July 01, 2020

Starting July 1, 2020, many Illinois cannabis consumers will see an increase in the taxes they pay on recreational cannabis as the Cannabis Retailers’ Occupation Tax that is allowed to be imposed by counties and municipalities goes into effect. This local option sales tax will be in addition to state excise, general sales and privilege taxes and existing local sales taxes on general merchandise.

The state legislation legalizing recreational cannabis, as amended by subsequent trailer bills,[1] allows municipalities to impose a Cannabis Retailers’ Occupation Tax of up to 3% in increments of 0.25%. Counties are allowed to impose a Cannabis Retailers’ Occupation Tax of up to 3% in increments of 0.25% for sales made in a municipality within its borders and up to 3.75% in unincorporated areas. The law provides that a municipality or county must pass an ordinance imposing the tax and file it with the Illinois Department of Revenue (IDOR) on or before April 1, 2020 in order for IDOR to administer and enforce the tax beginning on July 1, 2020. Ordinances filed on or after April 2, 2020, but on or before October 1, 2020, will be implemented by IDOR on January 1, 2021.

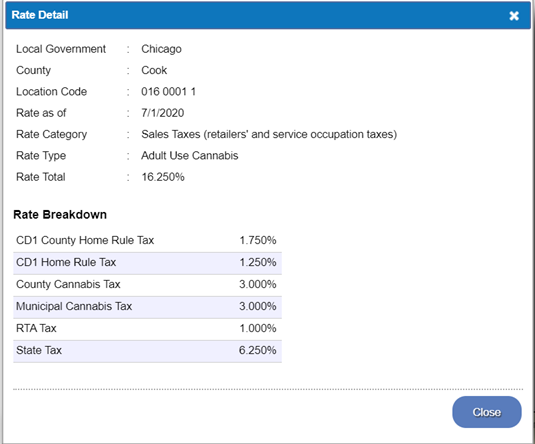

The City of Chicago and Cook County both passed a Cannabis Retailers’ Occupation Tax by the deadline. Cook County’s rate is 3.0% for any location in the County, including unincorporated areas. The City of Chicago’s is 3.0%. This means that recreational cannabis consumers in the City of Chicago will see another six percentage points in sales taxes added to their bills starting July 1 for a total of 16.25% within City boundaries. Cannabis purchasers in Illinois also pay an excise tax with a rate that depends on the type of product and its THC content. These taxes do not apply to medical cannabis purchases. See this blog post for additional information on the cannabis taxes Illinois imposes.

The City of Chicago projected last fall that its total receipts from taxes on cannabis in FY2020 would be $3.5 million. Cook County did not count on cannabis tax receipts in its FY2020 budget, but provided an updated projection in its preliminary budget forecast released last week for what the Budget Office believes all cannabis sales will generate: nearly $2.4 million. Despite the disruptions caused by the coronavirus pandemic, recreational cannabis sales have remained steady in Illinois, with record sales of $44.3 million in May.

To see whether your municipality and county have imposed the Cannabis Retailers’ Occupation Tax, visit IDOR’s Tax Finder website. Verify that the date is set to July 1, 2020 or later, enter the name of your jurisdiction and click the “Conduct Inquiry” button. Click on the number in the Adult Use Cannabis line to open a window that lists all of the different sales tax rates that make up the composite cannabis sales tax rate in your jurisdiction. The Cannabis Retailers’ Occupation Taxes will be listed as “County Cannabis Tax” and “Municipal Cannabis Tax.” The image below shows the entry for Chicago’s 16.25% composite recreational cannabis sales tax rate, including both City and County home rule sales taxes on general merchandise of 1.25% and 1.75%, respectively; the State’s 6.25% sales tax rate; the RTA sales tax rate of 1.0%; and the county and municipal cannabis sales taxes totaling 6.0%.

[1] Public Act 101-0027 as amended by Public Acts 101-0363 and 101-0593.