October 17, 2013

In June this blog described the property tax exemptions available to seniors in Illinois and explored the trends in the amount of property value they exempted from taxes over the past decade. This week, we look at the same trends for other property tax exemptions available to other categories of homeowners.

Article IX, Section 6 of the Illinois Constitution permits the General Assembly to grant homestead exemptions. The General Assembly has granted eleven exemptions targeted at different groups of homeowners, including veterans, seniors and disabled persons. All homestead exemptions are designed to reduce the taxable value of homeowners’ property.

While the value of the Senior Freeze exemption in Cook County has declined significantly with falling home values, it has not fallen by as much as other homestead exemptions, which demonstrates how valuable the Senior Freeze exemption is in comparison to other homestead exemptions, such as the Alternative General Homestead Exemption (35 ILCS 200/15-176), also known as the “7% cap.” (Read more about the 7% cap in the Civic Federation’s primer on the Cook County Property Tax Assessment Process and 2007 analysis of the program.)

The 7% cap was created in 2004 in reaction to the rapid increase in home values after 2000 and was intended to prevent increases in taxable value greater than 7% each year. It applies only to Cook County. Unlike the Senior Freeze, however, the 7% cap has exemption maximums. Additionally, the 7% cap was only meant to function as a brake on rising property taxes if home values were increasing. That is, after assessments started to decline in 2008-2009, the value of homestead exemptions declined at a faster rate than did the value of the Senior Freeze exemptions as homesteads ceased to qualify for the 7% cap while properties continued to qualify for the Senior Freeze.

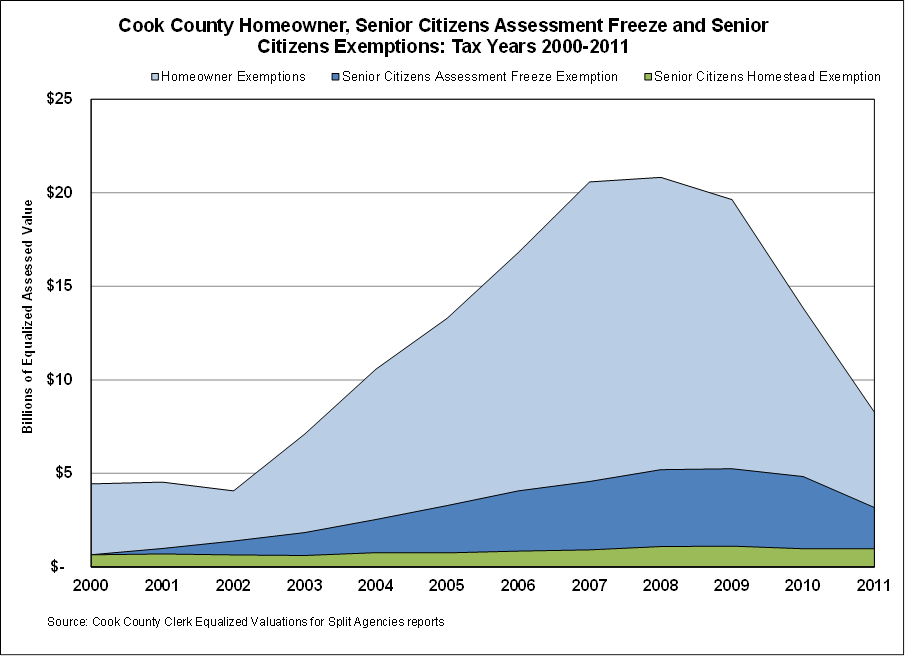

The following chart shows the change in the value of equalized assessed value (also known as taxable value or EAV) exempted by each of the two senior exemptions, as well as a category called “Homeowner Exemptions.” This category includes the General Homestead Exemption, Alternative General Homestead Exemption, Homeowner Exemption for Long-Term Properties, Long-Time Occupant Homestead Exemption and the Disabled Veterans’ Exemption, which were active for different periods between 2000 and 2011. The Civic Federation’s primer on the Cook County Property Assessment Process provides descriptions of these different types of exemptions.

The Homeowner Exemptions category is worth more in total because there are a greater number of properties that qualify for the different homeowner exemptions. Homeowner exemptions increased by a very significant amount between 2000 and 2009, 342.2% or $15.2 billion. The trend after 2009 for homeowner exemptions was much more dramatic than the Senior Freeze as the amount of EAV exempted by the different homeowner exemptions declined by nearly 59% or $11.4 billion, due in most part to the functional end of the 7% cap. For more about the demise of the 7% cap, see the March/April 2013 edition of “Tax Facts,” a publication of the Taxpayers’ Federation of Illinois.

The following chart shows the EAV exempted by the different homestead exemptions available in Cook County for tax year 2011. Also included below is the same chart for 2008, which was the last year of data available when the Civic Federation published its primer on property tax assessments. The total of $12.4 billion in EAV exempted in tax year 2011 is down from $27.1 billion in tax year 2008.