September 26, 2016

On September 14, 2016, the Chicago City Council approved a tax on water and sewer usage in the City of Chicago in order to fund the City’s Municipal Employees’ Annuity and Benefit Fund (MEABF). In a 40-10 vote, the City Council passed an ordinance that amends the Municipal Code of Chicago by adding Chapter 3-80: Chicago Water and Sewer Tax. This ordinance creates a new tax on water consumption applied to water and sewer bills that will be phased in over a four-year period. The revenue generated from each tax rate increase during that period would create a “ramp” to increase payments incrementally to the Municipal pension fund.

In order to increase the City’s pension contributions to the Municipal fund, the Illinois General Assembly and the Governor must approve legislation allowing for changes to the payment schedule. The City plans to introduce legislation this fall seeking approval to increase employer contributions and to make changes to new employee contributions. The proposal has not been released in bill form, but the outline of the proposal was made public in August. The agreement would increase employee contributions by three percentage points for new hires and would lower the eligibility age for full retirement benefits from 67 to 65 for new employees hired on or after January 1, 2017. Employees hired after January 1, 2011 but before January 1, 2017 would have the option to accept a lower eligibility age of 65 for full benefits in exchange for increasing their payroll contributions by three percent to 11.5%.

The Governor has reportedly been hesitant to support the City’s proposal because it creates a ramp that allows for payments to increase gradually rather than addressing pension funding immediately. If the Governor were to veto the legislation put forth by the City of Chicago this fall, the Illinois General Assembly would need to override it with a three-fifths vote in each House in order for the legislation to pass. For example, the Governor vetoed Senate Bill 777, which applied to Chicago Police and Fire pensions. The General Assembly overrode the veto, allowing the bill to become law.

On September 19, 2016, the Illinois House Personnel and Pensions Committee held a subject matter hearing for a pension funding proposal, Amendment to House Bill 705, put forth by the Municipal Employees’ Annuity and Benefit Fund. The MEABF plan would increase pension payments more quickly than the City of Chicago’s proposed payment schedule. Representatives from the City of Chicago spoke in opposition to the plan, stating that its steeper ramp would put too much of a burden on taxpayers. Representatives for the MEABF questioned the fixed payment amounts outlined in the City’s plan because there is a chance the fund could go insolvent before the City reaches the end of the ramp.

What is the water-sewer tax?

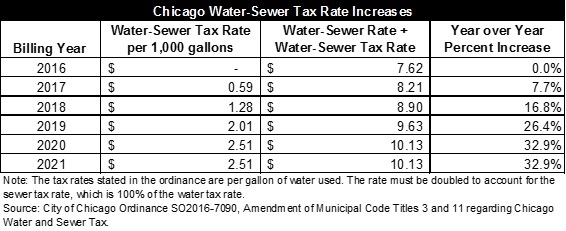

Chicago’s new water-sewer tax imposes a tax on the consumption of water and the transfer of wastewater to the sewer system. The current rate for water usage in Chicago is $3.81 per 1,000 gallons. Sewer charges are 100% of the water bill, meaning that if a household is charged $100 for water, it is also charged $100 for sewer services. The new water-sewer tax will add to the current water-sewer rate a tax charge of $0.59 per 1,000 gallons starting January 1, 2017, increasing to $2.51 per 1,000 gallons in 2020. The City estimates that the average household uses 7,500 gallons of water per month, which would increase the household’s total water bill by $225.90 per year by the time the new tax is fully implemented in 2020. The water-sewer rate itself will not change through this proposal, but will continue to increase annually at the rate of inflation. The following table shows the per unit water-sewer tax rates.

The new water-sewer tax will take effect on January 1, 2017. The charges will appear on Chicago residents’ unified utility bill, which includes water, sewer and garbage collection fees. Seniors who qualify for the senior citizen sewer exemption will continue to receive the exemption, which reduces the water and sewer bill by 50.0% by removing sewer charges.

For homes that do not have a water meter, water and sewer charges are based on a flat rate assessment that estimates water usage based on factors such as lot size and number of water fixtures. This can end up costing double what a metered household would pay. Having a water meter allows a household to pay for only the amount of water it actually uses. The City offers free installation of water meters through its MeterSave program.

