March 11, 2011

The Illinois House of Representatives took a significant step in its annual budget negotiations this week when legislators unanimously passed a resolution limiting General Funds spending to $33.2 billion. The cap on spending is tied to the total estimated revenues for FY2012 set by the House Revenue Committee and is significantly lower than the $36.8 billion annual spending limit included in the legislation passed in January 2011, which raised the State’s income tax rates.

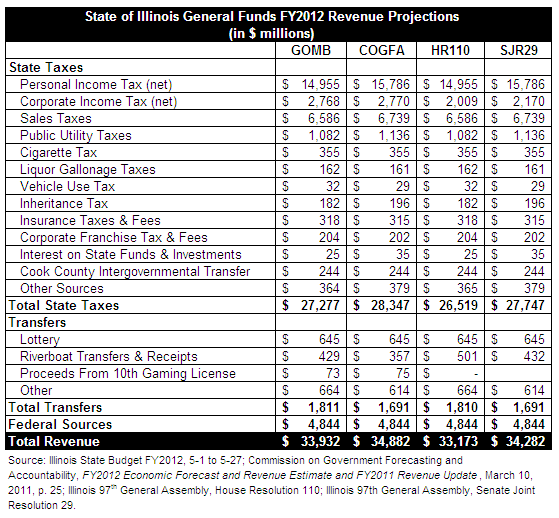

House Resolution (HR) 110 cites the requirement under the Illinois Constitution that annual budget appropriations match expected revenues. This revenue estimate is $2.1 billion less than the FY2012 General Funds expenditures of $35.4 billion proposed by Governor Pat Quinn. The resolution passed on March 8, 2011, a week after the Revenue Committee received testimony from the Commission on Government Forecasting and Accountability (COGFA) that revenues in FY2012 may actually be higher than the amounts included in the Governor’s budget. The information that was provided to the legislators was based on economic forecasts that are now published on COGFA’s website. However, despite the more optimistic projections of $34.9 billion in total General Funds revenues estimated by COGFA, the Committee decided on a much lower total level of spending.

The final revenue projections approved by the full House in the resolution much more closely matched the estimates from the proposed FY2012 budget provided by the Governor’s Office of Management and Budget (GOMB). The Governor’s FY2012 recommended budget is based on General Funds Revenues totaling $33.9 billion. The revenues in HR 110 matched all of the GOMB estimates except for the corporate income tax, which was reduced by $759 million. The Governor’s revenue estimates includes an increase in corporate tax receipts from two legislative changes that have not been passed by the General Assembly. As discussed here, the Governor’s budget included additional General Funds revenues from setting aside less to pay back corporate tax refunds owed by the state. It reduced the Refund Funds rate for the corporate tax from 17.0% to 12.5%. The GOMB corporate tax estimates also include additional receipts from a proposal by the Governor to decouple from federal tax laws that provided tax cuts to businesses through an increase in bonus depreciation rules.

The Illinois Senate has also begun deliberations of its own revenue estimates and spending limit included in Senate Joint Resolution (SJR) 29. The upper house’s revenue projections more closely mirror the COGFA totals but also reduce the corporate income tax revenues for FY2012 by $500 million. The Senate has yet to vote on the measure and it is scheduled for debate before the Revenue Committee on March 16, 2011. Currently the revenues in SJR 29 total $34.3 billion or $1.1 billion more than the revenues passed by the House.

The following chart compares the revenue estimates from the GOMB, COGFA, HR 110 and SJR 29.

The revenue estimates approved in HR 110 and proposed in SJR 29 also do not include the $1.5 billion in proposed borrowing for operations that was included in the Governor’s budget.

The differing resource estimates in the two houses will need to be reconciled before the FY2012 budget is enacted later in the spring legislative session. For now, as the Senate begins debate on its revenue estimates, the five House appropriation committees are expected to begin allocating the approved revenues to the various agencies and programs that fall under their spending oversight.

If the total spending is limited to the revenues in HR 110, it will amount to a 5.9%, or $2.1 billion, cut from the total expenditures included in the Governor’s FY2012 budget. However, the FY2012 recommended budget includes $403 million in debt service for the Governor’s proposed $8.75 billion General Obligation (GO) Restructuring Bonds, which have not been approved by the General Assembly.

The spending limit approved by the House of $33.2 billion represents a $492 million reduction from total estimated expenditures in FY2011 of $33.7 billion. However, the current budget total also includes one-time debt service payments that the State will not have to pay in FY2012. The total estimated General Funds expenditures for FY2011 include $781 million to repay amounts borrowed for cash flow purposes from other special funds and the budget stabilization. It also includes repayment of $189 million for Medicaid borrowing debt service. Excluding these one-time repayments, the total spending at the $33.2 billion limit in FY2012 would be an increase of $505 million in General Funds resources over FY2011.

As proposed in SJR 29, the spending limit of $34.3 billion for FY2012 would be a decrease of $1.1 billion from the total expenditures of $35.4 billion proposed in the Governor’s recommended FY2012 budget. Excluding the debt service for the proposed GO Restructuring Bonds in FY2012, the total cut from the Governor’s proposed budget to the Senate spending limit would total $697 million. The spending limit as currently proposed in the Senate would amount to an increase in total expenditures from FY2011 to FY2012 of $616 million, from $33.7 billion to $34.3 billion. Excluding the one-time payments in FY2011 for Medicaid borrowing repayment and transfer repayments mentioned above, the total increase available resources from FY2011 to the spending limit in SJR 29 for FY2012 would total $1.6 billion.