April 28, 2016

The City of Chicago and Cook County recently joined a number of states nationwide in a move to exempt female hygiene products from the sales tax.

At the Local Level

On March 16, 2016 the Chicago City Council voted to exempt certain female hygiene products from Chicago’s Home Rule Municipal Retailer’s Occupation Tax of 1.25%. The City Council also passed two resolutions calling on the Illinois General Assembly and the Illinois Department of Revenue to reclassify female hygiene products as a medical necessity from its current classification as a medical appliance, qualifying those products for a reduced state sales tax rate of 1.0% rather than the higher rate of 6.25%. Soon after the Cook County Board of Commissioners voted to exempt female hygiene products from the Cook County Retailer’s Occupation Tax of 1.75%.

Cook County’s ordinance exempting female hygiene products from its retailer’s occupation tax of 1.75% will take effect January 1, 2017. The City of Chicago ordinance exempting female hygiene products from its retailer’s occupation tax of 1.25% is also scheduled to take effect on January 1, 2017. There were no studies publicly presented on the projected loss in tax revenue from the exemption on these products.

The history of the how the Illinois Department of Revenue (IDOR) and the City of Chicago classify female hygiene products dates back to the late 1980s when a class action lawsuit was filed alleging the City of Chicago illegally taxed female hygiene products purchased from various retailers despite the fact that the IDOR construed those items as “medical appliances” exempt from the sales tax.[1] The lawsuit was eventually decided by the Illinois Supreme Court, which ruled that the tax imposed on the purchase of these items was illegal. The high court held that tampons and sanitary napkins were indeed medical appliances, not grooming and hygiene products, and therefore exempt from the Chicago’s sales tax. However, effective September 1, 2009, the Illinois Department of Revenue (IDOR) reclassified nonprescription medicine and drugs to not include grooming and hygiene products, such as tampons and pads, and subjected them to the higher general merchandise sales tax rate of 6.25%, rather than the reduced rate of 1.0%.[2] This change in classification was made in Public Act 96-0034, related to the Illinois Jobs Now! program that increased various fees and tax rates to help fund the State’s capital improvement program.

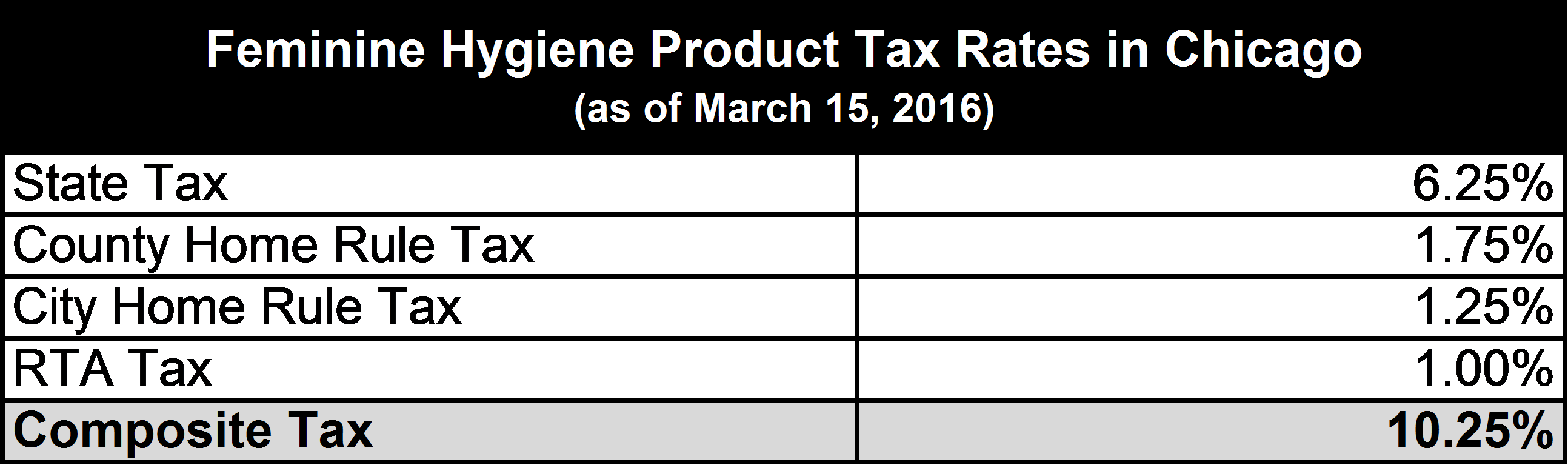

The chart below displays the tax rates that purchasers of tampons and sanitary pads were subject to prior to the passage of the ordinances by Cook County and the City of Chicago. With Chicago and Cook County passing legislation exempting these products from its local sales tax, the composite rate imposed on the retail purchase of female hygiene products is reduced to 7.25% in the City of Chicago. If the Illinois Department of Revenue reclassifies certain female hygiene products, those products would qualify for the reduced state sales tax rate of 1%, rather than the current rate of 6.25%.