How do Chicago’s water-sewer rates compare to other municipalities?

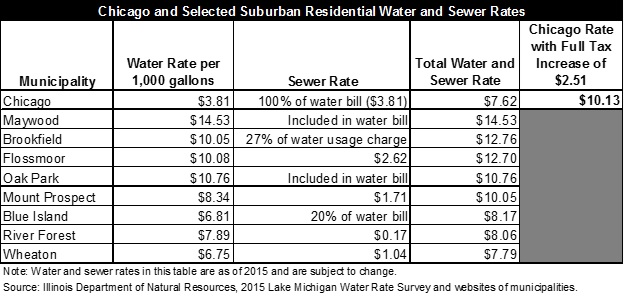

The City of Chicago states that its water rate is lower than that of 104 of 126 surrounding municipalities. While this is true, it fails to take into account the sewer rate. The City of Chicago charges 100% of the water rate for sewer services, which effectively doubles a home’s water bill. Below is a comparison of Chicago’s water and sewer rate to other municipalities as of 2015 based on a water rate survey by the Illinois Department of Natural Resources and public information available on the municipalities’ websites. While the new water-sewer tax does not increase the water usage rate, it will increase the total amount charged for water usage. By the time the full $2.51 tax increase is implemented in 2020, the full water and sewer charge per 1,000 gallons will be $10.13.

It should be noted that because many municipalities surrounding Chicago purchase their water from the City, their water fee schedules are often based on Chicago’s fee schedules. If the City increases its water rate, suburban municipalities that purchase water from the City will also likely increase their water rate.

Why the water-sewer tax?

Actuaries for the City of Chicago reported that the Municipal pension fund would run out of money in 2025 if the City failed to increase its payments into the pension fund. Currently, the Illinois Pension Code requires the City to make employer contributions equal to the employee contributions from two years prior multiplied by 1.25, the fund’s contribution multiplier. Although the City has made the required contributions under Illinois law to the Municipal fund, it has not made contributions according to the actual needs of the fund. For example, according to the pension fund’s Comprehensive Annual Financial Report, the City contributed $149.2 million to the pension fund in 2015 compared to the actuarially determined contribution (ADC) of $677.2 million.[1] Earlier this year, the Supreme Court struck down legislation that would have changed benefits for pension members and increased pension contributions. With this ruling, it was imperative that the City introduce new legislation to increase funding and find a funding source to make pension payments sufficient to meet the financial needs of the fund.

As a home rule municipality, the City of Chicago has the authority to impose taxes that are not prohibited by the legislature. Even with its home rule status, there are few options available to the City other than the property tax and sales tax that would generate the hundreds of millions of dollars needed to fund the Municipal pensions on an actuarially sound basis. The City recently increased the property tax to fund its Police and Fire pensions, and the Chicago’s composite sales tax rate is already the highest of any major city in the nation. Because the City believes it has authority to impose this tax on consumption of a utility at a flat rate, it chose the water-sewer tax as a funding option instead of further increasing the property tax or sales tax.

How will the tax help with pension funding?

In an analysis of the Municipal pension fund, Aon Hewitt showed how pension funding is projected to reach a 90.0% funded ratio by 2057 under the City’s proposed plan. In order to do so, the analysis projects that pension payments into the fund will need to reach nearly $900 million by 2023. The water-sewer tax is expected to generate $56.4 million in 2017, increasing to $240.1 million annually once it is fully implemented in 2020. Revenue from the water-sewer tax will help with pension contributions, along with existing revenue generated from the property tax and Enterprise Funds. However, City officials acknowledged during the House Personnel and Pensions Committee subject matter hearing that they will need to identify additional funding sources to meet the higher required contributions in 2023 after the end of the ramp.

[1] The FY2015 ADC was calculated under the provisions of Public Act 98-0641. The FY2016 ADC is $961.8 million. Municipal Employees’ Annuity and Benefit Fund FY2015 Comprehensive Annual Financial Report, p. 79.