December 08, 2011

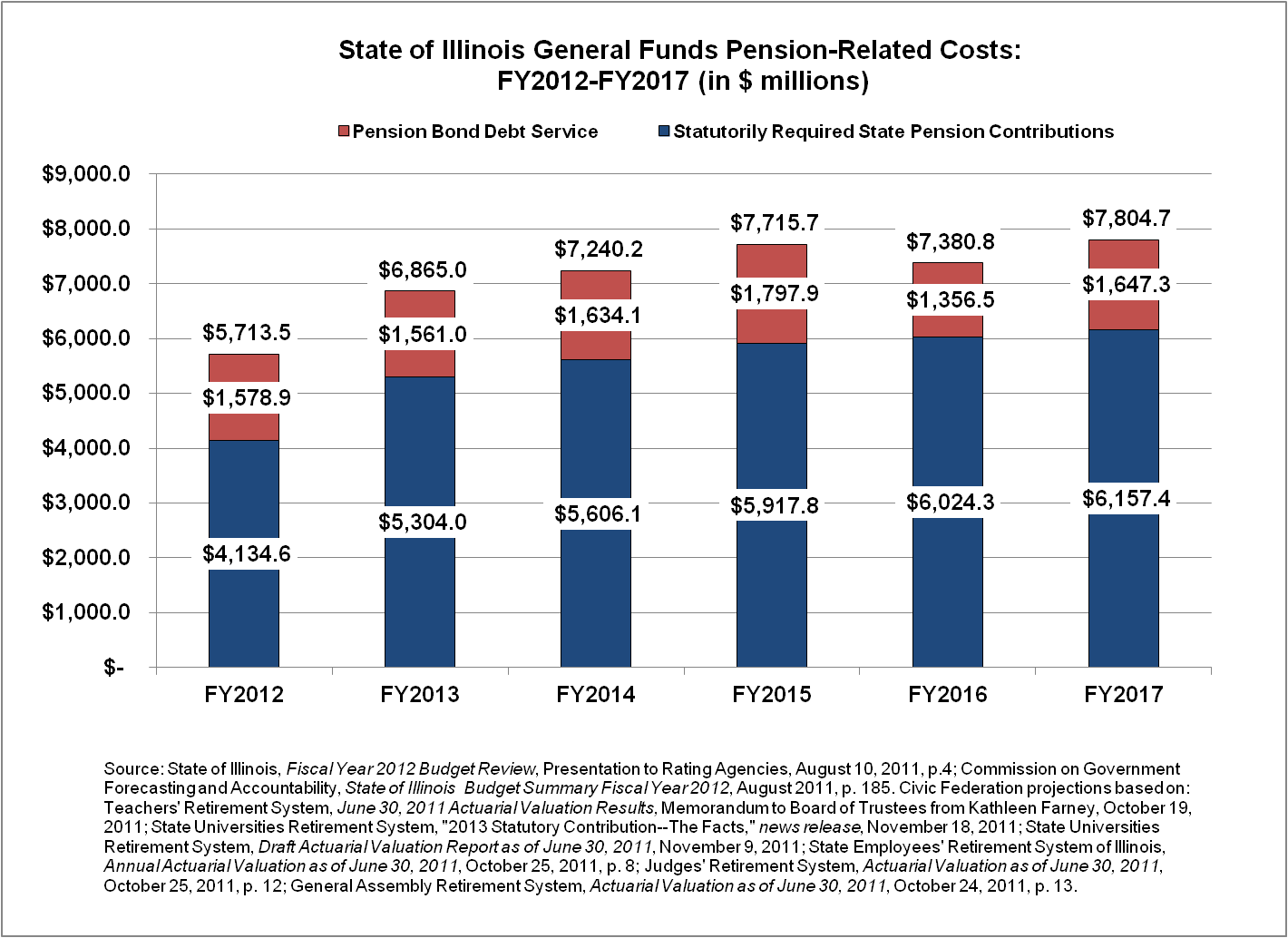

One of the greatest challenges facing the State of Illinois as it struggles to balance its annual operating budget is the continued growth in pension-related costs.

