January 14, 2016

A new report by Governor Bruce Rauner’s administration projects that the State of Illinois’ backlog of unpaid bills could grow to $25.0 billion in FY2019 from $4.4 billion in FY2015 based on current tax and spending policies.

The three-year forecast, issued on January 6, 2016, covers FY2017 through FY2019. It also includes actual budget results for FY2015, which ended on June 30, 2015, and estimated results for FY2016, which began on July 1, 2015.

The projected growth in unpaid bills is not surprising in light of the decrease in income tax rates that took effect midway through FY2015 and the State’s hefty contributions to its dramatically underfunded pension funds. State officials closed the budget gap in FY2015 mainly by using budgetary gimmicks and one-time revenue sources.

As discussed here, Illinois has been operating without a General Funds budget since the start of FY2016 due to an impasse between the Governor and the General Assembly. The new FY2016 estimate provides the administration’s first projection of expected spending in the current fiscal year.

The Governor’s Office of Management and Budget (GOMB) has been required to issue the three-year forecast in early January since 2011 as part of an economic and fiscal policy report. This year’s report is the first under Governor Rauner, who took office on January 12, 2015, after the publication of the 2015 report.

According to State law, the report must “outline the long-term economic and fiscal policy objectives of the State, the economic and fiscal policy intentions for the upcoming fiscal year, and the economic and fiscal policy intentions for the following two fiscal years.” However, Governor Rauner’s predecessor, Pat Quinn, only based his first three-year projection, in 2011, on policy intentions. Subsequent forecasts either showed expenditure cuts needed to balance the operating budget or expenditures and revenues under existing law.

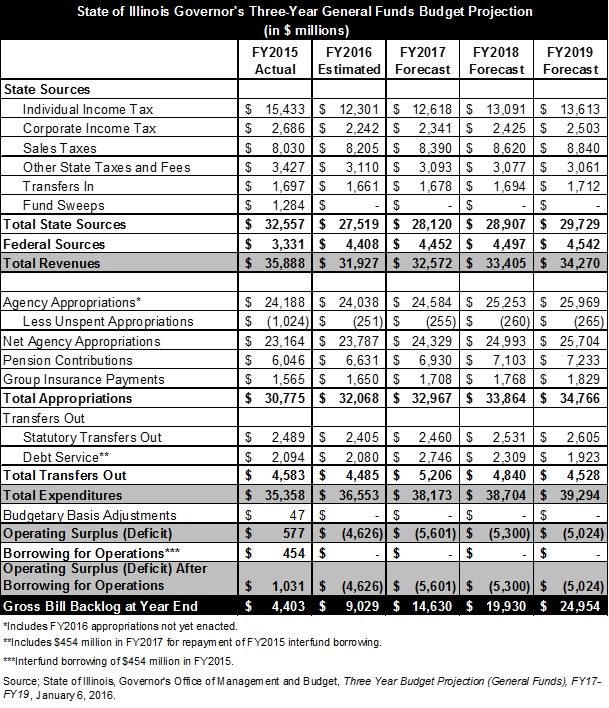

Governor Rauner’s projection also assumes the continuation of existing spending and revenue policies. The following table summarizes the information in the new projection.

Fiscal year 2016 is the first full budget year since the partial phaseout of temporary income tax rate increases enacted in 2011. As of January 1, 2015, individual income tax rates, which had been raised to 5.0% from 3.0%, declined to 3.75%; corporate income tax rates (not including the Personal Property Replacement Tax), which had increased to 7.0% from 4.8%, declined to 5.25%.

According to GOMB’s estimates, total General Funds revenues decline by 11.0% from $35.9 billion in FY2015 to $31.9 billion in FY2016, mainly because of the income tax rate reductions, and then rise moderately through FY2019 due to natural economic growth. Income tax revenues fall 19.7% from $18.1 billion in FY2015 to $14.5 billion in FY2016 before growing to $16.1 billion in FY2019.

Revenues in FY2015 were boosted by $1.3 billion in transfers of surplus balances from other state funds to General Funds—a practice known as fund sweeps. In FY2015 the State also borrowed $454 million from other state funds; this interfund borrowing must be repaid in 18 months.

Total General Funds expenditures are estimated to increase by 3.4% from $35.4 billion in FY2015 to $36.6 billion in FY2016 and by 4.4% from FY2016 to $38.2 billion in FY2017. Annual increases are projected at 1.4% and 1.5% in FY2018 and FY2019, respectively.

The relatively high spending increase in FY2016 reflects a jump in statutorily required pension contributions and artificially low General Funds Medicaid spending in FY2015, when the State used FY2014 revenues to pay for FY2015 Medicaid expenditures. Projected spending in FY2017 includes the repayment of the FY2016 interfund borrowing and an increase in debt payments owed on pension bonds issued in 2011.

