December 14, 2011

Last week marked the end of the budget season for the nine local governments monitored by the Civic Federation. These governments include: the City Colleges of Chicago, Chicago Public Schools, DuPage County, City of Chicago, Cook County, Chicago Transit Authority, Forest Preserve District of Cook County, Metropolitan Water Reclamation District of Greater Chicago and Chicago Park District.

While each local government’s budget and fiscal health status was evaluated individually, there are three specific problems that many of the governments we analyze share, including the declining health of their employee pension funds, a lack of adequate fund balance reserved for contingencies and possible future financial difficulties. The Civic Federation therefore makes similar recommendations to multiple governments that would help alleviate these issues. These recommendations include:

- Implement comprehensive pension reform;

- Follow the Government Finance Officers Association guidelines for General Fund fund balance policy; and

- Develop and implement a formal long-term financial planning process.

Recommendation #1: Implement Comprehensive Pension Reform

The Civic Federation offers the following specific recommendations to improve the long-term financial health of local government pension funds. These measures would require General Assembly authorization. The Civic Federation supported Public Act 96-0889, which created a different tier of benefits for many public employees hired on or after January 1, 2011. Over time these benefit changes for new hires will slowly reduce liabilities for all of the local pension funds as new employees are hired and fewer members remain in the old benefit tier. However, with the pension funds’ actuarial funded ratios falling, immediate action is needed, and we strongly urge local governments to seek approval for additional reforms.

Fund Pensions at the Annual Required Contribution Level

For the majority of the local governments the Civic Federation studies, employer contributions to pension funds are based on a multiple of past employee contributions with no relationship to the funded status of the plan. The employee contributions are a fixed percentage of pay. The Civic Federation recommends that employer and employee contributions be tied to actuarial liabilities and funded ratios, such that contributions are at levels consistent with the actuarially calculated annual required contribution (ARC).

The Civic Federation strongly recommends that local governments implement a method of sharing ARC funding similar to that of the Chicago Transit Authority model, which is based on a 60%/40% employer/employee contribution structure.

Reduce Benefits for Current Employees

Unfunded pension liabilities for local governments have grown significantly over the past ten years, making dramatic action to significantly increase contributions necessary. Otherwise, the contributions needed to rescue the fund will become so substantial that governments will have great difficulty funding the pension promises made to their employees. Raising taxes to a level high enough to deal with the problem may not be a viable option. Therefore, the local governments may have to seriously consider supporting reductions in non-vested pension benefits for current employees in future pension reform legislation.

Study Consolidation with the Illinois Municipal Retirement Fund

For some local government pension funds, there could be efficiency gains by merging with multi-government pension funds such as the Illinois Municipal Retirement Fund or the downstate Teachers Retirement System, and the Civic Federation strongly recommends that these governments study this option.

Pension Fund Governance Structure

The proper role of a pension board is to safeguard the fund’s assets and to oversee benefit administration. If a government does not join a multi-employer fund, the Civic Federation recommends that the structure of a pension fund governance board be reformed according to three standards:

- Employee and management representation should be balanced so that employees do not hold the majority of seats;

- A tripartite structure should be created that includes independent citizen representation on the board; and

- Financial experts should be included on the pension board and financial training for non-expert members should be required.

Recommendation #2: Follow Government Finance Officers Association Guidelines for General Fund Fund Balance Policy

Fund balance is an important financial indicator for local governments. Fund balance is the difference between the assets and liabilities in a governmental fund, which in most cases is the General Fund. Fund balance in a governmental fund differs from net assets typically included in financial reporting in that it includes only a subset of asset and liabilities. It is more a measure of liquidity than of net worth.[1] It can be thought of as the savings account of the local government.

According to the Government Finance Officers Association (GFOA), a government’s General Fund fund balance policy should express a fund balance target as a percentage of operating expenditures or revenues. The GFOA recommends at least two months of operating expenses or revenues, which is approximately 17%.

The Civic Federation generally encourages local governments to develop a fund balance policy based on the GFOA guidelines and establish a target percentage of operating expenditures or revenues for its fund balance. However, if a government has its own established fund balance policy, the Federation recommends that the government adhere to that policy.

Recommendation #3: Develop and Implement a Formal Long-Term Financial Plan

It is important for governments to disclose forecasts to help stakeholders understand what their future financial situations will be and set a framework for future budgets and plans. This can be accomplished through the development and implementation of a formal long-term financial plan that is shared with and reviewed by key policymakers and stakeholders. This plan must also include concrete action steps to address the government’s long-term fiscal balance.

The National Advisory Council on State and Local Budgeting (NACSLB) and the GFOA both recommend that all governments formally adopt a long-term financial plan as a key component of a sound budget process.[2] A long-term financial plan typically includes the following components:

- A review of historical financial and programmatic trends;

- Multi-year projections of revenues, expenditures and debt;

- An analysis of those multi-year trends and projections; and

- Modeling of options to address problems and opportunities, which helps governments address fiscal challenges before they become fiscal crises.

