February 09, 2018

After two years without a complete budget but with spending exceeding revenues, Illinois’ backlog of unpaid bills rose to $16.8 billion in November 2017. Now the cost for that payment delay is coming due.

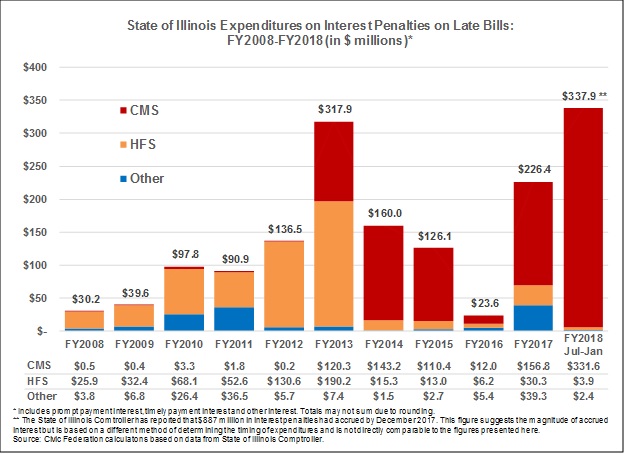

Through the first seven months of FY2018, the State spent $337.9 million on interest penalties on overdue bills, according to Civic Federation calculations based on data on the Illinois Comptroller’s website. Spending on interest penalties in the current fiscal year, which ends on June 30, 2018, has already exceeded the previous annual high of $317.9 million in FY2013. Most of the FY2018 spending—$245.8 million—was in January 2018.

Interest penalties are paid after the State clears the underlying bills, so it is not surprising that the surge in late payment interest spending follows Illinois’ sale of General Obligation bonds to reduce the backlog. The $6 billion bond issuance was authorized by the Illinois General Assembly as part of its FY2018 budget package, enacted on July 6, 2017, which ended the budget impasse.

The Comptroller’s Office has said that the bond sale immediately reduced the backlog by about $8.7 billion and was mainly used to pay down group health insurance and Medicaid bills. In addition to the expected proceeds of $6 billion, the State received a premium of $482 million on the bond price and $2.2 billion in federal Medicaid reimbursements.

The bond sale made financial sense because the State’s coupon rate of 3.5% on the bonds was far below the steep interest penalties it pays on many overdue bills. Under the State Prompt Payment Act, interest accrues at 1% a month, or 12% annually, on proper bills that are not paid within 90 days. Proper bills are defined as those that include the information needed to process the payment. Other claims, including those from healthcare providers, accrue interest at 9% a year after 30 days under the timely payment provisions of the Illinois Insurance Code.

Certain payables, such as transfers to local governments and other State funds, are not eligible for penalty interest. After prolonged payment delays due to the budget impasse, the General Assembly recently extended eligibility for Prompt Payment interest to grants to social service agencies. The law was passed over the veto of Governor Bruce Rauner, who stated in his veto message that the effort was well intentioned but would have the effect of adding to the State’s liabilities through higher interest costs.

Illinois spent $1.6 billion on late payment interest penalties from FY2008 through January 2018. As shown in the following chart, most of the penalties were paid by the Departments of Healthcare and Family Services (HFS) and Central Management Services (CMS). HFS administers the Medicaid program and was in charge of employee group health insurance before FY2013, when that program was shifted to CMS. The group health insurance program received no general operating funds during the budget impasse in FY2016 and FY2017.

A significant amount of accrued interest penalties are still unpaid. A January 2018 report by the Comptroller’s Office showed accrued interest penalties of $887 million on December 31, 2017. These numbers suggest the magnitude of accrued interest but are not comparable to the spending totals in the chart. Although all of the numbers are from the Comptroller’s Office, they reflect different points in the payment process; interest checks counted as pending in the report are shown as expenditures on the website.

The report was issued pursuant to a new law that requires agencies to make monthly reports to the Comptroller’s Office on bills that have not yet been submitted for payment; previously, agencies had to report once a year, on October 1, on bills on hand as of the end of the previous fiscal year on June 30. Additionally, agencies now have to show which accounts bills must be paid from, specify whether bills are supported by appropriations and provide an estimate of interest penalties owed.

Illinois Comptroller Susana Mendoza backed the measure as a way to help manage the State’s cash flow, minimize late payment penalties and improve public understanding of Illinois’ financial condition. The General Assembly enacted the law despite a veto by Governor Rauner, who stated that it would be unduly burdensome for agencies to compile the monthly reports.

The January report answered a question that has long interested State budget-watchers: does the backlog calculation include penalty interest? In fact, the reported $9.2 billion backlog as of the end of calendar year 2017 included a significant portion of the total $887 million in accrued interest, according to the Comptroller’s Office. The backlog included $791 million in interest owed on bills already paid, while the total $887 million in accrued interest also included interest owed on bills held at the Comptroller or at State agencies.

It remains to be seen how long it will take for the State to pay remaining accrued interest penalties. As of February 9, 2018, the Comptroller’s Office reported a backlog of $8.7 billion.