October 02, 2009

The surprise expansion of gambling to all corners of Illinois in the form of legalized video poker that was enacted by the General Assembly has not been well received by many residents or local governments. A recent poll conducted by the Chicago Tribune showed that nearly 60% of Illinois residents opposed legalizing video poker and many counties and cities are taking advantage of a provision in the law that allows local jurisdictions to ban video gaming. The law also allows video poker to be banned through voter referendum. Legalizing and taxing video poker were part of the funding bill to support the State’s $31-billion capital program, passed in May and signed into law by Governor Quinn on July 13, 2009.

On Thursday, October 1, 2009, the Finance Committee of the Cook County Board of Commissioners became the latest government body to approve a ban on video poker in the unincorporated areas of the county. The resolution sponsored by 10th District Commissioner Bridget Gainer passed 11 to 1 with 5 members absent but still needs to be approved by the full Board. The City of Chicago, which makes up the largest portion of the County, currently has a law prohibiting gambling and making it illegal to possess video poker machines.

However, the plan to use video poker to fund capital improvements is not only threatened by its lack of popularity among residents and some local governments. Recent studies show that gambling revenues nationally are on the decline, which may adversely affect the State of Illinois’ ability to rely on gambling proceeds to pay for capital bonds.

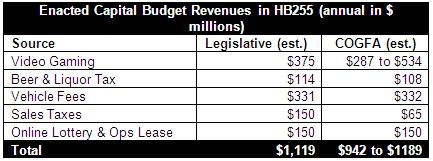

Governor Quinn originally intended to use part of a proposed 1.5 percentage point income tax hike to fund a long-delayed investment in the capital infrastructure of Illinois, but the income tax increase did not gain support in the legislature and was dropped during budget negotiations.Little was known about the new capital revenue bill HB255, enacted as Public Act 96-0034, before it was passed by the legislature on May 21, 2009 and later signed into law by Governor Quinn on July 13, 2009. The measure includes several new revenue sources projected to earn up to $1.2 billion annually to pay for debt service on $12 to $14 billion in borrowing for new capital projects. The provision regarding video gaming allows establishments that have liquor licenses to install up to five gaming machines and imposes a 30% tax on video poker revenue. The bill includes five other sources of revenue to pay for new capital bonds. The following chart shows the annual estimates for each revenue source as projected by the legislature compared with the analysis provided by Commission on Government Finance and Accountability (COGFA) after the measure was approved.

The COGFA analysis estimates the law allows for between 45,000 and 60,000 new video gaming machines to be operated in Illinois. Based on a projected daily income of $70 to $90 per machine, new video gaming receipts would total $3.2 million to $5.9 million every day. Five-sixths of the 30% tax imposed on video gaming proceeds would be put in the Local Gaming Distributive Fund and the rest deposited in the Capital Projects Fund.

However, the estimated revenue capacity of this new type of gaming in Illinois may be in jeopardy as local authorities move to ban video gaming. Evanston was the first major city to approve a local ban on video poker in a unanimous city council vote on September 14, 2009. The next day Naperville, the third largest city in Illinois, passed its ban on video poker followed by Rosemont and Country Club Hills. Similar measures are currently circulating in Palos Heights and throughout the state. Several Illinois counties other than Cook are also moving to ban video poker in their unincorporated areas. DuPage County has already approved such a ban, while McHenry County and Peoria County officials are also considering measures to prohibit video gaming.

The Cook County ban would not directly affect Chicago. Mayor Richard Daley had indicated his support for using video gaming revenue for capital projects, although currently the Municipal Code in Chicago prohibits gambling or possessing video gaming machines. A Chicago Tribune poll showed that 49% of Chicago residents currently oppose video poker in the city while 42% support it, which could make the area ripe for a voter referendum, if the law was repealed.

Local laws prohibiting video gaming are not the only factor making video poker revenue a risky bet for needed debt service funds for new capital bonds. A recent study from the Rockefeller Institute on Government showed states’ revenues from gaming in general have begun to decline across the country. The study showed gambling receipts are down an average of 2.8% nationwide. In Illinois, revenue from gambling is down 14.6%, or $198 million. According to the study, of the 13 states with legal casino gambling Illinois has shown the sharpest decline. Illinois’ casino revenue declined 14.7% between FY2007 and FY2008, and more dramatically between FY2008 and FY2009, falling by 23%. Although 25 states, including Illinois, are either expanding or considering expanding gaming in order to balance budgets and pay for capital, this downward trend raises questions about whether governments can rely on gambling revenues for stable revenue in the long run.

Video gaming is projected to provide up to a quarter of the revenue needed to support Governor Quinn’s recently enacted capital borrowing for Illinois Jobs Now! If video gaming is banned in much of the state and/or does not live up to its projected income per machine, additional revenues would be needed or the state might be forced to spend general funds to meet debt service that comes with the program, further complicating an already deficit-laden budget.

Although the law legalizing this expansion of gaming has been on the books for several months now, the Illinois Gaming Board has yet to finalize the licensing process and no new revenues have reached the State. Nonetheless, the State of Illinois has begun selling the bonds to support the new capital spending, issuing the first $400 million of the $12 billion to $14 billion in bonds needed for Illinois Jobs Now! on September 23, 2009. According to the documentation accompanying the bonds, the proceeds will be used for the following areas:

• $25.5 million general capital projects;

• $337 million roads and bridges,

• $15 million mass transit;

• $ 2.5 million antipolution projects and

• $20 million coal and energy development.

This newest bond issuance by the state was rated single A by Fitch Ratings, which is the lowest rated state debt issuance in the country except for California . California’s debt is currently rated BBB, which is only two steps above junk bond status.