November 14, 2024

In this short report, the Civic Federation analyzes indicators of the fiscal health of the Cook County Pension Fund based on the most recent FY2023 actuarial report as of December 31, 2023. Compared to many other pension funds in Illinois, Cook County’s pension fund is in a more sustainable financial situation. This is primarily due to employer contributions made by the County above and beyond the amount required by state statute in recent years. The County began making supplemental pension payments in 2016, funded through a 1.0 percentage point increase in the County’s portion of the sales tax. These supplemental contributions were codified into state law through Public Act 103-0529, passed by the General Assembly in May 2023, and signed by the Governor in August 2023. Previously, the contributions were made through an intergovernmental agreement with the Cook County Pension Fund.

PA 103-0529 included a funding schedule to determine actuarially required contributions to help the County Pension Fund reach 100% funding in the next 30 years. It also allows the County to make its annual pension contributions from any tax source, not limited to property taxes. Additionally, the legislation resolved an issue related to federal Safe Harbor rules, which require public pension benefits for government employees not subject to Social Security to be comparable to Social Security benefits. The bill increased the maximum pensionable salary for employees hired on or after January 1, 2011 (known as Tier 2 employees), aligning it with the Social Security Wage Base. This means that the maximum amount of pay used to calculate a pension for County employees will now increase at the same rate as the Social Security pay cap over time.

Membership Trend

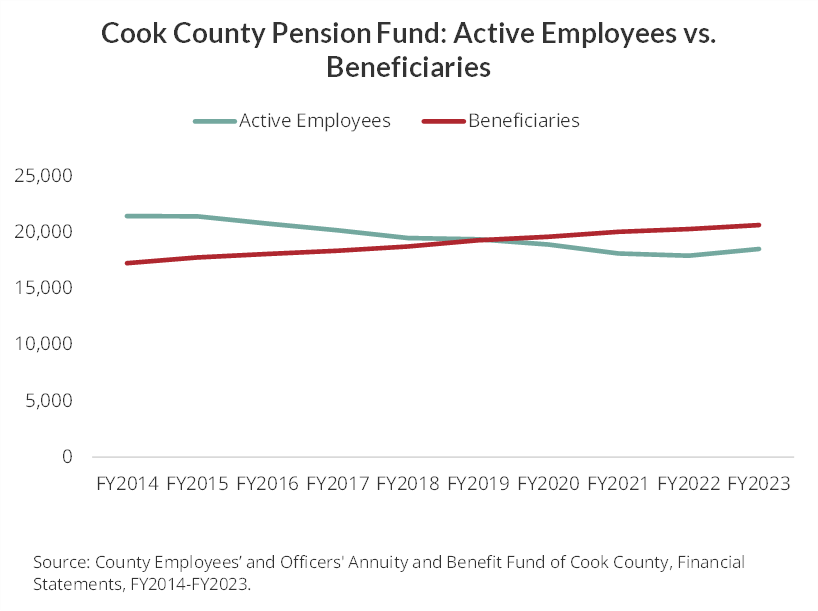

Trends in pension fund membership can indicate whether more financial stress on a pension fund can be expected due to changes in the number of employees paying into the fund over time. The number of active employees contributing to the Cook County Pension Fund has declined while the number of beneficiaries, or those receiving benefits, has increased. As of December 31, 2023, 18,529 active County employees were participating in the Pension Fund, compared to 21,467 ten years earlier. As of the same date, there were 20,661 beneficiaries, up from 17,265 in FY2014. These changes result in a ratio of active employees to beneficiaries of 0.9. Prior to FY2020, the County fund had more employees than retirees. A low ratio of active employees to annuitants means fewer employees are paying into the fund, and more retirees are taking annuity payments out of the fund. This ratio can be a signal of distress for a mature and underfunded pension like the County fund, where additional employer contributions will be needed to make up the difference.

Fiscal Indicators

Pension fund status indicators show whether funding is improving or declining over time and how well a pension fund meets its goal of accruing sufficient assets to cover its liabilities. Ideally, a pension fund should hold exactly enough assets to cover all its actuarial accrued liabilities (100% funded).

