October 22, 2025

By Grant McClintock and Daniel Vesecky

Update 11/6/2025: On November 5, S&P Global Ratings adjusted its outlook on Chicago’s credit rating from stable to negative. Read the Civic Federation's statement on the adjustment here.

The introduction of Chicago Mayor Brandon Johnson’s proposed FY2026 budget on October 16 provides Chicagoans with insight into how this administration proposes to address a $1.2 billion budget deficit and what they aim to prioritize in the coming year. Excluding grant funds, the proposed budget is 2.7% higher than the previous year, despite a significant deficit necessitating unprecedented revenue measures. The budget proposes closing the deficit by substantially increasing the cloud computing tax, levying a head tax on large corporations, reducing the City’s pension contributions, and utilizing other one-time fixes, including declaring yet another record-breaking Tax Increment Finance district surplus.

In a recent piece, the Civic Federation outlined the key fiscal issues facing Chicago in advance of the FY2026 budget release—noting the unprecedented position the City finds itself in and calling for a focus on long-term solutions and structural improvements to the budget. Unfortunately, the proposed budget is a transactional proposal that technically balances the budget with short-term fixes but fails to make the difficult decisions needed at the moment. Instead, the proposed budget continues a status quo widely understood as unsustainable and unacceptable, using some of the same disreputable bad practices of the past. The proposal balances the budget not through shared sacrifice between stakeholders, but with tax increases targeted at businesses, one-time revenue influxes, and borrowing to pay for operating costs. It largely ignores the work done by the Mayor’s own Financial Future Task Force, as well as supplemental work conducted by the City’s retained consultants, EY, to identify opportunities for savings and efficiencies.

Budget proponents are justifying the proposed revenue increases by arguing that the City needs to compensate for federal funding cuts by the Trump administration. But that narrative isn’t supported by the facts. While the federal government has tried to rescind a variety of Chicago’s grants, the City has parried those attempted cuts by challenging them in court. Although grants that have not yet been awarded may be at risk in future years, a first blush look reveals only $30-$40 million of existing federal grant funding to be on hold. The City has seen a significant decrease in overall federal funding, but this is due largely to the expiration of temporary American Rescue Plan Act (ARPA) funding from the pandemic era, which the City itself has been projecting and socializing for years, well before the present Administration in Washington won office.

The Mayor’s proposal is the opening gambit in what will be a longer process that requires deep and meaningful engagement by City Council to reach a budget that identifies long-term, sustainable solutions for the City’s financial struggles.

Key Takeaways:

- Closing the budget gap: The proposed budget closes the projected FY2026 budget gap through new and increasing taxes on business, sending the wrong message to the business community at a time when the City desperately needs jobs and economic growth. Several proposed options are one-time in nature and revert to bad past practices, such as borrowing for operational costs. These actions signal that the City has not taken seriously the need to address the long-standing structural budget deficit, which could trigger future downgrades by rating agencies.

- Expenditure Drivers: Overall expenditures will decrease in FY2026 only when including grant funds. The core budget actually proposes a year-over-year increase of 2.7%. This is driven primarily by increases in salaries and employee healthcare costs.

- Addressing the Structural Deficit: In order to reduce future borrowing costs, the City should focus on making sustainable structural reforms sufficient to elicit a favorable response from credit rating agencies.

- Relationship with Chicago Public Schools (CPS): The record-high TIF surplus of $1 billion provides a $552 million* windfall to CPS. This amount more than covers the school district’s assumptions in its own FY2026 budget and leaves open the question of whether CPS will use the remaining TIF funds to reimburse the City for a portion of the annual contribution to the Municipal Employees’ Pension Fund (MEABF). Whether CPS reimburses Chicago for these pension costs should be decided based on the District’s financial situation mid-year. Fully resolving the financial entanglements between the City and CPS will require continued engagement with State legislators, ideally with CPS taking on its portion of the MEABF pension liability, but with a funding source sufficient to cover the cost.

- What the Civic Federation hopes to see: As City Council works toward a final budget, it should consider additional revenue and efficiency options not incorporated into the FY2026 budget proposal, such as what was produced in the Chicago Financial Future Task Force’s report and EY’s financial and strategic reform options report. The final budget should not rely on one-time fixes or poor financial practices, but instead rely on recurring revenues and sustainable savings or cuts.

