October 23, 2025

By Paula R. Worthington

Over 41 million individuals rely on the federal Supplemental Nutrition Assistance Program (“SNAP”) to assist in buying food each month—including nearly 1.9 million individuals in Illinois. The current federal government shutdown threatens the funding of these benefits in the near term, and soon-to-be-implemented programmatic changes in federal policies present additional fiscal challenges to states across the country, not to mention budget pressures on SNAP participants. These changes to program funding structure, work requirements, and more raise key questions for state and local policymakers. What do policymakers and the public need to know about SNAP as tough budget and program decisions lie ahead?

SNAP Has Historically Been Federally Funded

The SNAP program provides benefits to eligible families to supplement their food budgets. Historically, this program was administered by states but funded by the federal government, which covered the full benefits paid to SNAP enrollees and reimbursed states up to 50% of their administrative costs.

- In the federal fiscal year (FFY) ending September 30, 2024, an average of 41.7 million individuals were enrolled nationwide, with an annual total cost (benefits plus the federal share of administrative costs) of $100.3 billion.

- In Illinois, total benefits paid were $5.4 billion in FFY 2023 (latest available data), all of which was covered by the federal government.

- Administrative costs were split equally between the federal government and states. In FFY 2023, Illinois’s share of costs totaled $166.7 million, with federal reimbursements and COVID-19 ARPA funding covering the rest.

Benefits Are Threatened by the Federal Government Shutdown

- In Illinois, nearly 1.9 million individuals—or members of over 1 million households—received SNAP benefits in May 2025. Support for these enrollees was significant, averaging $195.94 per person per month.

- These participants may be particularly vulnerable to disruption: the United States Department of Agriculture (USDA) reports that nearly 80% of participating households nationwide include at least one member who is a child, an elderly adult, or a person with a disability. In Illinois, 75% of individual enrollees live in households with income below the poverty line.

- Analysis by the Illinois Policy Institute shows that while most Illinois recipients are in northern Illinois, participation as a share of the population is greater in the southern part of the state.

Illinois Faces Significant SNAP-Driven Budget Pressures

In addition to the immediate impacts of the federal shutdown, H.R. 1, passed by Congress in July 2025, makes significant changes to federal support for SNAP. These changes will shift the funding burden to states.

- Under H.R. 1, federal reimbursements for administrative costs will decrease from 50% to 25% effective October 1, 2026. The Governor’s Office estimates an annual $80 million impact on Illinois’ budget.

- Further, as of October 1, 2027, the federal government will impose “cost-sharing” requirements on states, meaning states will be expected to cover a portion of the benefits paid to their SNAP recipients, with state cost shares rising with SNAP “payment error rates.” These administrative error rates measure how accurately states make eligibility and benefit determinations and include both over- and underpayments. Illinois’ error rate was 11.56% in FFY2024. If Illinois cannot reduce its error rate, it will need to cover 15% of benefits paid, estimated by the Governor’s office at $705 million annually based on current enrollment levels.

SNAP Enrollments Remain Elevated Above Pre-Pandemic Levels

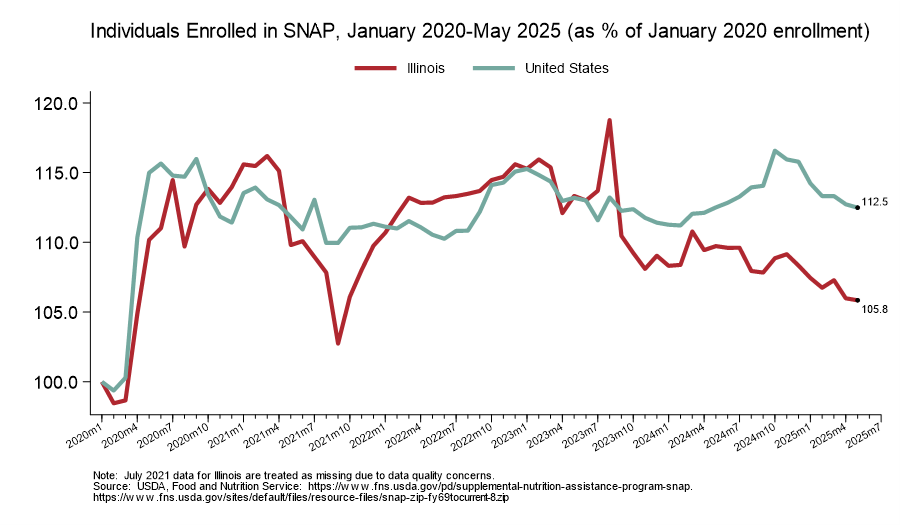

Unlike the post-pandemic “snapback” in employment and other measures, SNAP enrollments remain elevated above pre-COVID levels. While the monthly numbers are somewhat choppy, the figure below clearly shows that SNAP enrollment has not receded to pre-pandemic levels, either for the US overall (12.5% higher) or for Illinois in particular (5.8% higher).

Shutdown and H.R. 1: Double Threats

- The federal shutdown threatens to cut off SNAP benefits effective November 1st, and states have little to no built-in capacity to cover SNAP benefits costs.

- H.R. 1’s provisions explicitly aim at program participation, tightening work requirements, and limiting the ability of states to receive waivers. In fact, recent guidance from USDA indicates that even existing work requirement waivers related to “ABAWDs” (able-bodied adults without dependents) will be terminated as of November 3, 2025, meaning states have very little time to help enrollees meet the new requirements.

What’s Next

Temporary cut-offs of benefits due to the federal government shutdown and potential future decreases in enrollments and state support threaten to negatively affect households throughout the state. Further, local food banks and pantries may be ill-prepared to absorb the increased demand for assistance coming their way.

In the weeks ahead, the Civic Federation will follow developments on the federal government shutdown and deepen its analysis of the SNAP program, aiming to inform policymakers and the public in general about the dramatic changes coming to this program.