The Civic Federation analyzes three measures over time to evaluate pension funding status:

- Funded ratio;

- Unfunded actuarial accrued liabilities; and

- Investment rate of return.

Funded Ratio: The most basic indicator of pension fund status is its ratio of assets to liabilities, or “funded ratio.” In other words, this indicator shows how many pennies of assets a fund has per dollar of liabilities. For example, if a plan had $100 million in liabilities and $90 million in assets, it would have a 90% funded ratio and about 90 cents in assets per dollar of obligations to its employees and retirees.

When a pension fund has enough assets to cover all its accrued liabilities, it is considered 100% funded. This does not mean that further contributions are no longer required. Instead, it means the plan is funded at the appropriate level at a certain date. A funding level under 100% means that a fund does not have sufficient assets on the date of valuation to cover its actuarial accrued liability.

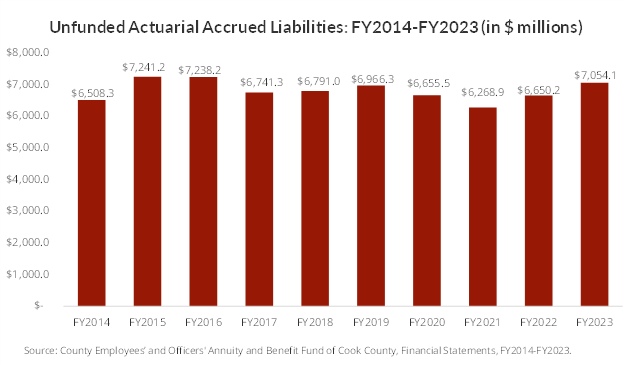

Unfunded Liability: Unfunded actuarial accrued liabilities (UAAL) are obligations not covered by assets. Unfunded liability is calculated by subtracting the value of assets from the actuarial accrued liability of a fund. For example, if a plan had $90 million in assets and $100 million in liabilities, its unfunded liability would be $10 million.

One of the purposes of examining the unfunded liability is to measure a fund’s ability to bring assets in line with liabilities. Healthy funds are able to reduce their unfunded liabilities over time. On the other hand, substantial and sustained increases in unfunded liabilities are a cause for concern.

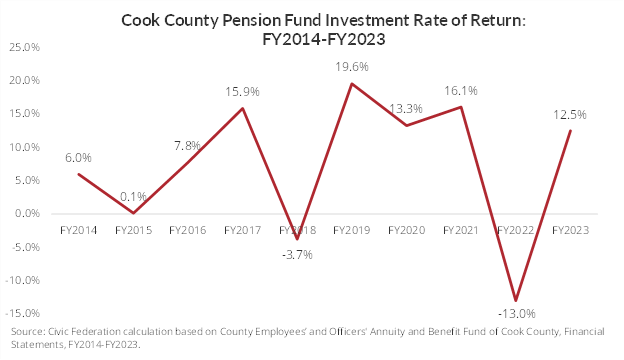

Investment Rate of Return: A pension fund invests the contributions of employers and employees in order to generate additional revenue over an extended period of time. Investment income provides the majority of revenue for an employee’s pension over the course of a typical career. In addition to the actual annual rate of return, the assumed investment rate of return plays an important role in the calculation of actuarial liabilities. It is used to discount the present value of projected future benefit payments and has been the subject of considerable debate in recent years. The assumed rate of return for the Cook County Pension Fund is 7.0%, reduced in FY2021 from 7.25%. Other major contributors to a pension fund’s financial status, in addition to employer contributions and investment returns, are benefit enhancements and changes to actuarial assumptions.