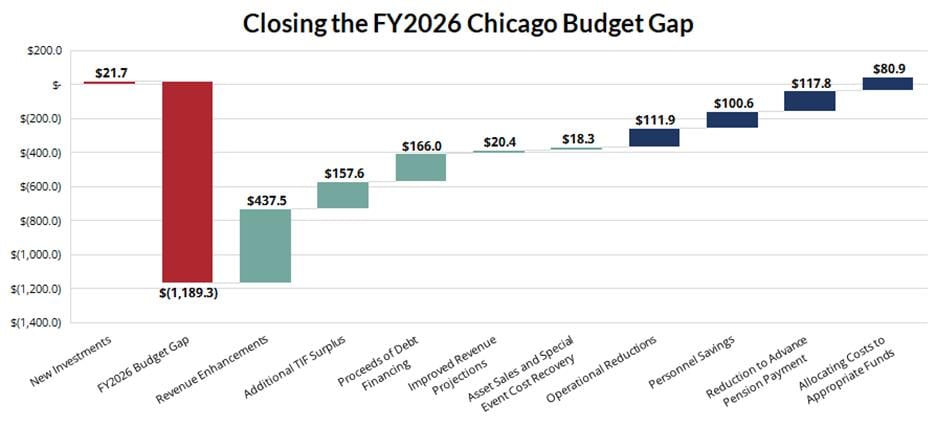

How the City Proposes Closing the FY2026 Budget Deficit

The City of Chicago (Chicago or the ‘City’) estimates a $1.19 billion budget gap in 2026. This is the largest budget gap in the City’s history—rivaled only by the budget gap in 2021 during the COVID-19 pandemic before the federal government came through with funding relief for state and local governments through the American Rescue Plan Act (ARPA). With no remaining ARPA funds, the question of how the City will balance the budget is critical.

The Mayor proposes closing the $1.19 billion deficit through nearly $800 million in revenue increases and approximately $400 million in purported savings and efficiencies. The plan relies on revenue solutions that would deter business, along with several actions that are one-time in nature, and neither will address the City’s structural problems, and could even trigger a rating downgrade.

Revenue Proposals:

The proposed revenue solutions rely heavily on taxing businesses—primarily through an increase to the personal property lease transaction tax from 11% to 14%, which is estimated to generate $333.2 million, and the reinstallation of a per-employee head tax at a rate of $21 per month per employee for businesses with more than 100 employees, which is estimated to generate $100 million. Both of these proposals would make Chicago an outlier compared to other U.S. cities and arguably send the wrong message to the business community, which already pays other high taxes through income and property taxes. The head tax, in particular, has been met with opposition from the business community and Governor Pritzker.

Although not included in this year’s revenue estimates, the City also plans to implement a first-in-the-nation tax on social media companies applied through the existing amusement tax. The legality of this tax is highly questionable and will likely need to be resolved through the courts. Other proposals include a new online sports betting tax, an adjustment to the existing Ground Transportation tax on ridesharing, an increase to the boat mooring tax, and a new hemp tax. Together, the revenue proposals are expected to generate $433.2 million.

Another $157.6 million would be generated through the City declaring a record-high tax increment financing (TIF) surplus of $1 billion, of which approximately $232.6 million would go to the City’s Corporate Fund. While sweeping TIF surplus funds has become common practice with increasingly lucrative payouts in recent years, increases in this revenue source are not sustainable at the current pace. TIF is also a revenue source that is not intended to fund general government operations but rather to fund economic development in blighted areas. The record FY2026 TIF surplus declaration indicates that the City is increasing its reliance on a revenue source that is projected to decrease in future years.

The City also plans to generate $166 million in bond financing by taking out short-term debt to cover operating costs, a move that will increase debt service costs in future years and is likely to attract negative attention from credit rating agencies. Borrowing for general operations, such as paying employee salaries, goes against best practice and would be a repeat of past mistakes that got the City into its current financial straits. The proposed budget justifies these moves by framing the debt as paying for retroactive salary increases for firefighters, as well as an unusually large amount of costs incurred by settlements of legal cases against the City, mostly involving police misconduct. The retroactive salary payments would be funded over three years, whereas the settlement payments would be funded over five. Borrowing for operating costs like salaries and settlements is precisely the sort of disfavored practice that is in part responsible for the fiscal straits we are in, and that the recent past Administration had phased out.

