November 09, 2017

The financial condition of Illinois’ pension funds improved slightly due to strong investment returns, but they remained critically underfunded at the end of fiscal year 2017.

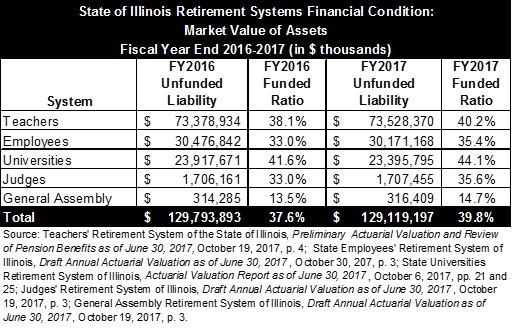

The five State-funded retirement systems had total unfunded liability of $129.1 billion as of June 30, 2017, based on the market value of assets, and a combined funded ratio of 39.8%. That compares with unfunded liability of $129.8 billion and a funded ratio of 37.6% a year earlier. Unfunded liability is the pension obligation that is not covered by pension assets. A funded ratio shows the percentage of accrued pension liability covered by pension assets.

The following chart compares unfunded liabilities and funded ratios at the end of fiscal years 2016 and 2017, based on the market value of assets, for each of the funds: the Teachers’ Retirement System (TRS), State Employees’ Retirement System (SERS), State Universities Retirement System (SURS), Judges’ Retirement System (JRS) and General Assembly Retirement System (GARS). The numbers come from preliminary actuarial valuations approved last month by the systems’ trustees.

Based on market values, the total assets of the State’s retirement systems rose by 9.2% to $85.4 billion at the end of FY2017 from $78.2 billion at the end of FY2016. The systems’ liabilities increased by 3.1% to $214.5 billion from $208.0 billion.

The Illinois results are in line with public pension funds across the U.S., which posted the largest investment gains in three years. TRS, the State’s largest pension fund, reported a 12.4% return on the market value of assets, the highest rate since FY2014, according to the preliminary actuarial valuation. The other systems’ reports showed returns of 12.2% (SERS and SURS), 11.6% (JRS) and 10.5% (GARS).

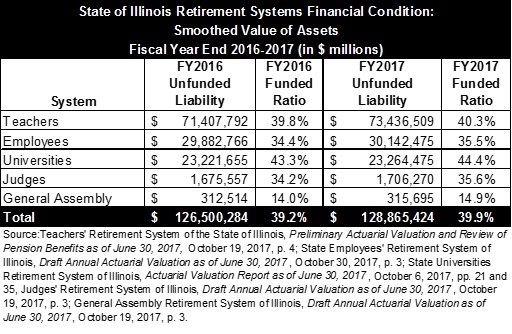

Since FY2009, Illinois law has required the use of smoothed asset values, rather than market values, to calculate State pension contributions. Under asset smoothing, unexpected gains and losses in any fiscal year—which differ from a fund’s assumed rate of investment return—are recognized over five years.

The next table shows the same information based on asset smoothing. The combined funded ratio on a smoothed basis inched up to 39.9% at the end of FY2017 from 39.2% at the end of FY2016, but the total unfunded liability increased to $128.9 billion from $126.5 billion. Asset smoothing moderated the impact of investment gains in FY2017. On a smoothed basis, total asset values increased by 5.1% to $85.6 billion in FY2017 from $81.5 billion in FY2016.

Under Illinois’ pension funding law, total unfunded liabilities are expected to increase each year until roughly FY2028 based on assumed investment returns. The 50-year plan, which began in FY1996, requires the State to contribute a level percentage of payroll sufficient to bring the retirement systems’ funded ratios to 90% by FY2045. The plan defers or backloads State contributions into the future, and contributions have been insufficient to prevent growth in unfunded liabilities.