March 21, 2025

By Daniel Vesecky

On February 19, Governor Pritzker released his proposed budget for Illinois’ fiscal year 2026 (FY2026), beginning on July 1, 2025. The proposed budget includes several new revenue sources but does not include a tax increase. It also includes a host of minor spending reductions across most state areas of expenditure, as well as significant savings due to the elimination of the state’s healthcare program for adult immigrants. Though the budget is balanced, it does not address several major fiscal challenges that are looming over the state of Illinois.

Most notably, the budget proposal does not provide any plan for addressing the fiscal cliff for regional public transit, recently estimated at approximately $771 million. The cliff could result in a budget gap for transit agencies as soon as January 1, 2026, and the agencies will need state support to prevent service cuts. The Chicago Public Schools District (CPS or the “District”) also faces an impending fiscal crisis, including a possible budget deficit, pension payments disputes between the City and the School District, and a collective bargaining agreement projected to cost $1.8 billion in its first year. While CPS-related issues do not affect any legal or budget obligations on the part of the State, they may require state action in the coming fiscal year.

Illinois additionally faces increased uncertainty in the face of reductions in federal grant and contract funding to the State itself as well as a variety of local governments, affiliated nonprofit service providers, and companies within its borders. The Governor has signaled that the State does not have the capacity to backstop federal funding, and the resulting financial strain may influence the State’s operations and spending in the next fiscal year. Finally, recent economic and revenue projections suggest that Illinois may downwardly revise its revenue estimates from those in the proposed budget.

Illinois' Budget Process

With the proposed budget now released, hearings in the State House and Senate finance committees have begun. The committees may adopt amendments to the Governor’s budget and then move the bill to the House or Senate floor for debate, amendment, and a full vote. Once a bill passes one chamber, it moves to the other chamber for a similar process. When both chambers have agreed on and passed a bill, it will go to the Governor to sign. The Illinois Constitution requires a simple majority vote for a bill passed on or before May 31. If the General Assembly does not pass the budget by then, a three-fifths vote is required for the bill to pass.

Once the governor has the bill, he may line-item veto or reduce spending on individual appropriations and then sign the bill. The General Assembly may override reductions with a simple majority and may override a line-item veto with a three-fifths majority. The budget implementation bill must be passed and signed by June 30, as the new fiscal year begins on July 1.

How the Proposed FY2026 Budget is Balanced

The Governor’s Office of Management and Budget (GOMB) originally estimated that the State would end FY2026 with a deficit of $3.2 billion based on information available at the time the Governor’s Office’s Economic and Fiscal Policy report was released in November 2024. However, the Governor’s Office acknowledges that these were early estimates based on economic and revenue projections available at that point in time and based on spending assumptions prior to the submission of departmental requests. The Governor’s FY2026 proposal released in February 2025 updated these projections, resulting in revisions to estimated revenue by $1.5 billion above November’s estimates. Additionally, the Governor’s budget proposes the following new revenue measures, which are collectively projected to generate an additional $469 million in revenue:

- A Delinquent Tax Payment Incentive Program expected to raise $198 million;

- A pause on the final shift of sales tax on motor fuel proceeds to the Road Fund expected to generate $171 million for the General Fund; and

- A tax increase at 15 of Illinois’ 16 casinos (excluding the Chicago Casino) is expected to raise $100 million.

After accounting for the revenue adjustments and new revenue measures, this leaves a remaining estimated deficit for FY2026 of about $1.2 billion. The Governor proposes to close this remaining gap through adjustments to departmental expenditure increases, as well as a major healthcare expenditure reduction primarily in the form of a proposal to end the Health Benefits for Immigrant Adults and Seniors program, which is projected to cost an estimated $440 million in FY2025.

FY2026 Budget Overview

The Governor’s FY2026 budget proposal totals $129.4 billion across all operating funds, including $55.2 billion in General Funds spending. The budget proposal also includes $59.7 billion in appropriations for the more than 700 other state funds set aside for specific purposes, the largest of which are the Road Fund and the Healthcare Provider Relief Fund. Another $15.8 billion in appropriations is supported by federal funds. The General Funds budget supports the regular operating and administrative expenses of most state agencies and are the funds over which the State has the most direct control.