Spending and Efficiency Proposals:

It is especially disappointing that this budget did not do the hard work of identifying real and lasting efficiencies. Rather than working to identify long-term cuts to programs or positions, the budget relies on efficiencies that are one-time in nature and will only leave the City in a similar or worse position in 2027.

The proposal calls for a little over $200 million in operational efficiencies and personnel savings, including a hiring freeze to save $50 million and smaller initiatives to improve procurement processes, modernize fleet management, recover the cost of special events, and consolidate real estate. While a hiring freeze is a reasonable way to tamp down spending, it is not a structural solution unless the positions are cut. They are not in any meaningful measure. Noticeably absent from the budget proposal is any mention of furloughs or unpaid days off. To generate structural savings from personnel would require work to determine which positions are needed and a request for labor unions to make a shared sacrifice.

Another key cost-saving measure identified is a $117.8 million reduction in the City’s supplemental pension payment to the four Chicago pension funds. The City began making supplemental pension contributions beyond the amount required by state law in 2023, as a strategy to stop mounting growth in unfunded liabilities. This has helped prevent unfunded liabilities from growing faster than contributions, reduced future pension costs, and resulted in rating upgrades from credit rating agencies. Cutting the advance pension payment in half this year could be looked at unfavorably by the rating agencies and lower the City’s credit rating. It is also a risky move given that a recent state pension sweetener bill increased benefits for Chicago police and firefighters, adding to the City’s unfunded liabilities and required pension contributions beginning in 2027.

Key Takeaways:

- The proposed budget closes the gap primarily through new and increasing taxes on business, sending the wrong message at a time when the City desperately needs jobs and economic growth.

- Several options proposed are one-time in nature, and some, such as borrowing for operational costs, revert to bad past practices.

- Taken together, these actions signal that the City has not taken seriously the need to address the long-standing structural budget deficit and could trigger future downgrades by rating agencies.

- The Mayor’s proposal only includes a small number of the budget options that were included in the Chicago Financial Future Task Force report, a group convened by the Mayor himself.

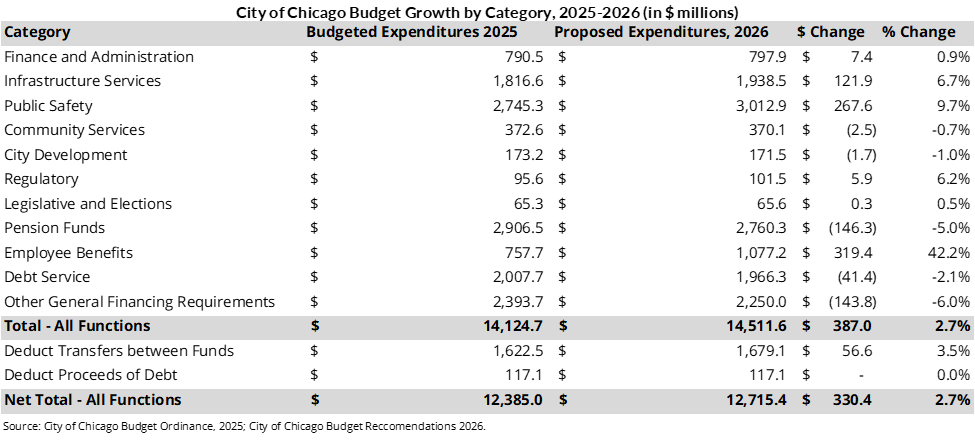

Drivers of Spending Increases

The FY2026 budget proposal decreases from the prior year by 3.5% across all funds, including grants, due to the wind-down of federal COVID-19 grant funds. But when excluding grant funds, the budget, totaling $12.7 billion, actually increases by $330.4 million, or 2.7%, from FY2025.

