January 13, 2010

This week the State of Illinois finalized one of its largest revenue sources enacted by General Assembly and approved by the Governor to fund the FY2010 budget, a $3.5 billion loan. By selling five-year pension obligation bonds, sometimes referred to as pension notes, the State freed up $3.5 billion to fund operations for FY2010 that would have otherwise been used to pay for the statutorily required payment to its five pension funds. However, as previously discussed on the IIFS blog, this move comes with a price.

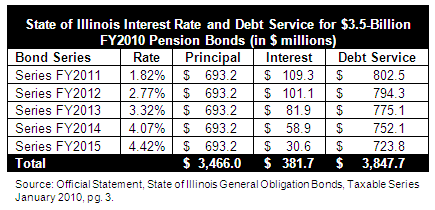

Next year, not only will the State have to make its annual payment to the pension fund – estimated to total $4.1 billion from General Funds – but it will also need to come up with the debt service payment for these new bonds. This will add to the State’s debt service for pension bonds that it is already paying on a $10 billion offering sold in FY2003, which totaled $543.5 million this year and will cost $541.9 million next year. The following chart shows the total annual debt service that will be due on the FY2010 pension loan for each of the next five fiscal years.

The principal for the loan is paid in equal tranches of $693.2 million each year, known as level principal, as listed in the official statement published on Wednesday, January 13, 2009. The total annual debt service including interest decreases from $802.5 million to $723.8 million as the debt is paid off between FY2011 and FY2015. The following chart shows the increase in total pension debt service over the next five years.

The total debt service, including interest and principal, owed by the State of Illinois to be paid back between FY2010 and FY2033 now totals $22.7 billion.

All of the pension bonds sold by the State are taxable. Investors are often attracted to municipal bonds because the interest earned can be exempt from federal income taxes. However, since these bonds will be used to make the State’s payment into the pension systems’ investment funds, the sale qualifies as “risk arbitrage” and federal rules do not allow these bonds to be tax exempt. The taxable status and other risks versus benefits of pension bonds are explained in detail in a report from the Government Finance Officers’ Association published in June 2003. The report came out after the State of Illinois sold $10 billion in pension bonds to make the FY2003 and FY2004 payments and compares several sales of pension bonds by various states and cities across the country. One notable concern highlighted by the GFOA report is the difficulty securing returns in the pension funds that will be greater than the interest rate on the bond proceeds deposited into the funds. According to the report, “pension bonds increase the overall level of financial risk for the plan sponsor. Investments must be made in equities, high-yield debt, or highly leveraged portfolios (such as hedge funds) if returns are to exceed borrowing costs. While studies suggest that over sufficiently long periods of time (30 years is a frequent assumption) equities will outperform bonds by 4 percent to 5 percent, that performance comes with increased risk, which is magnified in the short term.”

The shorter repayment term of these bonds, the State of Illinois’ ever-plummeting bond rating and the volatility in the stock market all make this pension issuance more likely to cost more than will be gained in the pension funds. In December, prior to this bond sale Fitch lowered the State’s debt rating to ‘A’ with a negative outlook, just one step above junk grade bonds and only higher than one other state, California.

The downgrading has led to higher interest rates, but even after accounting for the additional interest costs that comes with the lower debt rating, some investment analysts say Illinois is overpaying for these bonds. According to a report from Bloomberg Financial, several corporate bond issuances with lower ratings than the State’s that also hit the market last week received better terms than Illinois.