As previously discussed here, the State’s FY2013 pension contributions are now expected to be much higher than previously projected. An increase of $535 million to the statutorily required payment brings the total owed by the State to $5.8 billion in the next fiscal year. Approximately $5.3 billion of the total will be paid out of General Funds and a portion of the payment will also be made through funds outside the General Funds. Combined with the $1.6 billion in debt service it must pay toward past years’ Pension Obligation Bonds (POB), the State’s total General Funds expenditures for pensions will total $6.9 billion in FY2013. This equals a year-to-year increase of $1.2 billion from the FY2012 total of $5.7 billion. Projections for the next five fiscal years show an additional 36.6% increase in combined contribution and POB debt service totaling $2.1 billion, for a total cost of $7.8 billion by FY2017.

As pension-related costs continue to rise they will reduce the amount of General Funds resources that are available to fund the regular operations of the State. It will therefore be exceedingly difficult for the Governor and General Assembly to continue to fund all of the programs the State budget currently supports.

The following chart compares the FY2012 General Funds pension cost to the combined contributions and debt service projected for FY2013 to FY2017. These totals are based on projections from the systems’ actuarial valuation reports as of June 30, 2011.

The State’s contributions to its five retirement systems are determined by a 50-year funding plan that began in FY1996 (Public Act 88-0953). After a phase-in period of 15 years, the law requires State contributions at a level percentage of payroll sufficient to achieve a 90% funded ratio by the end of FY2045. The retirement systems calculate and certify by November 15 the amounts needed from the State to meet the funding requirements for the next fiscal year. According to the latest report from the Commission on Government Forecasting and Accountability, as of June 30, 2011 the systems had, on a market value basis, total unfunded liabilities of $83.1 billion and a combined funded ratio of 43.3%.

To reduce pension costs, the State in April 2010 passed Public Act 96-0889, which created a two-tier benefits system with lower benefits for workers hired on or after January 1, 2011. The new tier of benefits includes higher retirement ages, a cap on the maximum pensionable salary and lower cost of living adjustments. As a result of the changes, total statutorily required State contributions are expected to decline significantly through 2045. In the short term, however, pensionable salary caps for new employees lead to higher State contributions.

