July 10, 2024

Eight months after its formation, the Chicago City Council Finance Committee’s Subcommittee on Revenue held its first hearing on June 26. The committee is tasked with identifying revenue streams to fund the City’s large debt burden, along with new and existing City programs and services. As the Subcommittee continues to engage on the subject of revenue options and the City Council as a whole approaches the 2025 budget process, the Civic Federation is elevating for Subcommittee, Council and Administration consideration of its June 2023 report published at the outset of the then-new Mayoral Administration, Financial Challenges Facing the Chicago Mayor and City Council: Options and Recommendations, which examined many of the same potential tax/revenue sources listed in a survey distributed to the Subcommittee on Revenue.

The report, without endorsing or taking a position on the ultimate merits, outlines the pros and cons associated with various revenue options, as well as implementation considerations. (Revenue options discussed in the report can be found here). In doing so, the Civic Federation then (and now) stresses that any new taxes or revenue sources or increases to existing ones must be tied to a long-term financial plan that balances the City’s budget and stabilizes its finances over the long term and should involve efficiencies and other reforms (recommendations for which are also included in the June 2023 report). Understanding the implications and realities of each tax source on its own and in relation to other options, whether on the revenue or expenditure side, will be critical to ensuring good tax policy rather than politically popular options to address Chicago’s major fiscal challenges.

The Civic Federation has repeatedly voiced concerns over the City’s persistent structural imbalance between operating expenditures and recurring revenue sources – an imbalance that is projected to continue to grow absent action to reduce expenditures or increase revenues. The practice of using one-time revenue sources, particularly federal pandemic funding, operating reserves and TIF surplus, further exacerbates this deficit and leaves the City particularly vulnerable in the event of unexpected costs or economic downturns. Additionally, there are several emerging issues that will increase costs to the City and will need to be incorporated into projections and financial plans moving forward, including: looming financial cliffs for the City’s sister agencies including the Chicago Transit Authority (CTA) and Chicago Public Schools (CPS); continued spending on healthcare, housing and supplies for undocumented migrants; and collective bargaining agreements between City employers and unions.

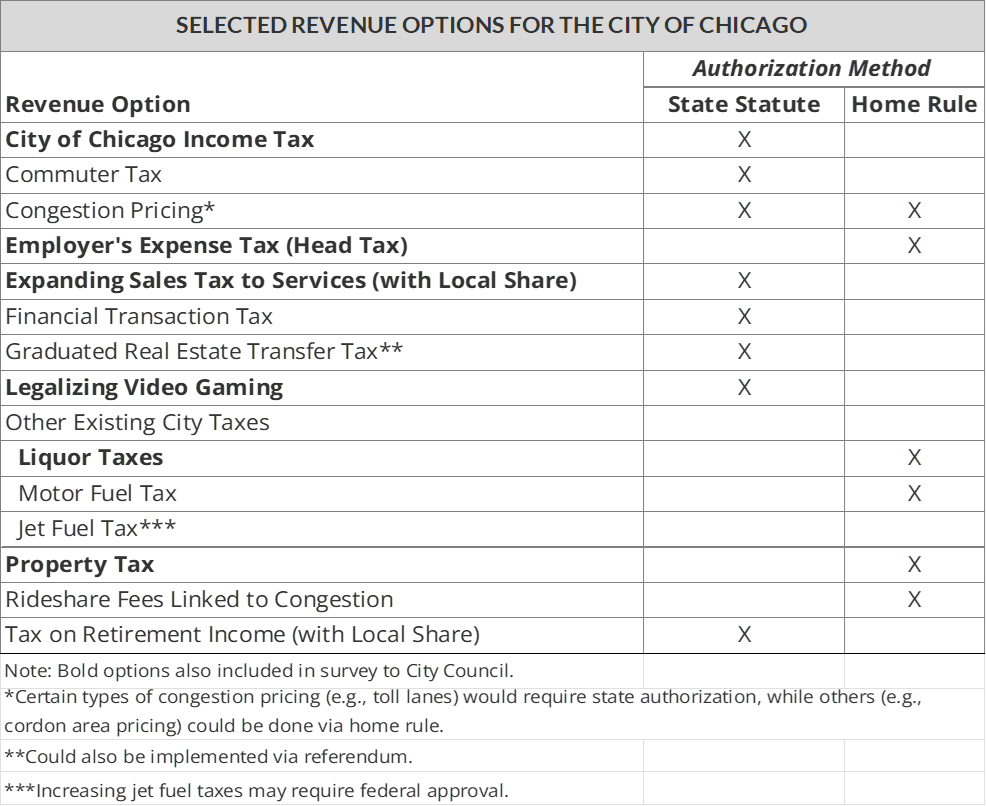

The table below shows each of the revenue options presented in the Civic Federation’s June 2023 report and the methods for authorizing such taxes. Importantly, many of the taxes discussed are beyond the Subcommittee or Council’s own authority and will require additional approval from the State and/or federal government. More than half would require changes to State statute. Bolded items indicate that the option was also included in the survey that was distributed to the members of the City Council ahead of the first Subcommittee meeting that solicited yes/no feedback on 16 potential sources of revenue. Other items included in the survey, but not the Civic Federation analysis, include a grocery tax, checking bag tax, City sticker tax increase, package tax, monthly/wireless plan tax, an increase in the City share of the Local Government Distributive Fund (LGDF) and enterprise zones.

The importance of the Subcommittee’s purpose and the prescient need for a comprehensive long-term plan to meet the City’s financial obligations warrants a reinforcement of this work. The full report includes an in-depth discussion of each option.

Finally, it is also important to point out that several of the revenue options presented in the Subcommittee on Revenue survey are already taxed by the City of Chicago. Further increases to existing sources warrant careful analysis and consideration of their possible strategic behavioral impacts to determine whether and what potential exists for higher rates. Examples include the checkout bag tax, city sticker tax (i.e. vehicle registration) and alcohol tax. A compilation of the many taxes paid by consumers within the City of Chicago can be found in another Civic Federation report, Consumer Taxes in Chicago as of January 1, 2024.

We strongly encourage the Subcommittee to take these considerations into account as it continues its work.