October 21, 2009

The property tax rates released yesterday by the Cook County Clerk show that the composite tax rates in the City of Chicago and many municipalities declined slightly from the previous year. However, many property owners will still see higher property tax bills arriving in the mail soon.

The Cook County property tax system is so complex that it is impossible to predict exactly how the new tax rates will affect an individual property owner’s bill.

However, there are a few features of tax year 2008 (payable beginning in late 2009) that will lead to higher tax bills for many taxpayers.

Many homeowners in the city and northern suburbs who have been receiving substantial homeowner exemptions will see higher taxable values for their properties due to the scheduled decline in value of the “7%” homeowner exemption. As prescribed in state statute (35 ILCS 200/15 176), the maximum homeowner exemption will decline in line with the County’s triennial reassessment cycle from $26,000 of equalized assessed valuation (EAV) to $20,000 EAV in the city and from $33,000 to $26,000 in the north suburban assessment triad, which encompasses Cook County suburbs north of North Avenue.1 With a reduced exemption, many homeowners will experience an increase in taxable value even if their assessments do not change. If the increase in taxable value is greater than the decrease in the tax rate, the tax bill rises.

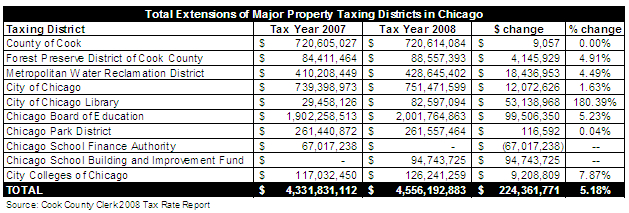

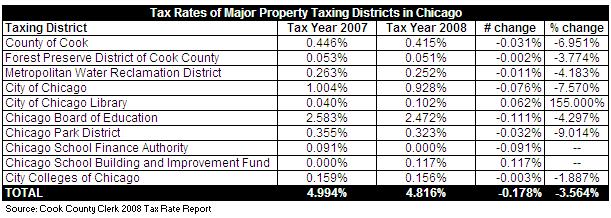

Many of the local governments listed on a City of Chicago property tax bill asked for significantly more money from taxpayers this year. Notably, a $53 million property tax increase that was passed by the City of Chicago almost two years ago is taking effect in this tax bill and appears in the Library line item.

Despite its tax extension increase, the City of Chicago tax rate (combining the City and Library lines) still fell slightly from 1.044% in 2007 to 1.030% in 2008 and the composite tax rate for most taxpayers in the city fell from 4.994% in 2007 to 4.816% in 2008. Tax rates fell because the total taxable value of property (or EAV) still rose more than the total tax extensions of the governments.

One major contributor to the increase in EAV is the scheduled decrease in homeowner exemptions discussed above, but another is the expiration of the Central Loop TIF district. The Central Loop TIF expired in 2008 and released over $2.2 billion of EAV. The Cook County Clerk will publish a report on the 2008 TIF values later this fall (see 2007 reports here).

1. For the south suburban assessment district, the scheduled maximum homeowner exemption will increase this year from $20,000 to $33,000 and will begin to decline in 2009.