November 04, 2024

The General Assembly has approved, and Governor Pritzker has signed an approximately $50.9 billion FY2025 capital budget.

Unlike the State’s annual General Funds budget, which is intended to cover only the cost of operations for the current fiscal year, capital appropriations are reauthorized over multiple years as planning, engineering and construction of capital investments commence. Since 2005 the capital budget has been proposed in a separate document from the State’s operating budget and is not part of the annual General Funds expenditures. The current multi-year capital budget was initially approved in 2019 as the Rebuild Illinois capital plan; it provides annual appropriation authority for capital project spending to proceed. Information about the Rebuild Illinois capital plan can be found here and here.

Annually, IDOT prepares and publishes 6-year plans for various transportation related projects. The 2025-2032 multimodal program for transit, rail aeronautics and ports will total approximately $11.7 billion in funding over the multi-year period. The multi-year road and bridge program will total $29.7 billion.

Types of Project Funding

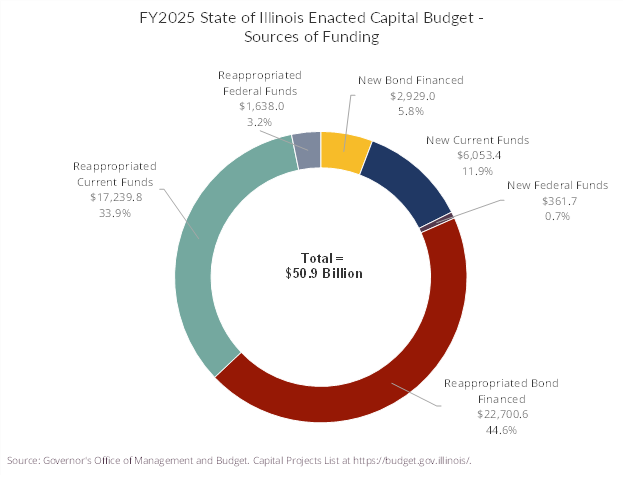

The following chart shows the total FY2025 enacted multi-year $50.9 billion capital budget by the type of project funding, including new funds, federal funds and multi-year funds from the original 2019 capital plan that are being reappropriated for the coming year. Of the $41.6 billion in reappropriated funds, $22.7 billion will be reappropriated bond proceeds, $17.2 billion will be reappropriated current (pay-as-you-go) funds and $1.6 billion will come from federal funds.

Of the approximately $9.3 billion in new appropriations, $6.0 billion will come from current funds, $2.9 billion will be from bond funds and $361.7 million will be derived from federal funds.

Capital Budget Expenditures

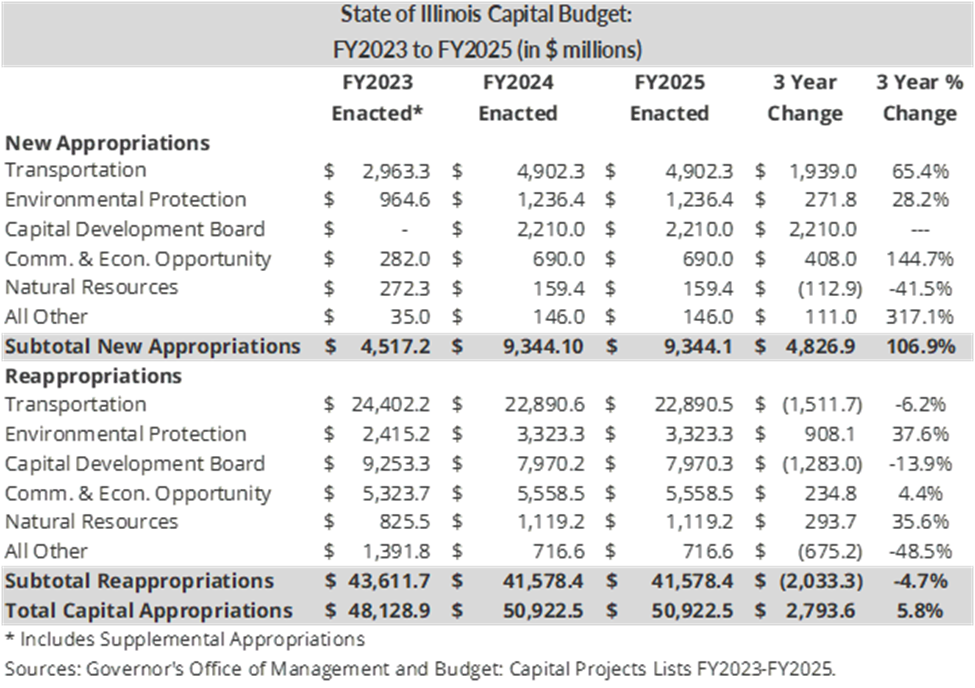

The following table compares total spending by department in the multi-year capital budget enacted by the General Assembly for FY2025 to the enacted capital budgets for FY2023 and FY2024.