There are several drivers of budget growth between the adopted FY2025 and proposed FY2026 budgets. Chief among them is employee benefits, which grew by 42%, or $319.4 million. Another major source of growth is public safety. The City’s overall public safety budget grew by $267.6 million from 2025 to 2026. $143.3 million in growth is attributable to an 8% increase in the Chicago Police Department’s budget, reflecting increased salary costs and higher estimates of overtime for 2026, but not a significant increase in staffing. The other significant surge in public safety spending is within the Chicago Fire Department, which will see a $124.3 million increase in spending, or 20%. This increase is due to the ratification of a collective bargaining agreement for firefighters, which stalled in negotiations for several years and will now require the City to provide back pay for retroactive raises. The City also expects significant increases in infrastructure services spending—a 7% increase of $121.9 million. The Department of Water Management and Department of Aviation will see 8% and 11% increases, respectively, while the Department of Transportation and Department of Streets and Sanitation see little change to their budgets.

The increases in FY2026 spending are partially offset by a reduction in the City’s pension contributions. In 2025, the City contributed $2.91 billion to its pension funds, but in 2026, it plans to contribute only $2.76 billion. This reduction is due to the City’s decision to cut in half its advance pension payment.

While personnel costs overall are increasing in FY2026 due to increasing salaries and healthcare benefits, the total number of personnel is proposed to decline by 446 from FY2025. These eliminated positions are not due to layoffs, but rather the closing of vacant positions. The City has a total of 4,022 vacant positions. The departments with the largest proposed position reductions are the Chicago Department of Public Health (CDPH) (282), the Department of Transportation (95), the Department of Streets and Sanitation (52), and the Chicago Public Library (69). Preliminary review suggests that a significant percentage of the CDPH reductions may be COVID/ARPA-specific grant-funded positions. Moreover, these departments’ expenditure levels will remain roughly constant between FY2025 and FY2026. The budget proposes personnel growth in some departments, including the Department of Aviation due to the O’Hare Airport Expansion program (53 positions) and the Department of Environment (65 positions).

Key Takeaways:

- Total non-grant spending is proposed to increase by 2.7% from FY2025. Spending increases are driven by growing salaries, employee benefits, increased spending on CPD and infrastructure services, and a new Fire Department contract.

- The City’s overall pension contribution is proposed to decrease by about $150 million due to a reduction in the advance pension payment.

- Overall budgeted positions are decreasing by 446, driven by the Departments of Public Health, Transportation, and Streets and Sanitation.

Addressing the Structural Deficit

For decades, the City’s expenditures have outpaced growth in revenues, leading to annual budget gaps in almost every year in recent memory. This is what is referred to as a “structural deficit.” In the past, City leaders have made poor financial decisions to close these budget gaps, such as borrowing to pay for operating expenses, refinancing debt to push off costs to the future (“scoop and toss”), spending down rainy day reserves, and failing to raise ongoing revenues commensurate with spending increases. This year’s FY2026 budget proposal reverts to the same kinds of mistakes made by City leadership in the past, which have contributed to the financial situation the City finds itself in today.

In a series of credit downgrades following the passage of last year’s budget, rating agencies made it clear that the City needed to address its structural budget deficit and reduce the reliance on one-time revenues to fund ongoing expenses to avoid the risk of further downgrades. Unfortunately, many of the agencies’ concerns remain unaddressed. Pensions and debt service payments still account for approximately 40% of the operating budget, and recent pension enhancements for police officers and firefighters threaten to bring two of the City’s funds into insolvency.

Sustainable solutions to the City’s decades-long structural budget deficit must involve a combination of efficiencies and revenues. However, the budget proposal does not make a meaningful effort to address spending. While the budget across all funds, including grants, will decrease by 3.5% from FY2025, much of that is attributed to the decline of federal grant funding. Excluding grant funds, spending is actually up 2.7%.

The Financial Future Task Force report laid out 89 revenue and efficiency options for consideration by the Mayor and City Council, supplemented by additional work by consulting firm EY. While a handful of these options made it into the Mayor’s budget proposal, such as controlling overtime costs and modernizing fleet and procurement management, many ideas were left off the table. Ideas to generate sustainable revenue to match cost inflation, such as indexing taxes and fees to inflation and recouping costs through fees commensurate with the cost of service delivery, warrant further consideration. The proposed budget also barely scrapes the surface of possible efficiencies. EY conducted an in-depth report at the call of the Mayor’s Office of Management and Budget, identifying 100 opportunities for cost savings. As City Council pursues budget deliberations in the coming weeks, it should work with the administration to implement these efficiency recommendations, as well as consider revenue options that align with good budgeting principles.