Funded Ratio

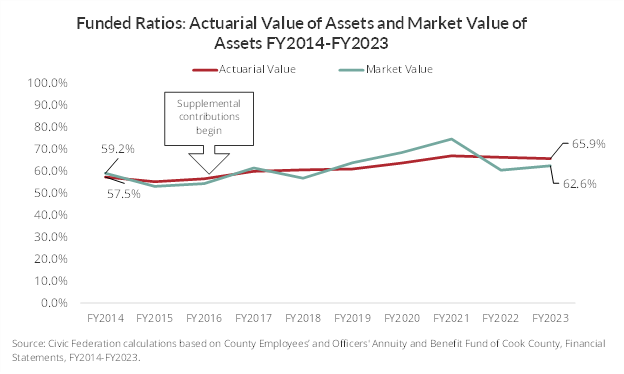

There are two measurements of a pension plan’s funded ratio: the actuarial value of assets measurement and the market value of assets measurement. These ratios show the percentage of pension liabilities covered by assets. The lower the percentage, the more difficulty a government may have in meeting future obligations.

The actuarial value of assets measurement presents the ratio of assets to liabilities, accounting for assets by recognizing unexpected gains and losses smoothed out over a period of three to five years. The market value of assets measurement presents the ratio of assets to liabilities by recognizing investments only at current market value. Market value-funded ratios are more volatile than actuarial-funded ratios due to the smoothing effect of actuarial value. However, market value-funded ratios represent how much money is actually available at the time of measurement to cover actuarial accrued liabilities.

The following chart shows both the actuarial and market value funded ratios for the Cook County Pension Fund over the ten-year period between 2014 and 2023. The actuarial value funded ratio has risen steadily over this period from 57.5% in FY2014 to 65.9% in FY2023. The market value funded ratio rose in FY2023 to 62.6% from 60.6% the prior year.

Prior to FY2016, the funded ratio had been declining for many years, but as noted above, the funded ratio has generally increased since the County began making supplemental pension contributions in FY2016, funded through a 1.0 percentage point increase in the sales tax rate.

Unfunded Actuarial Accrued Liability

The unfunded liabilities of the Cook County Pension Fund increased to $7.1 billion in FY2023 from $6.7 billion in FY2023. This increase was primarily due to higher-than-expected salary increases, which increased the unfunded liability by $278.4 million. Over the past ten years, the Pension Fund's unfunded liabilities have increased by $545.8 million, or 8.4%. Liabilities for the County Pension Fund include other post-employment benefits (OPEB), which are discussed further below.

Investment Return

In FY2023, the County Pension Fund experienced investment gains of approximately 12.5%.1 The County’s investment return assumption for the year was 7.0%, meaning that actual returns were higher than expected. The average return from 2014 to 2023 was 7.4% over the ten-year period.

Other Post-Employment Benefits

The Cook County Pension Fund administers a Postemployment Group Healthcare Benefit Plan (PGHBP) that provides healthcare and vision benefits for annuitants who elect to participate and their dependents. In FY2023, 18,686 active members and 11,385 retirees or other beneficiaries received benefit payments. The plan is administered through a trust but is funded on a “pay-as-you-go” basis. This means neither the Pension Fund nor Cook County is accumulating assets to pay for future OPEB benefits. Instead, benefit expenses are paid for as they come due. In FY2023, $47.2 million of the County’s pension contribution was dedicated to OPEB costs. The PGHBP expects employees and spouse annuitant contributions to cover 56% of annual medical costs.

Pension funds and governments are required to report information about OPEB liabilities, assets (if any), and expenses in their financial statements. Cook County reported total OPEB liability to be $1.8 billion as of December 31, 2023. The reported OPEB liability represents a net increase of $138.9 million from the prior year due to a decrease in the discount rate used to calculate the benefits from 3.65% in FY2022 to 3.26% in FY2023.

For more information about the Cook County pension fund in the FY2025 recommended budget, see the Civic Federation’s analysis.

References

(1) The Civic Federation calculates investment rate of return using the following formula: Current Year Rate of Return = Current Year Gross Investment Income/ (0.5*(Previous Year Market Value of Assets + Current Year Market Value of Assets – Current Year Gross Investment Income)). This is not necessarily the formula used by the pension funds’ actuaries and investment managers; thus investment rates of return reported here may differ from those reported in a fund’s actuarial statements. However, it is a standard actuarial formula. Gross investment income includes income from securities lending activities, net of borrower rebates. It does not subtract out related investment and securities lending fees, which are treated as expenses.