Total capital appropriations will increase by 5.8% or $2.8 billion in the three-year period between FY2023 and FY2025, rising from $48.1 billion to just over $50.9 billion.

New appropriations during that three-year period will increase substantially by 106.9%, or $4.8 billion. Much of the increase represents a $2.2 billion appropriation for the Capital Development Board, the state ‘s vertical construction management agency. That funding will be used for a variety of projects, including maintenance and modernization of Department of Corrections facilities, construction of a new Capitol Complex power plant, renovation of the State Armory, deferred maintenance and construction at higher education facilities and construction of public health laboratories.

Reappropriations over that same period will decrease by $2.0 billion or 4.7%. This is to be expected as capital funds are spent.

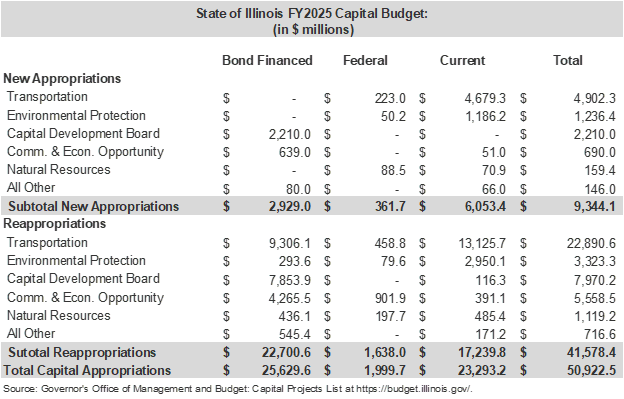

The next exhibit shows FY2025 capital budget spending by department and funding source.

Of the $17.2 billion in reappropriated current (pay-as-you-go) funding, 76.1%, or $13.1 billion, is earmarked for Department of Transportation projects. The largest amount of total reappropriations, roughly $22.9 billion, is also reserved for Department of Transportation projects. The second largest amount of total reappropriations, or $7.9 billion, will be for Capital Development Board projects.

Approximately $6.0 billion in new current funding was primarily appropriated for five departments: Transportation, Environmental Protection, the Capital Development Board, Commerce and Economic Opportunity and Natural Resources. Bond financed funds will be used for a total of $2.9 billion in projects. Federal resources will pay for $361.7 million in new spending.