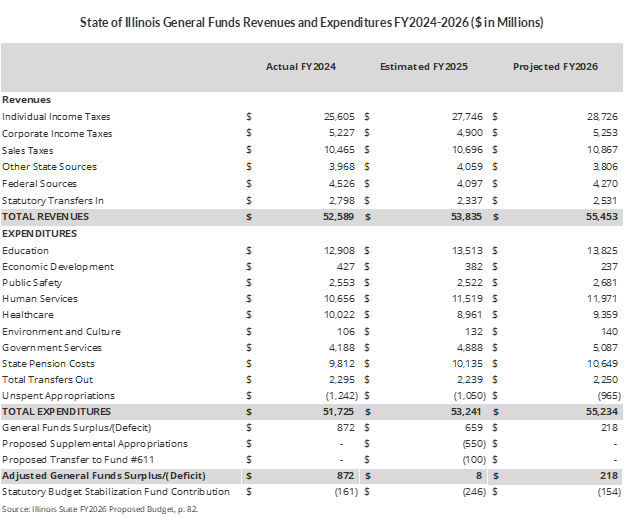

The following table shows the General Funds revenues and expenditures in the proposed FY2026 budget compared to FY2025 year-end estimates and FY2024 actuals. Between 2025 and 2026, revenue is expected to increase by $1.6 billion, a shift driven largely by an approximately $1 billion increase in revenue from the individual income tax. Expenditures are expected to increase by $2 billion, driven by increases of $452 million in human services, $398 million in healthcare, and $312 million in education, as well as a $514 million increase in statutory pension payments.

Based on the FY2025 year-end estimates, the Governor’s budget proposal assumes that the General Funds will end the year with an $8 million surplus. An additional $246 million contribution will be made to the Budget Stabilization Fund, or the State’s reserve fund, also known as the “rainy day fund.” This contribution comes from the cash balance available within the General Funds. Note that the final surplus/deficit numbers do not account for transfers to the Budget Stabilization Fund. The contribution is not treated as an expenditure because the Budget Stabilization Fund is one of the General Funds. Rather, it is treated as a shift in cash from one fund to another within the General Revenue Funds.

The budget proposal anticipates that FY2026 will end the year with a $218 million surplus and that $154 million will be contributed to the Budget Stabilization Fund.

Individual and corporate income taxes will together provide 61.3% of all General Funds revenue in FY2026, or $34 billion. Sales taxes are projected to be the second-largest revenue source at $10.9 billion, or 19.6%, of all General Funds revenues. Proposed General Funds expenditures total $55.2 billion. General Funds expenditures include both direct spending and transfers to Special Funds. This year, the State’s largest areas of funding are primary education, totaling $11.2 billion, and human services, at nearly $12 billion. The state also will be required to spend $10.6 billion, or 19% of the General Funds budget, on pension payments.

It is important to remember that the FY2026 proposal is only an estimate. The Commission on Government Forecasting and Accountability (CGFA), an independent agency that provides analysis and research support for the Illinois legislature, also produces an annual revenue estimate. In March 2025, following the Governor’s budget proposal released in February, CGFA released its predictions for the FY2026 fiscal year. CGFA anticipates a total of $1.2 billion less revenue than the Governor’s Office. In most years, CGFA predicts more revenue than GOMB does, but this year the reverse was true. Some of this difference arises because CGFA did not factor in the Governor’s proposed new sources of revenue. However, even when those sources are factored in, CGFA’s revenue estimate is still $737 million lower than GOMB. Using CGFA’s predictions, if no changes are made to the Governor’s proposed expenditures, we calculate that this would result in a deficit of $673 million in FY2026 after factoring in a $154 contribution to the Budget Stabilization Fund. Although CGFA provides legislators with an independent source of budget analysis, the numbers produced by GOMB are still considered official and will be used as revenue projections for the final budget passed by the legislature.

Revenues

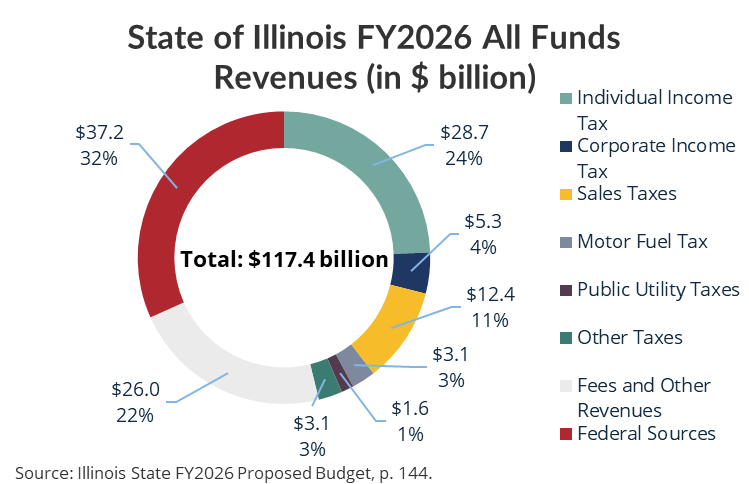

The State of Illinois generates annual operating resources by collecting taxes and levying fees. These revenues are augmented by grants and reimbursements provided by the federal government. The single largest revenue source for the proposed FY2026 budget is federal funding, which is expected to total $37.2 billion, or 32%, of all General Funds revenues. Individual and corporate income taxes will together provide the second-largest source of All Funds revenue, 28% in FY2026, or $34 billion. Sales taxes are projected to be the third-largest revenue source at $12.4 billion, or 11%, of All Funds revenues.