Key Takeaways:

- As City Council works toward a final budget, it should consider additional revenue and efficiency options not incorporated into the FY2026 budget proposal, such as those produced in the Chicago Financial Future Task Force’s report and EY’s financial and strategic reform options report.

- The final budget should not rely on one-time fixes or poor financial practices and instead should rely on recurring revenues and sustainable savings or cuts.

- The City should focus on making sustainable structural reforms sufficient to elicit a favorable response from credit rating agencies in order to reduce future borrowing costs.

Relationship with Chicago Public Schools

During and following the passage of the Chicago Public Schools’ (CPS or the ‘District’) FY2026 budget over the summer, there was a question over how much TIF surplus funding the City of Chicago would declare and whether it would be enough to cover CPS’ projection. The proposed TIF surplus of $1 billion provides CPS with $552 million*—more than enough to cover the $379 million revenue assumption.

With CPS receiving TIF funding in excess of its projection, observers have reopened the possibility of a $175 million reimbursement from CPS to the City for the Municipal Employees Annuity and Benefit Fund (MEABF). For many years, the City has met a mandatory legal obligation to cover this payment, which applies to non-teacher CPS employees. Amid a surge in federal pandemic funding, Mayor Lightfoot negotiated an intergovernmental agreement with CPS to secure payment reimbursements beginning in 2021, which continued and grew through 2023. However, CPS did not provide the City with the reimbursement in FY2024 or FY2025 as the District dealt with its own budget crisis. The City’s FY2025 budget assumed continued reimbursement for this payment, totaling $175 million. CPS’ ultimate refusal to reimburse the City amid its own budget deficit set off a lengthy debate that resulted in a year-end budget deficit for the City. The City’s FY2026 budget proposal does not rely on reimbursement from CPS.

However, the size of the projected TIF surplus in FY2026 would provide CPS with an extra $140 million. The CPS budget indicated that the District would make the $175 million MEABF payment contingent on additional revenue beyond budgeted assumptions in the form of additional FY2026 TIF surplus revenue, other local resources, or additional state revenue. Whether CPS reimburses the City is a decision that should depend on the financial state of the District and the Board’s assessment of its stability through the remainder of the 2026 fiscal year.

Fully resolving the financial entanglements between the City and CPS will require continued engagement with State legislators. Ideally, CPS would take on its share of pension costs related to the MEABF, but should also be given authority to establish a revenue source sufficient to cover the cost of the payment.

Regardless of whether CPS makes this pension payment, the size of this year’s TIF sweep is unsustainable. The City and CPS should both anticipate weaning off this revenue source, as it is likely to decline as more TIF districts close in the coming years.

Key Takeaways:

- The question of whether the City should continue to cover the full MEABF payment warrants negotiation and fixing through cooperative dialogue between CPS, the City, and Springfield. However, absent a change in State law, it remains the City that is still legally required to cover this cost.

- The City and CPS should work with the State of Illinois to resolve the legal and financial entanglements between the two governments, and if legal responsibility is assigned to CPS to pay the employer contributions for its MEABF-covered employees, the District should be afforded commensurate, dedicated revenue authority to cover the obligation.

- Until the entanglement issue is legally reset, the City should not assume reimbursement, nor should CPS, which itself is in a fiscally precarious situation, make any such payment.

Conclusion

In a budget that could have marked the beginning of a more responsible era of fiscal stewardship, the FY2026 proposed budget avoids making necessary, difficult decisions. Although technically balanced, this budget is heavily reliant on one-time revenues, reduces supplemental pension funding, and all but ensures a similar conversation will be taking place next year.

This budget proposal also leaves out several options for right-sizing the City’s finances—many of which were included in the reports commissioned by the Mayor’s Office of Management and Budget. As City Council works to finalize the budget in the coming weeks, alders should engage with the Mayor’s administration and consider every measure necessary to begin to correct Chicago’s course. The Civic Federation looks forward to working with all stakeholders to achieve a responsible final budget plan.

*The total TIF amount allocated to the Chicago Public Schools is based on best estimates from the City of Chicago budget proposal. This was most recently updated as of 10/30/2025.