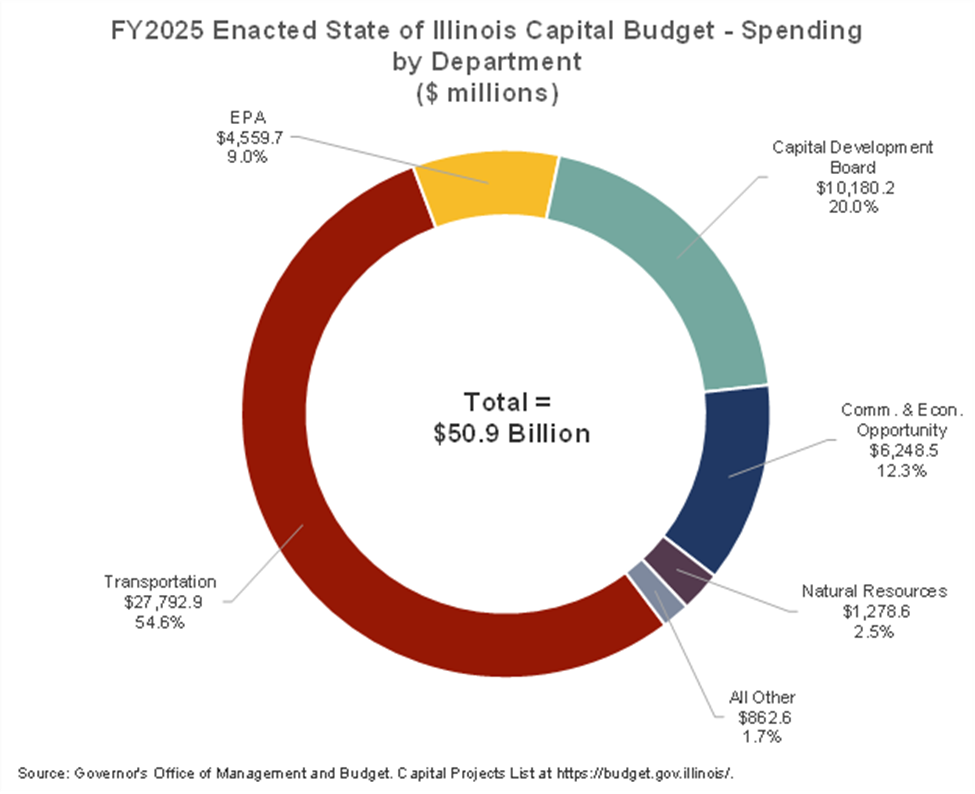

Total multi-year capital budget spending by major department for FY2025 is shown below. Funding for transportation, including statewide road and bridge construction, will be the largest portion of the State’s capital expenditures. The enacted FY2025 capital budget includes roughly $27.8 billion in total spending for the Illinois Department of Transportation, including the annual road program for ongoing surface transportation improvements such as roads, bridges and mass transit. The second largest amount, or roughly $10.2 billion, is earmarked for Capital Development Board projects. Nearly $6.2 billion will be spent on projects overseen by the Department of Commerce and Economic Opportunity.

FY2025 Capital Budget Revenues

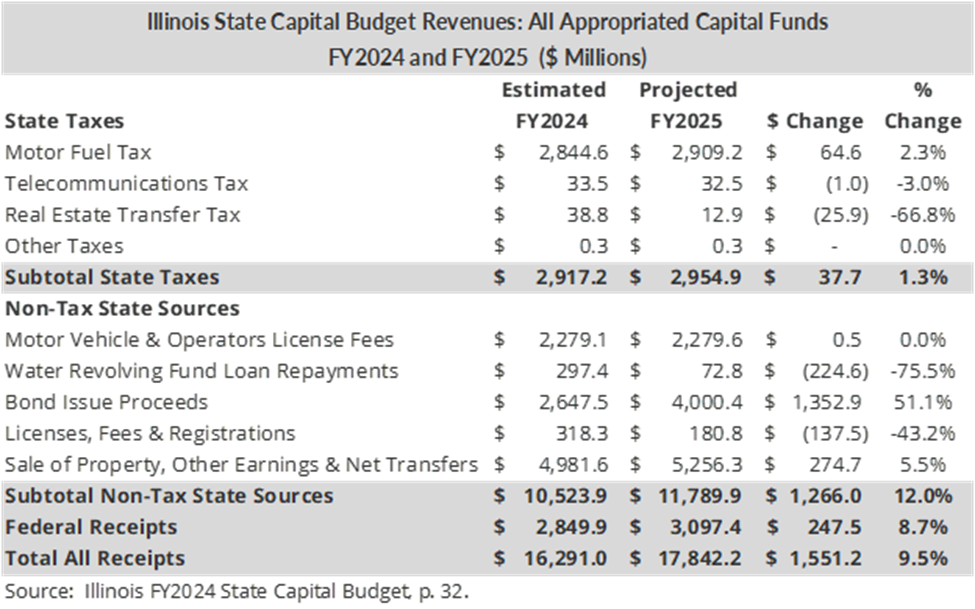

The state capital plan is supported by certain state taxes such as motor fuel taxes and non-tax state resources such as motor vehicle and operator’s license fees, bond issue proceeds and federal receipts. Much of the capital budget is supported by borrowed funds. Information about Illinois’ debt burden can be found here.

The FY2025 Illinois one-year State Capital Budget projects that total resources deposited into all appropriated capital funds will rise by 9.5% from the previous fiscal year, increasing from an estimated amount of $16.2 billion in FY2024 to $17.8 billion. Roughly 61.1% of all revenues, or nearly $11.8 billion, come from non-tax sources, 16.6% or nearly $3.0 billion from state tax receipts and 17.4% or another $3.1 billion from federal receipts.