Appropriations

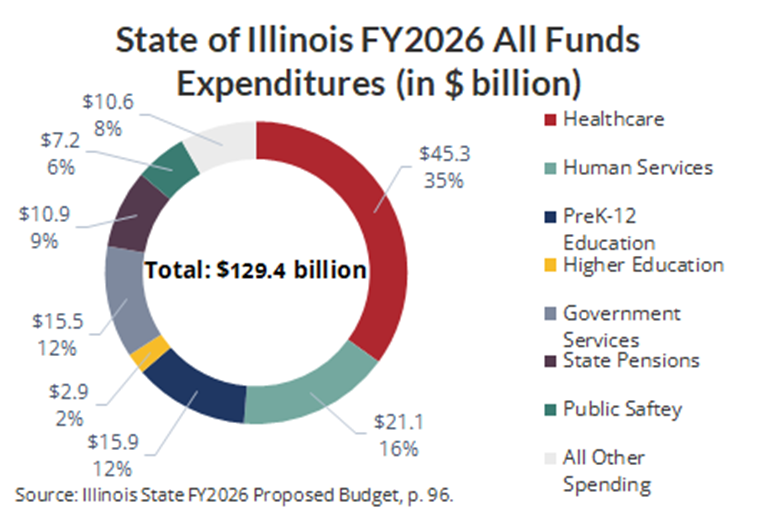

Proposed All Funds expenditures total $129.4 billion. This includes both expenditure through the General Funds and through Special Funds, which are typically earmarked for a specific purpose, as well as usage of federal funds and debt service. This year, the State’s largest area of funding is healthcare, totaling $45.3 billion, followed by human services at $21.1 billion. The state will also spend $15.9 billion on primary education.

The proposed FY2026 budget has a balanced general funds budget, but shows $12 billion more in expenditures than revenues when expanded to account for All Funds. This does not mean the budget is not balanced, however. Many Special Funds take in differing amounts of revenue by year, which means that they can accrue large cash balances. When the state spends more Special Funds money than it takes in, it is likely spending down larger balances that is accumulated in previous years. Thus, this apparent budget gap will draw on existing cash balances, rather than forcing the government to dip into reserves or borrow.

Pensions

Illinois’ retirement systems are among the most poorly funded of any state in the country. At the end of FY2024, the five State pension plans had actuarial unfunded liabilities totaling nearly $144.3 billion, with a combined funded ratio of only 45.8%. A pension fund’s funded ratio is the percentage of assets available to cover current and projected pension benefits and is calculated based on a wide array of economic and demographic assumptions.

The State’s 50-year funding plan, which began in FY1996, requires the five retirement systems to reach 90% funding by FY2045. To achieve the 90% funding goal, annual State contributions for all funds are currently projected to rise to $18.5 billion per year in the next 20 years from $10.6 billion in FY2026. This year’s budget also sets aside $1.2 billion in debt service for pension funding bonds.

To address budgetary pressures due to increasing pension costs, in 2011 the State created a second, significantly less generous Tier 2 of pension benefits for new State employees. Among other benefit changes, Tier 2 employees hired after 2011 receive annual increases after retirement of 3% or half of the rise in the Consumer Price Index (CPI), whichever is lower, calculated on a simple-interest basis. In contrast, employees hired before 2011 receive a 3% annual increase on a compounded basis. Although State contributions are expected to decline over time as new employees make up an increasing share of the workforce, there are concerns that Tier 2 benefit caps might eventually fall below the minimum standards for exemption from Social Security coverage, which are laid out in the Social Security Safe Harbor rule.

Alongside the existing funding schedule, the Governor’s budget has proposed a $78 million funding increase aimed at aligning Tier 2 pensions with the Social Security Safe Harbor rule. The proposed budget recommends increasing the funding ratio goal from 90% to 100% and extending the State’s funding plan by three years to account for the added costs. Finally, the Governor proposes increasing annual pension contributions once the State finishes paying off debt that it took out in the past to cover pension payments.

This report was updated on 3/21/2025.