December 21, 2011

In this latest entry in a blog post series on local government pension funds, the Civic Federation analyzes the Metropolitan Water Reclamation District of Greater Chicago’s pension fund.

The MWRD is the only sanitary district in Illinois to have its own pension fund. All other sanitary districts that provide pension benefits participate in the Illinois Municipal Retirement Fund. The MWRD pension fund is governed by a seven-member Board of Trustees. As prescribed in state statute, four members are elected by the employees and three members are appointed by the MWRD Board of Commissioners with the approval of the pension fund Board of Trustees. One of the appointed members must be a retiree.

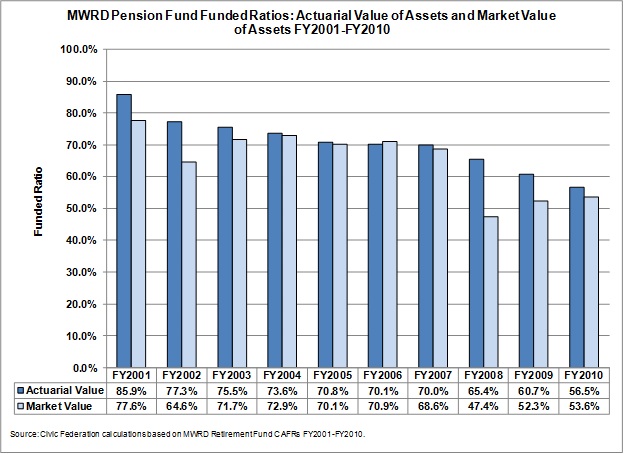

The funded ratio of the MWRD pension fund has declined significantly over the past ten years. The actuarial value funded ratio fell from a high of 85.9% in FY2001 to 56.5% in FY2010. The market value funded ratio fell from a high of 77.6% in FY2001 to a low of 47.4% in FY2008 before rebounding slightly to 53.6% in FY2010. The sizeable difference between FY2008 actuarial and market value funded ratios is due to the fact that FY2008 investment returns were much lower than the smoothed returns over five years. This continued decline in funded ratio is a cause for concern. In general, a ratio below 80% is considered to be an indication that the fund is in poor health.

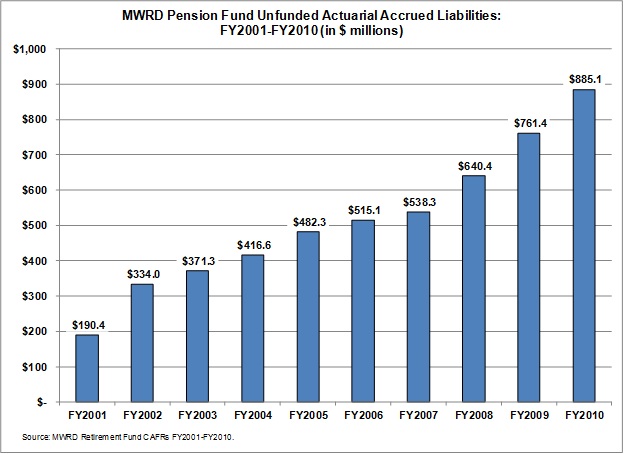

Unfunded actuarial accrued liability (UAAL) is the dollar value of accrued liabilities not covered by the actuarial value of assets. As shown in the exhibit below, unfunded liability for the MWRD pension fund totaled $885.1 million in FY2010, up from $190.4 million in FY2001.

The largest contributor to the growth in unfunded liabilities between FY2001 and FY2010 was investment returns failing to meet the 7.75% expected rate of return. This added $426.0 million to the UAAL. The second largest contributor was employer contributions that were $218.8 million less than the annual normal cost plus interest on the UAAL.[1]

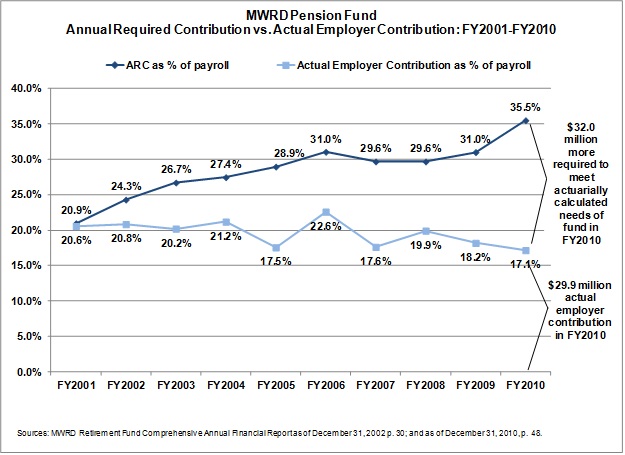

Previous blog posts have described the annual required contribution (ARC), which is an amount of employer contribution that would be adequate to both cover normal cost and amortize the unfunded liability of a pension fund over 30 years. The graph below illustrates the growing gap between the MWRD pension fund ARC as a percent of payroll and the actual employer contribution as a percent of payroll. The spread between the two amounts has grown from a 0.3 percentage point shortfall in FY2001 to an 18.3 percentage point shortfall in FY2010. In other words, to fund the pension plan at a level that would both cover normal cost and amortize the unfunded liability over 30 years the District would have needed to contribute an additional 18.3% of payroll or $32.0 million in FY2010.

MWRD has consistently levied and contributed its statutorily required amount of 2.19 times the employee contribution made two years prior. However, that amount has been less than the ARC for each of the last ten years. The pension fund actuary estimates that in order to contribute an amount sufficient to meet the ARC in FY2011, MWRD would need to levy property taxes equal to a tax multiple of 4.19 rather than 2.19.[2]