August 13, 2009

Police, parks, streets, schools, community colleges, public hospitals, elections, courts, jails, mosquito abatement, sewage treatment…these are just a few of the services that, in Illinois, are provided by many different local governments. Illinois has more units of local government than any other state in the nation, with 6,994 as of October 2007.

Many of these governments rely on property taxes as a revenue source. Whether you are an owner or renter of property, you pay property taxes to a constellation of local governments with separate governing boards that ask for different amounts of property tax revenue. If you are a property owner in Cook County, you can see this list of governments on your second installment tax bill that arrives in the fall each year. If you are a renter, there is unfortunately no easy way for you to know how much of your rent goes toward property taxes and to which local governments your landlord pays property taxes.

The typical property tax bill for a resident of the City of Chicago shows ten or twelve separate line items depending on where you live. Some of them represent separate functions of the same government. For example, Cook County Health Facilities, Cook County Public Safety, and County of Cook appear as three separate lines but are all part of Cook County government.

In the fall of 2008, property owners paid taxes for the 2007 tax year (there is a one-year lag in the property tax cycle). For the 2007 tax year, the composite property tax rate for a typical Chicago property was 4.994% of the taxable value listed on the tax bill. Some Chicago properties had slightly different rates if they were in special service areas or mosquito abatement districts.

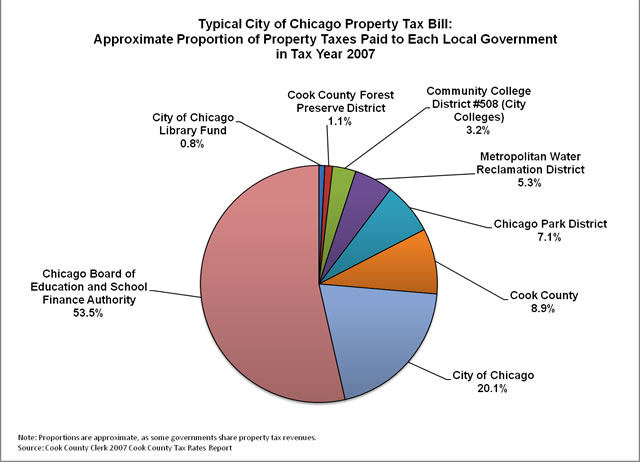

The following pie chart is based on the Cook County Clerk’s annual tax rate report and illustrates what proportion of a typical Chicago property tax bill goes to each local government. Over half of a typical Chicago property tax bill is for the Chicago Board of Education (the public K-12 school system) and a related unit of government that was created to finance school building projects. Roughly 20% is for the City of Chicago, and lesser fractions are for Cook County government, the Chicago Park District, the Metropolitan Water Reclamation District (stormwater and sewage treatment), City Colleges (community college system), the Cook County Forest Preserve District, and the City of Chicago Library system.

What is not represented on a tax bill

Many local governments share revenues and resources, so the lines on a property tax bill only represent approximately where your property tax dollars go.

For example, $35 million of the City of Chicago property tax levy pays for bonds used to build City Colleges facilities. If this $35 million were moved from the City of Chicago pie slice to the City Colleges slice above, the City would represent 19.2% of the tax bill while the City Colleges would represent 4.1%.

Also, Tax Increment Financing (TIF) does not appear on tax bills or in the pie chart (click here for a detailed Civic Federation report on TIF). In addition to its regular 2007 property tax levy of over $739 million, the City of Chicago also received $555 million in TIF property tax revenue. TIF dollars are used by municipalities for economic development projects. The Civic Federation will discuss TIF further in future blog posts.