October 18, 2019

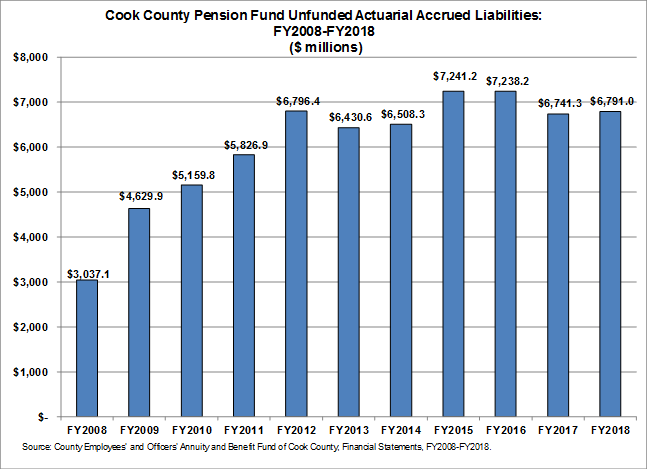

Since the beginning of FY2009, the Cook County Pension Fund has seen an increase in its liabilities not covered by assets, or the unfunded liability, of nearly $3.8 billion. The increase is attributable to a number of factors and has fluctuated over the years.

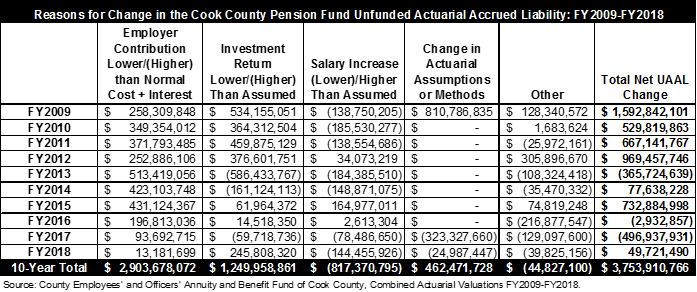

The following table presents the contributing factors that have increased or decreased the fund’s unfunded liability since the beginning of FY2009.

The largest contributor to the nearly $3.8 billion growth in unfunded liabilities between the beginning of FY2009 and the end of FY2018 was a shortfall in employer contributions as compared to a contribution that would prevent growth of the unfunded liability. That is normal cost plus interest, sometimes also called the “tread water” contribution. The County was even further short of contributing an amount that would reduce the unfunded liability. The employer contribution shortfall added $2.9 billion to the unfunded actuarial accrued liability over 10 years.

The second largest contributor was investment returns failing to meet the expected rate of return, which was 7.5% for 2009-2016 and 7.25% for 2017-2018. This added $1.25 billion to the unfunded liability over the 10-year period. Of that increase, $245.8 million was added in FY2018, mostly due to poor investment returns of -3.75% in FY2018 that were partially recognized due to smoothing.

These unfunded liability increases were somewhat offset by salary increases that have tended to be lower than originally assumed, reducing the unfunded liability by $817.4 over the past decade. Finally, changes to actuarial assumptions have added $462.5 million to the unfunded liabilities, with a large increase in FY2009 mainly due to updated mortality assumptions somewhat offset by reductions in the past two fiscal years due mainly to changes in retiree healthcare assumptions.

Looking at the employer contribution column above, it is possible to see the positive impact of increased employer contributions in recent years that have been funded by a one percentage point increase in the County’s sales tax rate. The Civic Federation supports Cook County’s practice of making supplemental contributions to its pension fund in an effort to make up for shortcomings of the contribution amount the County is required to make by State law. Cook County began making supplemental employer contributions to the pension fund in FY2016 and in the short time since then the funded status of County pensions has already improved. While the shortfall in employer contributions annually added hundreds of millions of dollars to the unfunded liability between FY2009 and FY2015, the rate of increase has steadily declined since then. In FY2018 the County’s contribution was $13.2 million short of an amount that would prevent the unfunded liability from growing, compared to $431.1 million short in FY2015, the last year before the supplemental contributions started.

The following chart shows the change in the Cook County Pension Fund unfunded liability since the end of FY2008. The values in the total net UAAL change column in the table above can be seen in the annual jumps between the different bars below.