A key component of financial planning is engaging all stakeholders in the process of developing the plan. The GFOA describes long-term financial planning as “not just a staff-driven process. It is consensus-driven and inclusive, involving elected officials, staff and the public.”[3] Among other benefits, involving all stakeholders can help staff refine forecasts, institutionalize planning processes and promote strategic decision-making.

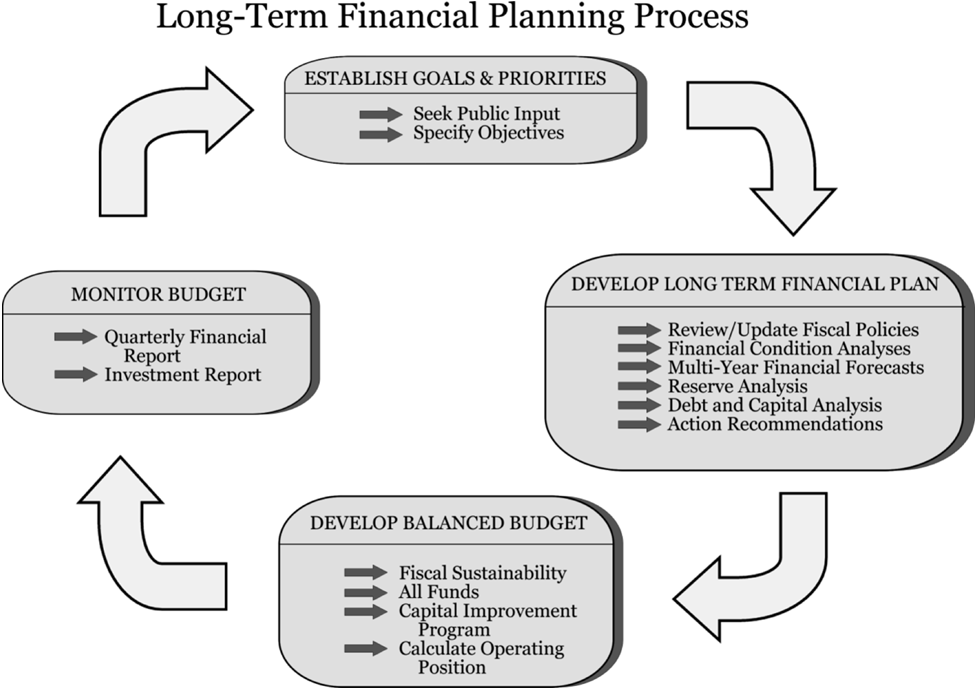

For governments undertaking a new long-term financial planning process, we recommend proceeding in four stages:

Stage 1: Fiscal and programmatic goals and priorities should be articulated through public input.

Stage 2: The long-term financial plan should evaluate financial and service data in order to determine how to accomplish the goals and priorities. It should include a review of the government’s financial policies, a financial condition analysis that presents ten years of historical trend information, multi-year financial forecasts, a reserve analysis, an evaluation of debt and capital obligations and a series of action recommendations.

Stage 3: The insights derived from the long-term financial plan should directly inform the development of a balanced budget that is fiscally sustainable each year.

Stage 4: The plan should then be regularly monitored to ensure its viability by means of regular financial reports.

If a government chooses not to undertake a full long-term financial planning process, then at a minimum an annual document should be developed and published that would include:

- A description of financial policies, service level targets and financial goals. Each policy should be reviewed using relevant forecasting data to determine if the policy is being followed, if the policy should be amended and if new policies should be added.

- A scorecard or rating of the financial indicators as part of the financial analysis that assesses whether the trend is favorable, warrants caution, is a warning sign of potential problems or is unfavorable.

- Possible strategies, actions and scenarios needed to address financial imbalances and other long-term issues. For example, a discussion of the long-term implications of continuing or ending existing programs or adding new ones. These actions should include information on fiscal impact and ease of implementation.

- Sufficient stakeholder input including holding a public hearing for decision makers and the public to provide meaningful input on a long-term financial strategy to address the government’s financial challenges.

All nine FY2012 local government budget analyses, including full recommendations, can be downloaded from the Civic Federation website.

[1] Stephen J. Gauthier, The New Fund Balance (Chicago: GFOA, 2009), p. 9.

[2] See National Advisory Council on State and Local Budgeting and Government Finance Officers Association.

[3] Government Finance Officers Association, “An Introduction to Financial Planning,” http://www.gfoa.org/downloads/LTFPbrochure.pdf (last visited on January 10, 2011). The following graphic illustration of the long-term financial planning process is based on the City of San Clemente, California’s Long-Term Financial Plan and is reproduced in the Government Finance Officers Association document “Long-Term Financial Planning for Governments” available at http://www.gfoa.org/downloads/LTFPbrochure.pdf.