September 28, 2016

The Civic Federation recently released a report that examines unincorporated areas in Cook County. This report builds on an earlier report released by the Civic Federation in 2014 by providing a comprehensive analysis of all unincorporated areas in Cook County as well as recommendations to assist the County in eliminating unincorporated areas. In the report, the Civic Federation presents findings on the cost of the County providing municipal-type services in unincorporated areas compared to revenue generated from the unincorporated areas as of the County’s 2014 fiscal year (the most recent available as of the time of data collection for this report). Those findings are described below. The Civic Federation will continue to publish additional material from the Unincorporated Cook County report on this blog over the next several months.

Cook County Unincorporated Area Revenues and Expenditures

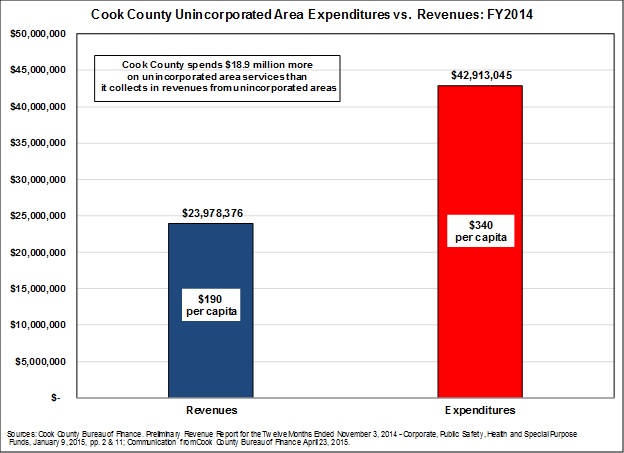

Cook County spent approximately $18.9 million more on unincorporated area services than the total revenue it collected in those areas in FY2014. This includes nearly $24.0 million in revenues generated from the unincorporated areas of the county and $42.9 million in expenses related to the delivery of municipal-type services to the unincorporated areas of the county. In sum, all Cook County taxpayers provide an $18.9 million subsidy to residents in the unincorporated areas. On a per capita basis, the variance between revenues and expenditures is $150, or the difference between $340 per capita in expenditures versus $190 per capita in revenues collected.[1]

Estimated Cost of Cook County Services Provided to Unincorporated Areas

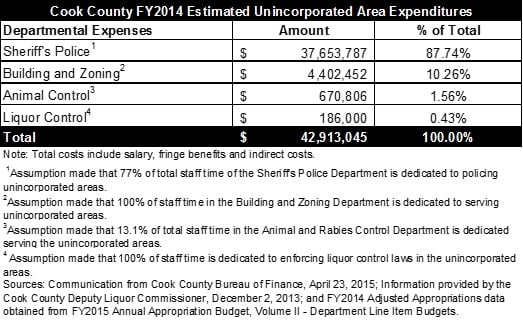

In FY2014 Cook County’s cost to provide law enforcement, building and zoning, animal control and liquor control services was approximately $42.9 million or $340.49 per resident of the unincorporated areas. The following chart identifies the Cook County agencies that provide services to the unincorporated areas and the costs associated with providing those services.

Estimated Revenues Collected in the Unincorporated Areas

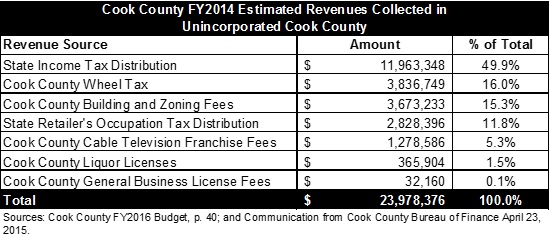

Services provided to Cook County’s unincorporated areas are funded through a variety of taxes and fees. These include revenues generated from both incorporated and unincorporated taxpayers to fund operations countywide. Some revenue sources are generated or are distributed solely within the unincorporated areas, such as income taxes, building and zoning fees, state sales taxes, wheel taxes and business and liquor license fees. The unincorporated areas also generated revenues from the Cook County sales and property taxes, which totaled nearly $15.5 million in revenue. However, those taxes are imposed at the same rate in both incorporated and unincorporated areas and are used to fund all county functions.

Revenues Generated Solely Within the Unincorporated Areas

Income Taxes. The State of Illinois allocates income tax funds to Cook County based on the number of residents in unincorporated areas. If unincorporated areas are annexed to municipalities, then the distribution of funds is correspondingly reduced by the number of inhabitants annexed into municipalities.[2] In FY2014 the County collected approximately $12.0 million in income tax distribution based on the population of residents residing in the unincorporated areas of Cook County.

