November 12, 2014

The provisions of Public Act 98-0622 will not go into effect until January 1, 2015, but the changes to Chicago Park District employee and retiree pension benefit levels contained in the legislation have already reduced the fund’s unfunded liability by $109.4 million or 18.5% and increased the funded ratio by five percentage points to 45.5%. Those changes, described in more detail in this blog post, include a reduced automatic annual increase for current employees and retirees, staggered years where no automatic annual increases will be granted and increased early retirement age.

The Park Employees’ Annuity and Benefit Fund of Chicago Fiscal Year 2013 Comprehensive Annual Financial Report shows the financial impact of only the benefit changes included in the reform package, since the increased employee and employer contributions will not be received until after January 1, 2015.

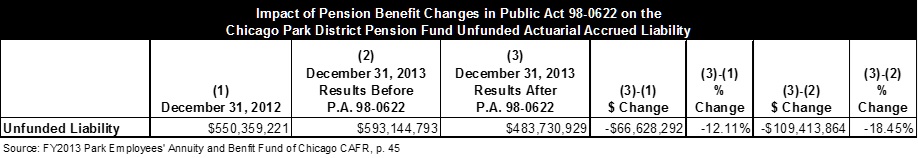

Page 45 of the FY2013 Park Fund CAFR shows the impact of the benefit changes on the fund’s unfunded actuarial accrued liability by disclosing both what the FY2013 valuation of the fund would have been without the changes and then laying out the FY2013 valuation with changes. The following chart summarizes those changes, showing the results as of December 31, 2012,[1] what the December 31, 2013 results were before the changes in P.A. 98-0622 were applied and what the December 31, 2013 results were after the benefit changes.

If the benefit changes had not been made, the unfunded liability would have increased in FY2013 by $42.8 million over year-end 2012. Instead, the unfunded liability fell by $66.6 million by the end of FY2013 from year-end 2012. Thus, the total impact of the benefit changes passed for the Park District fund was a decrease of $109.4 million or 18.5% in the unfunded liability in FY2013 from what it would have been without the changes.

The funded ratio also increased as a result of the benefit changes. The funded ratio as of December 31, 2012 was 43.4% and would have fallen to 40.5% in FY2013 if the benefit changes had not been made. Instead, the 2013 year-end results show an increase in the funded ratio after the benefit changes to 45.5%.[2] The entire reform package is intended to raise the funded ratio of the Park District Pension Fund to 90% by 2049 and to 100% by 2054. Prior to the reforms, the fund had been projected to run out of money within 10 years.

[1] Results as of December 31, 2012 are not FY2012 results. The Park District Fund changed its fiscal year from July-June to a calendar year fiscal year for FY2013, meaning there was a six-month fiscal year ended December 31, 2012 between the end of FY2012 on June 30, 2012 and the start of FY2013 on January 1, 2013. Therefore, this blog refers to results as of December 31, 2012 rather than referring to a fiscal year. The change was made pursuant to Public Act 97-0894. See Civic Federation, /civic-federation/blog/changes-chicago-park-district-pension-fund-fiscal-year, for more details.

[2] Park Employees’ Annuity and Benefit Fund of Chicago Comprehensive Annual Financial Report as of December 31, 2013, p. 45.