September 15, 2009

The Governor’s office recently published its first official document that included details of the revenues and expenditures approved by the General Assembly for FY2010 fiscal year. The Official Statement accompanying the sale of $1.25 billion in short term debt on August 20, 2009 includes new information on the State’s fiscal condition. It should eventually be available along with the other bond issuance documentation on the Governor’s Office of Management and Budget website. Until then it is available online through the Municipal Securities Rule Making Board.

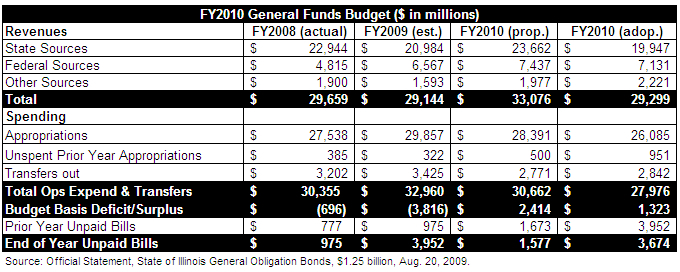

The statement shows a projected drop in State source revenue of more than $1 billion in FY2010 or 4.9% of the estimated revenue from FY2009. Spending approved by the General Assembly (not including statutory transfers or left over FY2009 appropriations) totaled $26.1 billion, which is down 12.6% from $29.9 billion last year.

The following chart shows details from the FY2008 actual budget, the FY2009 estimated budget, the budget proposed by the governor for FY2010, and the budget approved by the General Assembly for the FY2010.

Although State revenues and expenditures seem to be in balance in the data provided for FY2010, other details regarding total unpaid bills and the amount of short-term debt issued by the State cast doubt on this positive outlook.

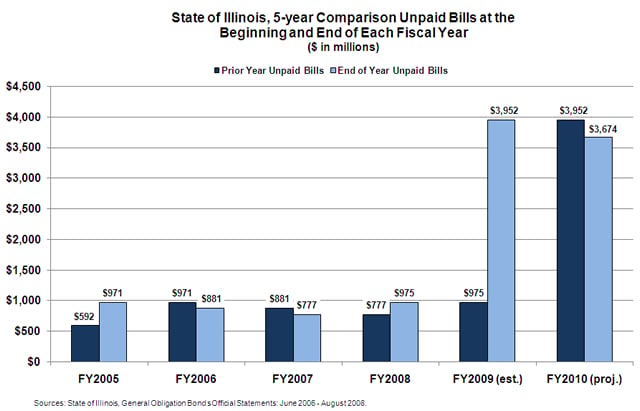

Just before the close of the previous fiscal year, on May 14, 2009, the State sold $1 billion of short-term debt, which must be paid back in full out of the current year’s budget along with all interest and borrowing costs. It will also need to pay back all of the $1.25 billion from the August 2009 sale before the end of the year. According to the Official Statement, paying off the debt reduces the Budget Basis Surplus listed above to $279 million at the end of FY2010. However, the State also predicts having $3.7 billion in unpaid bills at the end of FY2010. After applying the surplus to the unpaid bills, the State will still have $3.4 billion in backlogged accounts payable due at the end of the year. The following chart show the dramatic increase in carrying over unpaid bills from one year to the next from FY2009 to FY2010 compared to prior years.

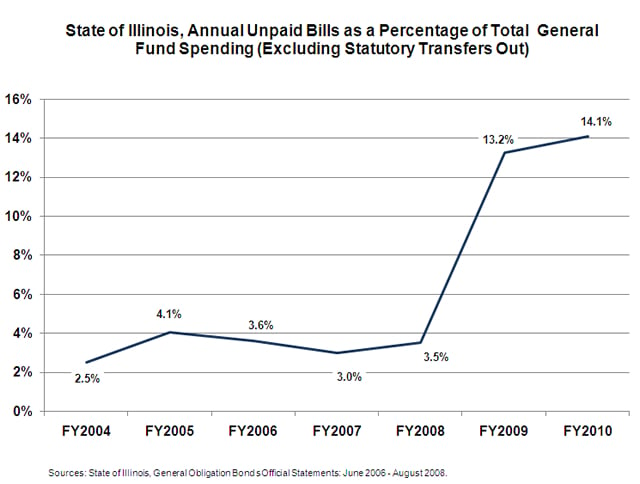

Although the total of unpaid bills is projected drop between FY2010 to FY2009, the ratio of total bills not paid compared to annual spending approved by the State will increase from 13.2% to 14.1%. That is up from an average of 3.3% from the five years prior. The following illustrates the increase in this ratio:

In late 2008, the State Comptroller began warning that not paying its bills on time was threatening the solvency and operations of the State. At the time, bills owed by the state were averaging a 12 week delay and officials worried the backlog of bills could reach up to $5 billion. A total fiscal meltdown in Illinois was averted at the time through short-term borrowing and the opportune arrival of stimulus funding advanced by the federal government. Despite a near miss with fiscal calamity, the adopted budget for FY2010 makes no significant improvements to the total backlog of bills. The State is now moving forward with a budget that depends heavily on borrowing more money at the onset of the fiscal year than ever before on top of continuing to not pay its bills. Local governments feel the ongoing strain of this delay in payments, as do private vendors that must shoulder the cost of the State’s lack of revenue. According to the Comptroller’s website, vendors’ payments are currently delayed 105 business days, or 21 weeks.