June 07, 2013

Ed. note: Updated information on this topic can be found here.

-----

Article IX, Section 6 of the Illinois Constitution permits the General Assembly to grant homestead exemptions. Homestead exemptions are intended to reduce the taxable value of homeowners’ property. They are only permitted for a primary residence that is inhabited by the owner (not a second home). Of the eleven homestead exemptions allowed under Illinois statute, two are specifically dedicated to senior citizens: the Senior Citizens Homestead Exemption and the Senior Citizens Assessment Freeze Homestead Exemption. This blog will discuss how these senior exemptions have fared in Cook County during the run-up and decline of property values over the last decade.

The senior exemptions discussed in this blog exempt equalized assessed value (EAV) or the final assessed value of a property multiplied by the equalization factor calculated by the Department of Revenue. To read more about the equalization factor, also known as the multiplier, see this blog post. The EAV of a homestead property minus any exemptions yields the final taxable value to which the composite tax rate is applied to produce a tax bill. For more about tax rates and tax bills in Cook County, read this blog post. In Cook County, applications for both senior homestead exemptions must be made annually to the Assessor.

Homestead exemptions are designed to provide some relative tax relief to homeowners since the property tax is an ad valorem (“according to value”) tax and not based on a taxpayer’s ability to pay. Exemptions are therefore specifically targeted at seniors because many elderly people are on a fixed income and thus are viewed as being less able to adjust to increasing property tax bills. The reason exemptions are targeted at homeowners is because, unlike business property owners, homeowners cannot pass on their costs to customers, owners or suppliers.

The Civic Federation believes the most effective way to target property tax relief to homeowners with the least ability to pay is a means-tested “circuit breaker” that kicks in when a person’s property tax liability exceeds a certain percentage of their annual income. Exemptions should not be granted to homeowners who have the ability to pay their full tax liability because tax relief provided to one property owner must be made up and paid for by all other owners. For more about the Civic Federation’s position on the Cook County property tax system and homestead exemptions, click here.

Senior Citizens Homestead Exemption

The Senior Citizens Homestead Exemption (35 ILCS 200/15-170), created in 1970, is available to homeowners at least 65 years old. In Cook County for tax years 2008 through 2011, the amount of this exemption was a flat $4,000 of EAV. Public Act 98-0007, signed into law on April 23, 2013, will increase the Senior Citizens Homestead Exemption in Cook County to $5,000 for tax year 2012 (payable in 2013) and thereafter. Previous to tax year 2008, the flat dollar amount of the exemption was increased from $2,500 to $3,000 for 2004-2005 and to $3,500 for 2006-2007.

It is important to note that the Senior Citizens Homestead Exemption is in addition to the General Homestead Exemption. That is, if a homeowner qualifies for the Senior Citizens Homestead Exemption, they automatically also qualify for the General Homestead Exemption. In tax year 2011, the General Homestead exempted a maximum of $6,000 of EAV from taxation. Also per P.A. 98-0007, the General Homestead Exemption will increase in Cook County in 2012 to a maximum of $7,000. Thus the maximum exemption a senior qualifying for the Senior Citizens Homestead Exemption in Cook County could receive in tax year 2011 (payable in 2012) was $10,000 and in tax year 2012 (payable in 2013) that maximum will increase to $12,000.

Senior Citizens Assessment Freeze Homestead Exemption

The Senior Citizens Freeze Homestead Exemption (“Senior Freeze” 35 ILCS 200/15-172), created in 1994, is available to homeowners at least 65 years old with household income under $55,000. The exemption “freezes” an eligible homeowner’s EAV at the level of the year prior to a homeowner’ first application. In other words, it exempts all EAV increases over the base amount. There is no exemption maximum or property value maximum, so it is a very valuable exemption for qualifying homeowners. The household income eligibility limit was increased from $35,000 to $40,000 in 1999 through 2003, from $40,000 to $45,000 in 2004 through 2005, to $50,000 in 2006 through 2007 and to $55,000 in tax year 2008 and thereafter.

It is important to note that the Senior Freeze does not freeze tax bills or tax rates, only the taxable value of a qualifying homeowner’s property. It is therefore possible for a homeowner’s tax bill to increase even if they receive the Senior Freeze exemption if taxing districts increase their levies.

Impact of Increasing and Falling Home Values on Senior Exemptions

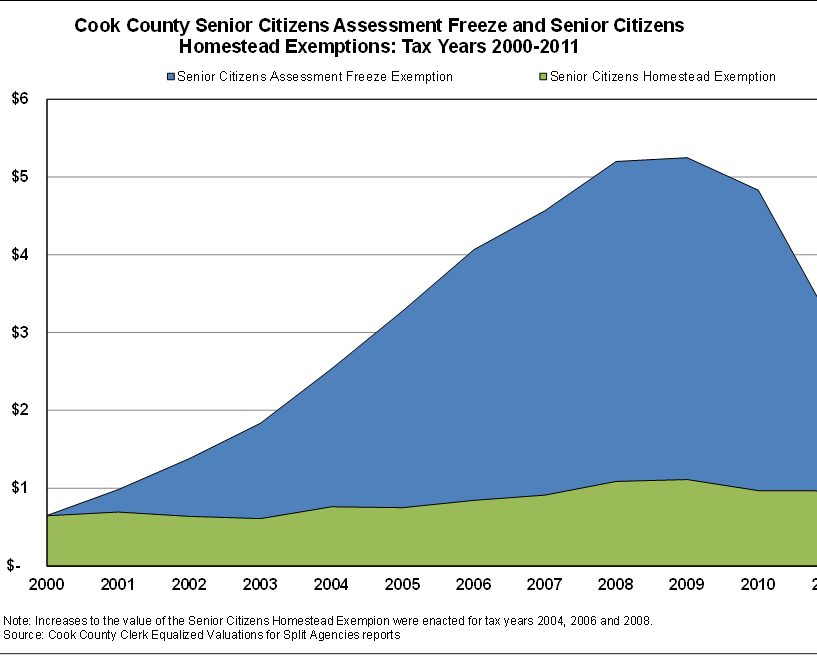

The strong increase in home values that occurred between 2000 and subsequent crash is very visible in the amount of EAV exempted by the Senior Freeze since that exemption is linked to EAV growth above a base amount. Between 2000 and 2009, the Senior Freeze value in Cook County increased by 706.6%, or $4.6 billion of EAV, from $650.6 million to $5.2 billion. The EAV exempted by the Senior Freeze subsequently fell by 39.5%, or $2.0 billion between the peak value in 2009 and 2011, the most recent data available. In contrast, the value of the Senior Citizens Homestead Exemption grew at a much slower rate, increasing in value by 49.4% between 2000 and 2009 and also falling at a slower rate of 13.2% between 2009 and 2011. The following chart shows the change in the value of EAV exempted by both programs. (Click to enlarge.)

The total EAV exempted by all homestead exemptions available in 2011 was $12.4 billion or 7.1% of gross EAV. In other words, homestead exemptions removed 7.1% of total EAV from the net taxable EAV. This was down from a total of $27.1 billion, or 12.6% of gross EAV removed from net taxable EAV in tax year 2008.

For a discussion of how another homestead exemption, the Alternative General Homestead Exemption or “7% cap,” fared during the housing downturn, see the March/April 2013 edition of “Tax Facts,” a publication of the Taxpayers’ Federation of Illinois.