the federal funding freeze announced in January 2026, the action adds fiscal risk on top of the structural gaps already identified in the forecast.

Drivers of Out-Year Gaps

Growth in pension obligations, education spending, Medicaid and other healthcare costs, and constrained revenue performance drive the structural gaps in the multi-year outlook. Pension contributions are scheduled to rise under existing law. At the same time, healthcare spending continues to grow faster than overall revenue, resulting in a persistent mismatch between recurring revenues and the cost of maintaining existing services. Additional federal policy changes, including scheduled limits on Medicaid provider taxes, are expected to add pressure in the later years of the forecast.

Over the five-year period, General Fund revenues are expected to grow at an annualized growth rate of 2.1%, while expenditures are projected to increase at an annualized growth rate of 3.7% per year. This persistent gap between revenue growth and expenditure growth indicates that Illinois’ fiscal challenge in the out-years is structural and will not be resolved absent policy changes or sustained economic outperformance.

What to Watch for in the FY2027 Budget Proposal

As the Governor prepares to release the FY2027 budget proposal, central considerations include how to address slowing revenues, whether known cost increases are fully acknowledged, how reserves are treated, and how the State is positioned to manage federal uncertainty.

The FY2026 enacted budget shows that the State has limited capacity to backstop significant federal funding losses. As a result, any reduction in federal support will place pressure on state operations and spending priorities, making it difficult to offset with State resources, and underscoring the importance of how the FY2027 budget addresses potential federal reductions in healthcare and human services.

The State has taken targeted actions to mitigate some federal revenue impacts. The General Assembly adopted partial decoupling measures consistent with recommendations from GOMB, reducing projected income tax revenue losses in FY2026. Whether additional adjustments are pursued will be an important indicator of the State’s revenue strategy.

The Governor’s office has also taken administrative steps in response to federal uncertainty, including directing agencies to prepare for potential reductions and to reserve a portion of appropriations. Together, these actions point to a cautious budget approach focused on managing risk amid constrained resources.

Illinois’ recent fiscal progress has improved its capacity to manage near-term challenges, particularly compared to previous budget cycles marked by chronic deficits and liquidity stress. Stronger revenues, a normalized payment bill cycle, and targeted actions to mitigate federal tax impacts provide a more stable foundation entering FY2027.

At the same time, GOMB’s projections and recent federal actions indicate that the margin for error has narrowed. Structural cost pressures continue to outpace revenue growth, and the State faces increasing exposure to federal funding reductions, cost shifts, and policy uncertainty, particularly in healthcare and human services. These risks are difficult to address within a budget where most resources are already committed to fixed or nondiscretionary obligations.

As the Governor prepares to release the FY2027 budget proposal on February 18, the key question is not whether the budget balances in the coming year, but whether it realistically accounts for known cost drivers and federal uncertainty without relying on short-term solutions that shift risk forward. And, it must be noted, the choices made in the FY2027 budget will carry implications beyond the coming fiscal year. The Civic Federation will be paying close attention to how the Governor proposes to close the $2.2 billion structural budget gap and position the State to manage fiscal challenges that extend beyond a single fiscal year.

Related Research

Understanding H.R. 1: How Federal Tax Code Changes Could Impact Illinois

On the Right Track: Illinois' New Transit Agency and Path to Sustainability

Understanding H.R. 1: How New Federal Rules Could Reshape SNAP in Illinois

GOMB Report Projects Pressure on Illinois’ Budget Amid Federal Policy Changes

Federal Shutdown Threatens Food Assistance for Illinois Families

State of Illinois FY2026 Budget Roadmap: Landscape, Issues, and Recommendations