The Wheel Tax. The wheel tax is an annual license fee authorizing the use of any motor vehicle within the unincorporated area of Cook County. The annual rate varies depending on the type of vehicle as well as a vehicle’s class, weight, and number of axles. Receipts from this tax are deposited in the Public Safety Fund. In FY2014 the tax generated an estimated $3.8 million.[3]

Building and Zoning Department Fees: The Cook County Department of Building and Zoning assesses a number of permit and zoning fees, which generated nearly $3.7 million in revenues in FY2014. These fees include:

Contractor’s Business Registration Fee: There is a fee of $105 for initial registration and a fee of $52.50 for renewal.

Annual Inspection Fees: $63 per hour per inspector for inspections by plumbing, electrical, building, fire, elevator and liquor and/or food dispensing establishments.

Local Public Entity and Non-Profit Organization Fees: As of December 1, 2014, all organizations are required to pay 100% of standard building, zoning and inspection fees.

In addition, there are a number of specific zoning, building permit, mechanical permit, electrical permit, plumbing permit and temporary permit fees. [4]

State Retailer’s Occupation Tax: The State of Illinois imposes a tax on the sale of certain merchandise at the rate of 6.25%. Of the 6.25%, 1.0% of the 6.25% is distributed to Cook County for sales made in the unincorporated areas of the County. In FY2014 this amounted to approximately $2.8 million in revenue. However, if the unincorporated areas of Cook County are annexed by a municipality this revenue would be redirected to the municipalities that annexed the unincorporated areas.

Cable Television Franchise Fees: Cable television providers pay a fee to the County for the right and franchise to construct and operate cable television systems in unincorporated Cook County. In FY2014 the fee generated nearly $1.3 million in revenue.

Liquor License Fees: Businesses located in unincorporated Cook County pay a fee in order to obtain a license that allows for the sale of alcoholic liquor. The fee is paid annually upon renewal of the application. The minimum required license fee is $3,000 plus additional background check fees and other related liquor license application fees. In FY2014 these fees generated $365,904.[5]

General Business License Fees. Businesses in unincorporated Cook County engaged in general sales, involved in office operations, or are not exempt are required to obtain a Cook County general business license. The license fee is $40 for a two-year license.[6] In FY2014 Cook County generated approximately $32,160 in revenue from business license fees in unincorporated areas.The exhibit below provides an overview of revenues generated solely within the unincorporated areas. The two largest revenue sources are income tax and wheel tax receipts. Together they totaled $15.8 million, or 65.9% of all unincorporated area revenues generated in FY2014. Building and zoning fees generated roughly 15.3% of all revenues. The State of Illinois Retailer’s Occupation Tax Distribution generated approximately $2.8 million. Cable television franchise fees generated nearly $1.3 million in revenue. Smaller sums were generated from liquor license fees and general business license fees, which totaled approximately $398,000 in revenue.

Revenues Generated in Incorporated and Unincorporated Areas

Cook County Property Tax. Property owners in Cook County paid a 0.560% property tax rate on the equalized assessed value (EAV) of their properties in tax year 2013 (payable in 2014). The estimated EAV of all Cook County unincorporated properties in tax year 2013 was $2.3 billion. That generated approximately $12.6 million in property taxes.[7] However, the same tax rate is imposed on all property owners countywide and cannot be classified as a revenue collected to provide municipal-type services to the unincorporated areas because all Cook County residents pay the Cook County property tax rate. If the unincorporated areas were eventually annexed, Cook County would continue to collect the Cook County property tax to fund countywide operations and residents would then be subject to a municipal property tax, which is typically much higher. For example, in tax year 2013 (payable in 2014) municipal tax rates ranged from 0.059% in the City of Countryside to 10.974% in the Village of Park Forest.[8]

Cook County Home Rule Retail Occupation Tax. Cook County imposes a sales tax on the sale of tangible personal property at retail countywide at the rate of 0.75%. The sales tax generated approximately $333.5 million in revenue in FY2014. If the unincorporated areas of Cook County are annexed by a municipality, the County would continue to collect this revenue source for countywide operations.

[1] It is important to note that these figures do not include Cook County property and sales taxes because they are imposed at the same rate on both incorporated and unincorporated areas countywide and would continue to be collected if the unincorporated areas are annexed by a municipality. According to Civic Federation calculations, the unincorporated areas generated approximately $12.6 million in property tax revenue in tax year 2013 (payable in 2014). The Cook County Home Rule Retailer’s Occupation Tax generated approximately $2.8 million in revenue within the unincorporated areas of the county. However, the property tax and sales tax is imposed on both incorporated and unincorporated taxpayers to fund general operations countywide, not specifically for the delivery of municipal-type services to the unincorporated areas of the county.

[2] 30 ILCS 115/2, section 2 (a).

[3]Cook County FY2016 Budget, p. 40.

[4] A complete list of Cook County Department of Zoning and Building fees can be found at http://www.cookcountyil.gov/wp-content/uploads/2014/06/14-5599-Building-Fee-Schedule.pdf