March 03, 2011

For the second year in a row, the State of Illinois raised funds in the municipal bond market to make its annual pension contributions. On February 23, 2011, the State finalized the sale of $3.7 billion worth of Pension Obligation Bonds (POB) for FY2011.

Similar to its FY2010 POB sale, Illinois’ bonds that sold last week were also oversubscribed, meaning more orders were placed for the bonds than the available supply. The State’s bond underwriters received $6.1 billion in orders for the new taxable state debt. It was reported that the FY2010 bonds received more than $8 billion in orders for the $3.5 billion in bonds sold. Although this indicates success in marketing the bonds to investors, it does not indicate if the bonds were issued at the lowest price possible or best value for the State.

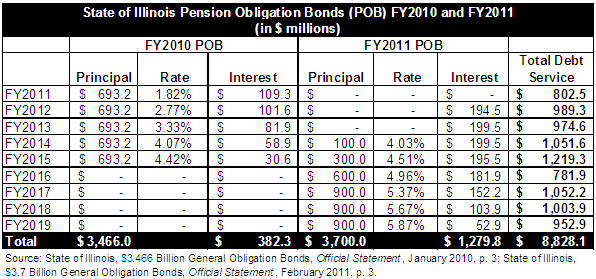

The final official statement issued by the State on the bonds, which included the interest rate, specific maturities and the total debt service, was published on March 2, 2011. The document shows that the State will pay a total of $1.3 billion in interest on the bonds over the next eight years. This is a large increase over the total of $382.3 million of interest cost it was charged for the FY2010 bonds, even though the total principal borrowed is only slightly more. The $3.7 billion principal of the FY2011 POBs was $234.0 million or 6.8% more than the $3.5 billion sold in FY2010. However, the State will pay $897.5 million more in interest for the FY2011 bonds, or a 234.8% increase over the total interest cost for the FY2010 bonds.

The following chart shows the principal amounts borrowed, interest rates charged and total debt service that the State must repay for the last two years of pension borrowing.

Several factors led to the increase in interest cost for the bonds. As previously discussed here, the back loaded structure of the FY2011 POBs means the State will be carrying larger amounts of principal for a longer time, which leads to a higher total interest cost. The State has also been downgraded by all three major credit rating agencies in reaction to its ongoing fiscal crisis since selling the FY2010 POBs. This well publicized and ongoing weakness in the State’s fiscal condition leads to higher yields and increased total interest cost for Illinois bonds, as detailed in the Cost of Crisis report previously published by the Civic Federation. The State’s longest maturing bonds, which will be repaid in FY2019, will pay investors 5.9% annually.

It is possible that the State could have reduced the interest rates on these bonds in light of the demand for this debt. Both of these issuances were negotiated sales, meaning that the underwriter or underwriting group are chosen before the sale of the bonds to directly market the debt and either keep or distribute the notes to its clients once the sale date is determined. In the other type of bond sale, a competitive sale, the underwriters enter bids on the bonds at a designated time and the one that offers the lowest interest cost is awarded the issuance. Competitive bond sales typically ensure the lowest possible rates, but for governments with poor credit, the negotiated sale offers the chance to more thoroughly market its debt and preview investor interest prior to the final sale. According to the best practices published by the Government Finance Officers Association, government issuers should have sufficient market information and be in close enough contact to the underwriters to suggest repricing at a lower rate if demand for its debt far exceeds the total bonds to be issued at the end of the order period. According to the statements by officials in the governor’s office, the State received orders from 129 investors for the FY2011 POBs at the rates in the table above.

Increased debt service costs will continue to complicate the State’s annual budgets as it struggles to fund ongoing programs and agency operations out of its operating revenues. Under the State’s General Obligation Bond Act, the State must transfer debt service payments that it owes on these and other General Obligation (GO) debt out of General Funds revenues before it may use funds for any other appropriations or liabilities. According to the Governor’s recommended budget for FY2012, the State owes $2.9 billion in total GO debt service in FY2011. However, the State will pay $570 million from General Funds of the total $1.5 billion it owes in debt service related to capital bonds because capital GO bonds receive funds from outside the General Funds from the Road Fund and the Capital Projects Fund.

The State also receives General Funds relief for the debt service it owes on the $10 billion in POBs sold in FY2003 because of a reduction in the amount required to be paid into the retirement systems each year. Public Act 93-0002, which authorized the bonds, also included a provision that annual pension contributions calculated by the pension funds must be reduced by the total annual debt service owed for that fiscal year. This effectively pays for the pension bonds each year by freeing up General Funds resources that would otherwise be used to make its required pension payments.

Unlike other GO debt service owed by the State, the FY2010 and FY2011 POBs are only funded through General Funds resources. This means that from FY2011 through FY2019 the State must pay an average of nearly $1 billion a year in debt service from its General Funds revenues for the new POBs that in previous years would have been available to pay for its ongoing operations.

If the State continues to borrow for operations, as proposed in the Governor’s FY2012 budget, even more of its General Funds operating resources will be absorbed by debt service rather than being available for operations. The long-term cost of the proposed $8.75 billion GO Restructuring Bonds is discussed here.