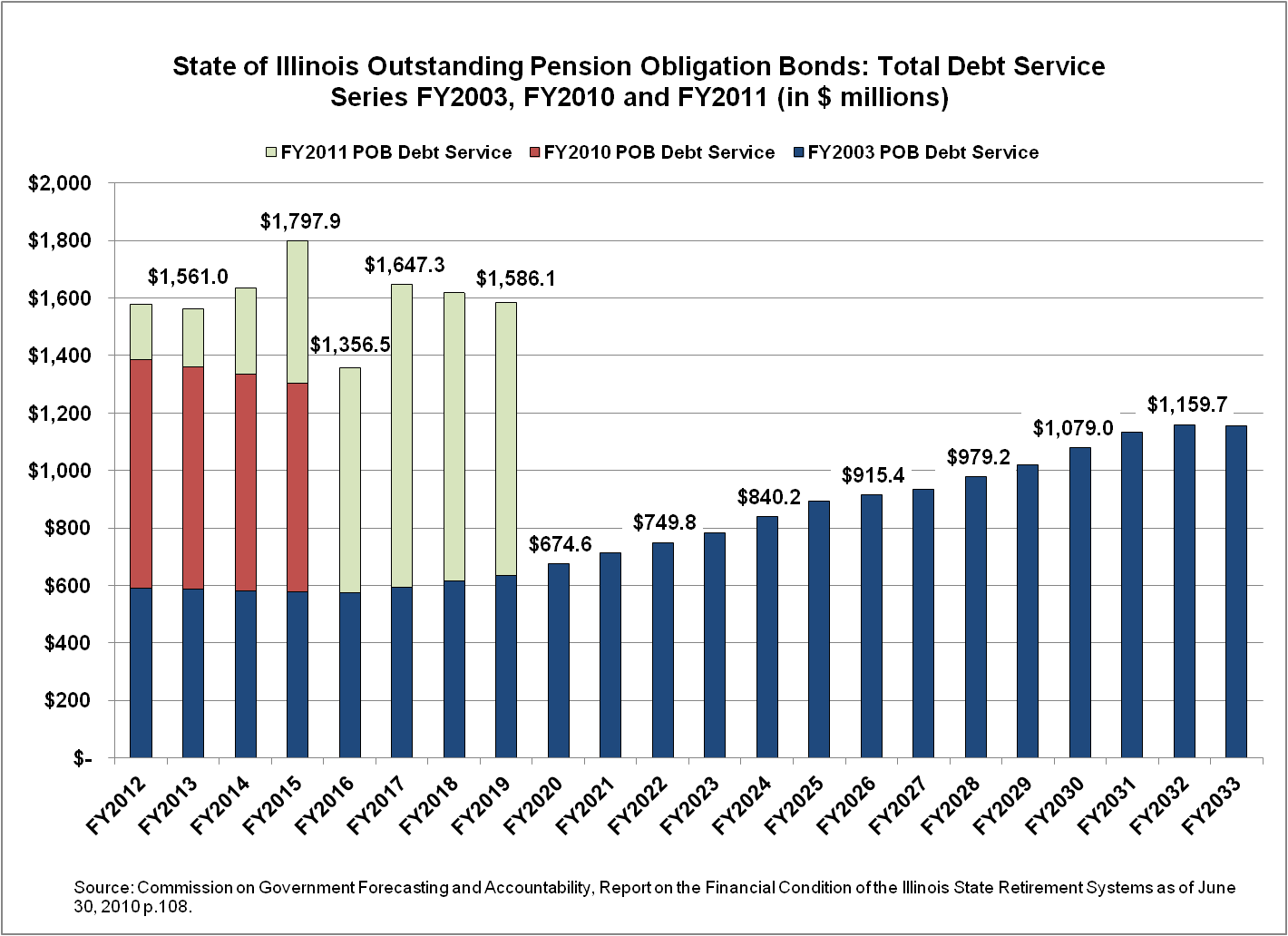

General Funds pension costs also include principal and interest payments on Pension Obligation Bonds (POBs) issued by the State in FY2003, FY2010 and FY2011. Illinois sold $10 billion of POBs in FY2003, of which $7.3 billion was used to reduce the retirement systems’ unfunded liabilities and other proceeds were used to pay part of the FY2003 State contribution and all of the FY2004 State contribution. The State also issued a total of $7.2 billion in POBs to make its pension contributions for FY2010 and FY2011 that otherwise would have come from General Funds. Debt service costs decline in FY2016 due to final retirement of the FY2010 POBs in FY2015.

Under the legislation that authorized the FY2003 POBs, the State’s annual pension contributions certified by the pension funds are reduced by the total annual debt service owed on the bonds. This effectively offsets the cost of the pension bonds each year and frees up General Funds resources that would otherwise be used to make required pension payments. The original FY2003 POBs were financed over 30 years and the last bonds will be retired in FY2033.

The debt service owed by the State on the FY2010 and FY2011 POBs is paid directly from the General Funds without any offset from the pension contribution. The FY2010 POBs are retired over five years and the FY2011 series are eight-year bonds. The principal repayment on the FY2011 POBs is delayed until after the FY2010 bonds have been repaid. This back loading of the principal for the FY2011 POBs keeps the aggregate debt service owed on both series of bonds relatively level but significantly increases the total cost of the FY2011 bonds.

The FY2010 POBs totaled $3.5 billion and will cost the State a total of $382 million in interest over five years. The FY2011 bonds, which totaled $3.7 billion, will cost the State a total of $1.3 billion in total interest cost over eight years. Although the total principal borrowed only increased by $234 million, or 6.8%, the State will pay $897.5 million more in interest for the FY2011 bonds, or a 234.8% increase over the total interest cost for the FY2010 bonds.

The State will repay a total of $16.3 billion in outstanding POB principal with interest costs of $9.5 billion, for a total of $25.8 billion in POB debt service paid between FY2012 and FY2033. The following chart shows total pension-related debt service owed by the State on all outstanding POBs.