At the National Level

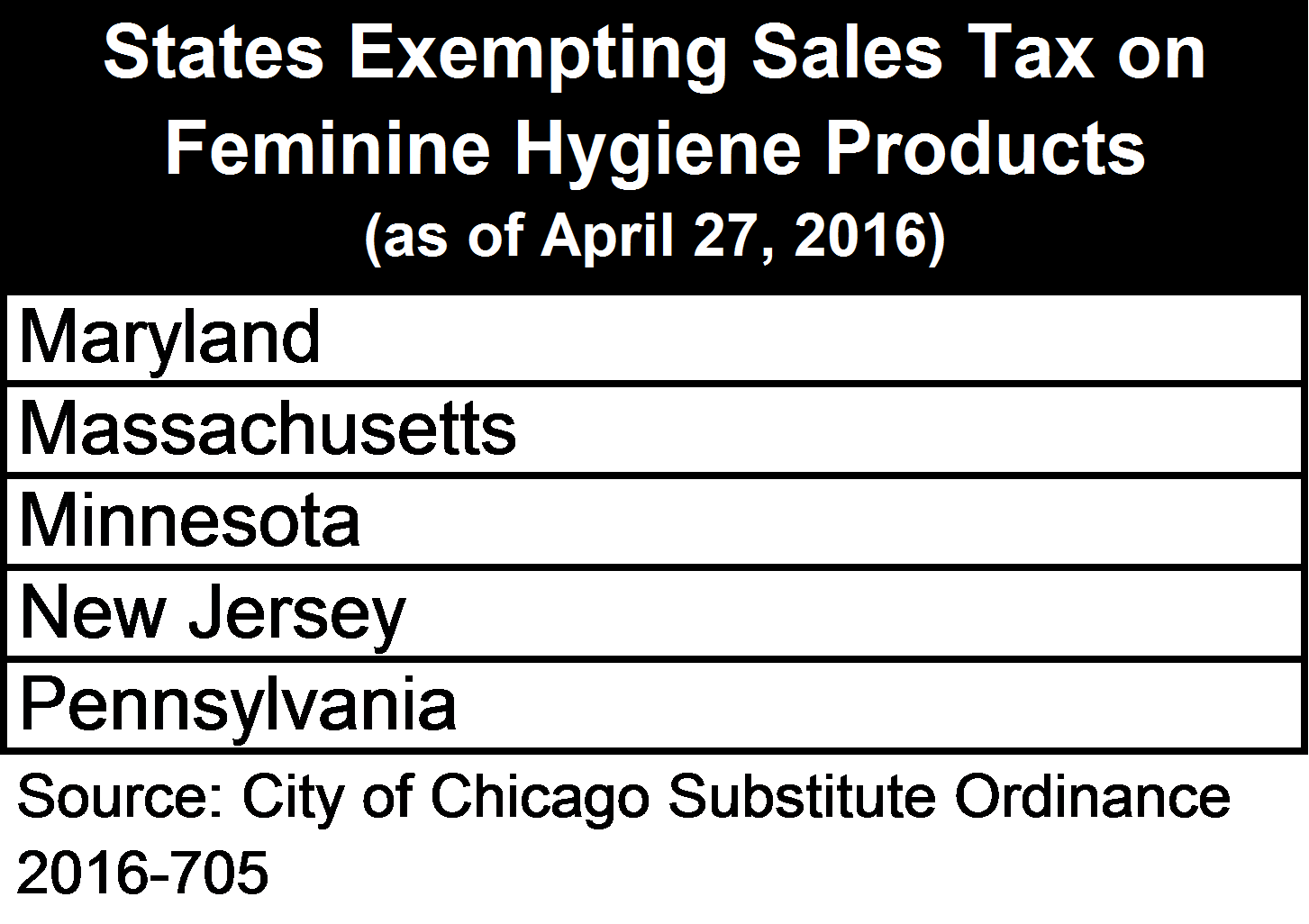

According to the Tax Foundation, there are five states that do not impose a statewide sales tax: Alaska, Delaware, Montana, New Hampshire and Oregon. In addition to the five states that do not impose a statewide sales tax, the chart below identifies the five states that have passed laws exempting female hygiene products from their statewide sales tax.

The next chart identifies states that currently have legislation pending that would exempt female hygiene products from the statewide sales tax. In Utah the bill to exempt incontinence and feminine hygiene products from the State’s sales and use tax failed to pass in the Utah House of Representatives. In the Wisconsin State Legislature, Assembly Bill 949, which would have exempted certain female hygiene products from its sales and use tax also failed to pass.

|

Pending Legislation Exempting Feminine Hygiene Products from Sales and Use Tax in Selected States (as of April 27, 2016) |

||

|

State |

Legislation |

|

|

Illinois |

||

|

California |

||

|

Connecticut |

||

|

Michigan |

||

|

New York |

||

|

Ohio |

||

|

Rhode Island |

||

|

Tennessee |

||

|

Senate Bill 2285 |

||

|

Virginia |

||

The chart below identifies the projected loss in tax revenue of selected states that are currently considering legislation that would exempt certain female hygiene products from the state sales tax. As noted above, there are a number of other states’ legislatures that are considering exempting certain female hygiene products from the various states sales taxes. However, fiscal impact studies on the projected loss in tax revenue for those states have not been conducted or are not publicly available.

|

Selected States Projected Loss in Sales Tax Revenue by Exempting Certain Female Hygiene Products (in $ millions) |

|

|

State |

Loss of Revenue |

|

California |

|

|

Illinois |

|

|

Tennessee |

|

|

Virginia |

|

|

Wisconsin |

|

Helpful Link

For more information on taxes, including rates and descriptions, see the Civic Federation’s most recent report on Selected Consumer Taxes in the City of Chicago.

[1] http://lawecommons.luc.edu/cgi/viewcontent.cgi?article=1832&context=lclr

[2] In the Regional Transit Agency’s (RTA) jurisdiction food and drugs are also subject to a tax of 1.25%