January 04, 2012

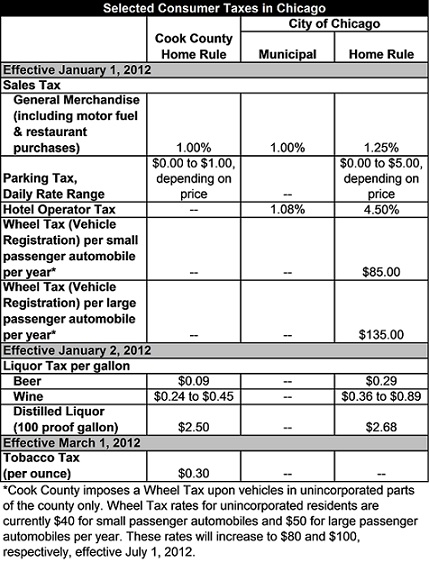

Chicago residents will experience changes in a number of consumer taxes going into effect throughout 2012 as a result of policy changes at the City and County levels. The new consumer tax rates are presented in the exhibit below. Following the table are explanations for each of the consumer taxes and historical changes to their rates.

Sales Taxes

“Sales” taxes in Illinois are actually composed of two matching pairs of taxes: retailers’ occupation and use taxes and service occupation and use taxes. For simplicity, we refer to them as sales taxes. The sales tax on general merchandise applies to tangible items excluding food and drugs but including alcoholic beverages, soft drinks and food prepared for immediate consumption. Various exemptions apply.

The composite sales tax rate for Chicago residents, which includes the State of Illinois, Cook County, City of Chicago and Regional Transit Authority, is 9.50% as of January 1, 2012. Recent changes that have impacted the composite sales tax rates include:

· Chicago home rule tax was imposed at 1.00% on August 1, 1981 and increased by 0.25% on July 1, 2005;

· Cook County home rule tax was imposed at 0.75% on September 1, 1992 and increased to 1.75% effective July 1, 2008;

· On November 17, 2009 the Cook County Board of Commissioners approved a reduction in the home rule tax rate to partially roll back the 1.00% increase imposed in 2008. On July 1, 2010, the sales tax rate decreased 0.50 percentage points to a rate of 1.25%;

· Cook County’s home rule tax decreased 0.25 percentage points to 1.00% as of January 1, 2012.

Parking Tax

This tax applies to businesses that operate parking lots and must collect the tax from customers. The tax rates vary by the hourly rate of parking, and there are different tax schedules for daily, weekly and monthly parking fees. On January 1, 2012, the top-tier of the parking tax increased from $3.00 to $5.00 with an amendment to the 2012 City of Chicago Revenue Ordinance. This tax increase is imposed only if the parking charge or fee is paid on a weekday.

(Code of Ordinances of Cook County Chapter 74, Article XIII)

(City of Chicago Municipal Code Chapter 4-236)

Hotel Operators’ Tax

This rate is expressed as an effective rate because three levels of government tax gross hotel operator receipts while two levels tax net receipts. The State, Municipal and Illinois Sports Facilities Authority hotel taxes are all taxes on gross receipts including tax receipts. In order to compensate for this structure and not double-tax, the rates are expressed as a fraction of total receipts, excluding the receipts from collecting the Metropolitan Pier and Exposition Authority tax and the City of Chicago home rule hotel tax. The latter two taxes are applied to net receipts or base charges paid by guests.

The Hotel Operator’s Tax is the only tax available to the Illinois Sports Facilities Authority. The City of Chicago tax also applies to online sales. On November 13, 2007, with the approval of the FY2008 City Budget, the Chicago City Council amended the law to clarify that the law applies to online sales. Permanent residents of a lodging place are exempt from the tax.

On November 2, 2011, the Chicago City Council passed an ordinance increasing the Hotel Operators’ Tax from 3.50% to 4.50% effective January 1, 2012. The composite Hotel Tax rate in Chicago is now 16.39%.

(City of Chicago Municipal Code Chapter 3-24)

Wheel Tax

The City of Chicago Wheel Tax is the equivalent of the state vehicle registration tax and is due annually. There are different rates for different sizes and types of vehicles. The City of Chicago rates increased with the approval of the FY2012 City Budget, effective January 1, 2012. The annual rate per automobile will increase from $75 to $85 for small passenger vehicles and from $120 to $135 for large passenger vehicles.

Cook County also imposes a wheel tax on vehicles in unincorporated parts of the county. These annual rates per automobile will increase on July 1, 2012 from $40 to $80 for small passenger vehicles and from $50 to $100 for large passenger vehicles.

(City of Chicago Municipal Code Chapter 3-56)

(Cook County Code of Ordinances Chapter 74 Article XIV)

Liquor Tax (per gallon)

This tax is applied to the making or distribution of alcoholic beverages in Illinois and is passed on to consumers. There are different rates for beer, wine and liquor based on alcohol content.

The Cook County Board of Commissioners adopted an ordinance increasing the County’s alcohol beverage taxes effective January 2, 2012. The changes in County rates per gallon are reflected in the following list: from $.06 to $.09 per gallon of beer, from $.016 to $.024 per gallon of liquor 14% or less in alcohol, from $.030 to $.045 for liquor over 14% but under 20% in alcohol. The County tax rate for liquor over 20% alcohol rose from $2.00 to $2.50 per gallon.

(Cook County Code of Ordinances Chapter 74 Article IX)

(City of Chicago Municipal Code Chapter 3-44)

Tobacco Tax

On November 15, 2011 the Cook County Board of Commissioners approved an ordinance to extend cigarette taxes to other tobacco products. The Tobacco Tax will be effective March 1, 2012 and will impose a tax of $0.30 per ounce of smoking tobacco (e.g. pipe and roll-your-own tobacco) or smokeless tobacco (e.g. snuff and chewing tobacco). Little and Large Cigars will be taxed at a rate of $0.05 and $0.25 per unit or cigar, respectively. There is no City of Chicago tax on these products.

(Cook County Code of Ordinances Chapter 74 Article X)

(City of Chicago Municipal Code Chapter 3-43)