December 04, 2019

A recent report shows that Illinois’ statutorily required contributions to its five pension funds are expected to total $9.8 billion in the upcoming fiscal year. How much of the State’s budget will be devoted to pension payments?

The answer is not as simple as it might appear and has been the subject of some confusion, including here and here. The main reason for the mistake is that most commentators focus on the General Funds budget, while State pension contributions come from other State funds as well as general operating funds.

The issue is important because it amounts to a difference of more than $1 billion in FY2021. The preliminary estimate of General Funds pension contributions in FY2021 is $8.6 billion, which represents 20.4% of the $42.2 billion general operating budget projected by the Governor’s Office of Management and Budget (GOMB). Projected General Funds pension payments increase by $512 million, or 6.3%, in FY2021 from $8.1 billion in FY2020.

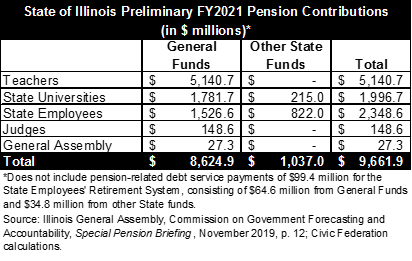

The following table, based on the recent report by the General Assembly’s Commission on Government Forecasting and Accountability (COGFA), compares General Funds and total funds contributions to the State’s pension funds. The FY2021 State contribution numbers reported by COGFA are preliminary amounts, which will be finalized by the pension funds after review by the State Actuary.

Three of the Illinois retirement systems—the Teachers’ Retirement System (TRS), Judges’ Retirement System (JRS) and General Assembly Retirement System (GARS)—receive all of their State contributions from General Funds. The State Employees’ Retirement System (SERS) gets about 35% of its contributions from other State funds that support agency payrolls. The State Universities’ Retirement System (SURS) typically gets a portion of its State funding from the State Pensions Fund, which receives proceeds from the sale of unclaimed property.

Another wrinkle involves the accounting for SERS’ share of debt service payments for pension bonds issued by the State in 2003. COGFA includes these debt service payments in State pension contributions, while GOMB’s General Funds budget projections show debt service separately. The table above excludes SERS’ debt service of $99.4 million, consisting of General Funds debt service of $64.6 million and other State funds debt service of $34.8 million. If the debt service were included, total pension contributions would be $9.8 billion instead of $9.7 billion. Total General Funds pension-related debt service costs are much higher, at about $755 million in FY2020. That figure includes debt service for all of the retirement systems on the 2003 pension bonds, as well as debt service on bonds to fund pension buyouts.

By any measure, Illinois pays a huge amount to meets its statutory pension funding requirements. The debate about pension funding can only be improved if commentators use accurate numbers.