March 10, 2017

In addition to many other obstacles to achieving a balanced budget, Illinois now faces another setback this week, this time in the form of under-performing revenues. A report issued by the Commission on Government Forecasting and Accountability (COGFA) revised the agency’s earlier forecast of FY2017 General Funds revenues down by $674 million. The first forecast, issued in July 2016, had estimated $31.8 billion[1] in total revenues for the fiscal year. The revised estimate projects only $31.1 billion.

The largest component of the decline is from the “Big Three” State revenues: individual income tax, corporate income tax and sales tax. The net decline from the earlier forecast in these three sources is $657 million, despite the earlier forecast including conservative assumptions in these categories. Individual income taxes were estimated to grow by only 2% from FY2016. Corporate income taxes were forecast at 1.5% growth, and sales taxes at 1.9%. Although sales tax collections in the first two thirds of FY2017 have kept up with the original projections, individual income tax receipts are down 3.9% from this point last year, and corporate income taxes are down 43.7%. The State saw similar declines during the last recession.

Federal sources, which are primarily reimbursements for Medicaid spending, have been revised downward by $100 million. COGFA warned that the federal shortfall could be much greater if additional Medicaid bills are not spent by the end of the fiscal year, meaning that they would be reimbursed in the subsequent year. The projection for other State sources, including public utility taxes and lottery transfers, has been revised slightly upward by $83 million.

The COGFA report is careful to note that accounting changes by the Illinois Department of Revenue have made it difficult to distinguish between true revenue underperformance and intra-year delays in receipts. However, the agency concluded that the magnitude of the underperformance warranted a downward revision in the projection.

COGFA argues that FY2018 will be a challenging year for revenues as well. A report prepared for the agency by Moody’s Analytics predicts that Illinois job growth will lag the national average, especially outside of the Chicago metropolitan area. As a result, COGFA has adopted conservative estimates of FY2018 revenues as well: individual income tax at 2.5% over the (revised, lower) FY2017, sales tax at 2% growth, and corporate income tax with no growth at all. Combined with transfers and federal reimbursements, FY2018 is forecast to deliver $824 million more revenues than FY2017.[1]

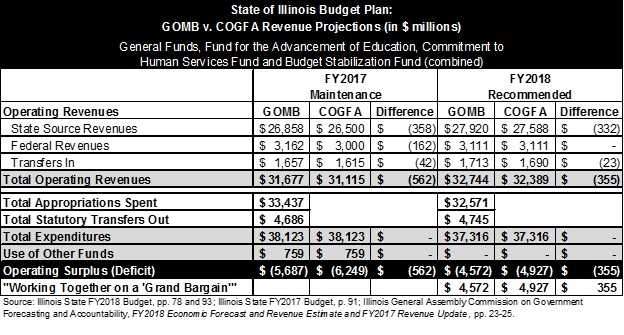

If these revised forecasts are accurate, it will serve to compound the ongoing fiscal difficulties faced by Illinois. The Governor’s Office of Management and Budget (GOMB) had already forecast an FY2017 General Funds operating deficit of $5.7 billion. This figure is based on two assumptions. The first is that expenditures will reach maintenance levels, either through new appropriations to finish the year after the expiration of the stopgap budget, or through the existing combination[2] of appropriations, continuing appropriations and court-mandated spending that have continued throughout the budget impasse. The second assumption is that no new revenues will be approved and realized before the end of FY2017. If spending occurs at the level forecast by GOMB, but revenues come in at COGFA’s revised level, the FY2017 deficit will rise from $5.7 billion to $6.2 billion. This increase could drive the backlog, measured on a budgetary basis, to over $15 billion by the end of the fiscal year.

Similarly, the proposed FY2018 budget relies on a “grand bargain” with the General Assembly to close a gap of $4.6 billion. If GOMB’s revenue estimates are replaced with COGFA’s, the gap becomes $4.9 billion.

The following chart shows the effects of both GOMB’s and COGFA’s revenue projections on the FY2017 and FY2018 budgets. In both cases, the expenditures are those projected by GOMB, at the “maintenance” level in FY2017 and at the recommended level, before accounting for the effects of a “grand bargain,” in FY2018.

For now, the grand bargain upon which the FY2018 budget balance rests has stalled. But the projected weakness in revenues highlights the urgency with which the State will have to take action to restore fiscal stability and balanced budgets. To the extent that new revenues are used to balance FY2018 and mitigate the deficit in FY2017, delays in implementation will make such increases less effective. For instance, the next withholding deadline for those who file income taxes on a quarterly basis is May 1.