State tax revenues in FY2025 will increase by 1.3%, rising from $2.9 billion to nearly $3.0 billion. Nearly 98% of all state tax revenues in both years derive from motor fuel taxes.

State non-tax resources include motor vehicle and operator’s license fees, bond issue proceeds, the sale of property, transfers and other fees and repayments. They will increase by 12.0%, from $10.5 billion to nearly $11.8 billion. Most of this increase will be driven by a $1.3 billion, or 51.1%, increase in bond issue proceeds.

Federal receipts will increase by 8.7%, or $247.5 million, to $3.1 billion.

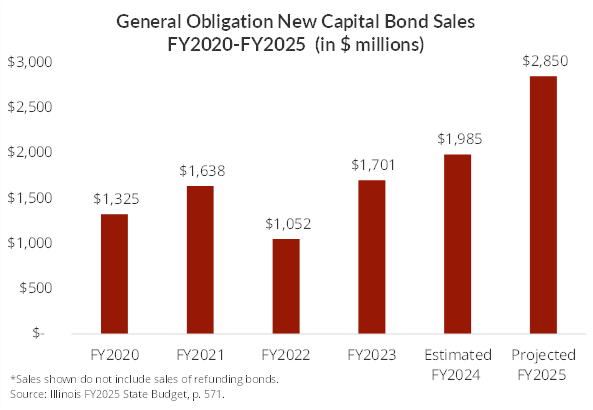

New General Obligation Debt Issuances in FY2024 and FY2025

In the FY2025 Budget Book, the State announced that it would issue nearly $2.9 billion in new GO bonds to fund capital projects. This is an increase from the $1.9 billion planned for issuance in the previous FY2024 fiscal year. The new bond issues will be used to finance a number of capital projects that have progressed from the planning and design stages to the construction phase. The bond issues over the five years from FY2021 through FY2025 will support projects in the State’s Rebuild Illinois capital plan approved in June 2019.

Bond Ratings

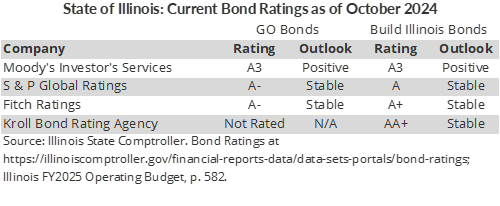

Bond ratings are one of the factors that help determine interest rates the State must pay to issue debt. The following chart shows the current ratings for Illinois’ General Obligation Bonds and Build Illinois special revenue bonds.

Recent Rating Agency Actions

In 2024, Moody’s Investors Services affirmed its A3 rating of the State of Illinois and revised the State's outlook to positive from stable. It has also affirmed the A3 rating on the State's previously issued general obligation debt and the A3 rating on the State's outstanding Build Illinois sales tax bonds. The reason for the outlook change was the State’s increased fund balance and budget reserves and other financial management decisions that have improved the State’s fiscal health. The rating agency cautioned that downside risk remains due to the large size of the State’s unfunded pension liabilities.

In 2023 three of the rating agencies – Moody’s Investors Services, Standard & Poor’s Global Ratings and Fitch Ratings – upgraded the credit ratings for State of Illinois debt.

Moody’s Investors Services upgraded the State of Illinois’s issuer rating from Baa1 to A3 on March 14, 2023. Concurrently, it also increased the credit ratings of the State’s general obligation and Build Illinois sales tax bonds to A3 from Baa1. Moody’s cited continued improvement in the State’s financial situation for the upgraders, including expansion of fiscal reserves, increased payments toward outstanding liabilities such as the pension funds and improved governance processes. The rating agency warned, however, that Illinois continues to face large long-term liability pressures that constrain its fiscal flexibility.

In May 2023, Fitch Ratings revised the outlook on the State’s general obligation bonds to positive from stable due to the State’s improved economic outlook and increased reserves.

In February 2023 Standard and Poor’s Global Ratings raised its credit rating to A- from BBB+ with a stable outlook on the State of Illinois’ outstanding long-term general obligation debt. It also raised the rating to A from A- on the State’s Build Illinois junior and senior lien sales tax bonds. The reasons given for the upgrade were the State’s increased repayment of its liabilities, increases in the Budget Stabilization Fund and a slowing of growth in statutorily required pension fund growth.