As discussed here, the State has been paying a large portion of its expected FY2016 expenses even without a General Funds budget due to statutory requirements, consent decrees and court orders. In addition, although Governor Rauner and the Illinois General Assembly have not reached agreement on most of the FY2016 general operating budget, the Governor did sign an appropriation bill for elementary and secondary education. In all, the State is authorized or compelled to spend approximately $31.5 billion out of General Funds in FY2016, according to documents issued in connection with the State’s upcoming bond sale on January 14.

The $31.5 billion does not include group health insurance, the cost of which must be paid eventually because of State law and union contracts. Other areas that have historically been funded but are not being financially supported currently are public universities and community colleges, monetary assistance grants for college students, human services programs not covered by Medicaid and operational expenses of certain agencies. The new FY2016 General Funds spending estimate allocates $5.1 billion to currently unfunded areas, bringing total expected expenditures to $36.6 billion.

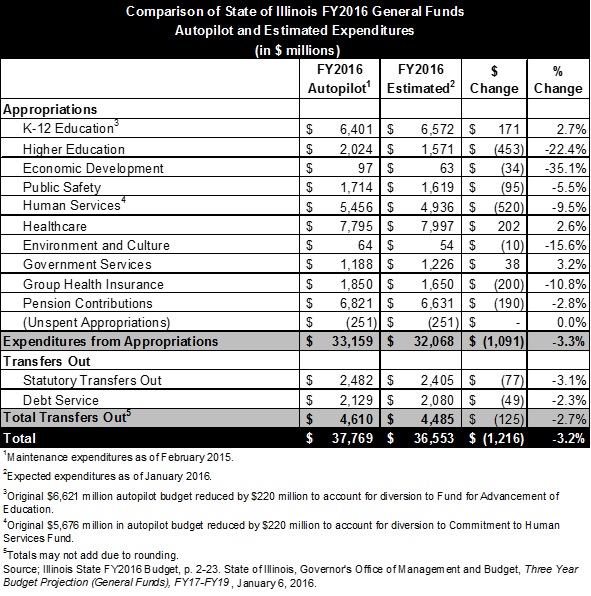

The following table compares FY2016 spending in the new three-year projection to the FY2016 autopilot budget in Governor Rauner’s recommended budget document issued in February 2015. The autopilot or maintenance budget in the recommended budget was intended to show expenditure levels needed to support existing State programs and services.

In the table above, FY2016 autopilot expenditures total $37.8 billion. This represents a decrease of $440 million from $38.2 billion autopilot spending in the recommended budget document. The original number did not properly account for the statutorily required diversion of $220 million to each of two separate funds to support education and human services, according to GOMB.

The expected spending in FY2016 is $1.2 billion below the FY2016 autopilot budget. The major reductions include the following:

- Higher education: The $453 million decrease is in line with the Governor’s FY2016 budget recommendation, which proposed that spending on public universities be cut by 31.9% to $849.1 million from $1.2 billion in the autopilot budget.

- Human services: The $520 million reduction reflects savings on programs that are not being funded because they are not covered by court orders or consent decrees, as well as administrative actions taken to reduce costs. For example, the Rauner administration tightened eligibility requirements for subsidized child care for low income families, although the restrictions were partially rolled back in November 2015 after opposition from recipients and advocates.

- Group health insurance: The $200 million decrease is due to rate reductions negotiated with insurers and health care providers, savings from an audit of dependent eligibility and use of cash balance from the program’s special account, according to GOMB.

- Pension contributions: The reduction of $190 million reflects regular funding from the State Pensions Fund, which receives proceeds from the sale of unclaimed property. This funding was not accounted for in the autopilot budget but is deducted from General Funds spending in the new estimate.

Although estimated FY2016 spending of $36.6 billion is below the autopilot budget, it is significantly higher than the $31.5 billion in FY2016 expenditures proposed by Governor Rauner in February 2015. The Governor’s recommended FY2016 budget provided for a balanced operating budget with a slight surplus to pay down a portion of the State’s backlog of unpaid bills. As explained here, the proposal was based on spending cuts to most areas of government as well as steep reductions to employee pension and healthcare benefits that were subject to legal challenges or labor negotiations.

The General Assembly’s FY2016 General Funds spending plan of about $36.3 billion did not include revenues to close the operating deficit and was largely vetoed by the Governor. Governor Rauner has said he would consider tax increases, but only in connection with the enactment of his Turnaround Agenda. The agenda includes changes in workers’ compensation; limits on damages in civil lawsuits; constitutional amendments on term limits and redrawing legislative districts; and a freeze on local property taxes, combined with measures to cut costs for local governments by limiting the scope of collective bargaining and eliminating prevailing wage requirements.

As stated in the new report, “With progress in the Turnaround Agenda that would ensure our State’s future, the Governor is willing to partner with legislators to increase revenues and responsibly limit spending.” The report notes the Governor’s desire to reduce State payments on pensions, health insurance and Medicaid, but does not provide details.

More specifics are expected on February 17, 2016, when Governor Rauner is scheduled to present his budget proposal for FY2017.