January 03, 2013

A pension reform proposal introduced in the Illinois General Assembly late last year could immediately reduce the State’s required annual contributions by nearly $2 billion, according to recent actuarial reports.

As discussed here, a bipartisan group of legislators unveiled House Bill 6258 on December 5, 2012 as a way to help resolve the State’s pension funding crisis. HB6258 applies to four of the five State-funded pension systems: the Teachers’ Retirement System (TRS), the State Employees’ Retirement System (SERS), the State Universities Retirement System (SURS) and the General Assembly Retirement System (GARS). The bill does not apply to the fifth system, the Judges’ Retirement System.

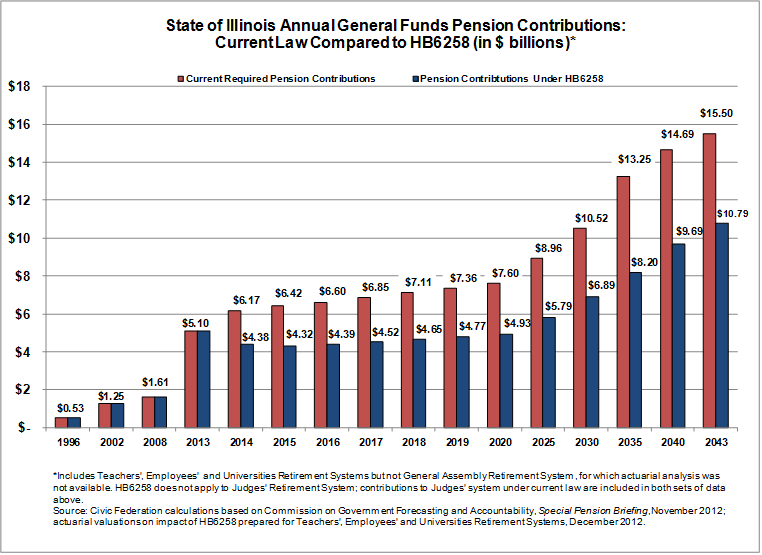

The chart below shows projected State general operating fund contributions under current law and under HB6258. The bill reduces State costs by cutting pension benefits, increasing member contributions and shifting costs from the State to the actual employers of TRS and SURS members: school districts, universities and community colleges. As a result, the General Funds contribution would decline by approximately $1.8 billion, or 29%, in FY2014 from $6.2 billion under current law to $4.4 billion under HB6258. HB6258 calls for 100% funding of pension obligations by FY2043. State contributions would peak that year at $10.8 billion, down from $15.5 billion under current law. (Click to enlarge.)

The chart above is based on actuarial reports for TRS, SERS and SURS, the largest pension funds, which accounted for pension obligations of $156.3 billion, or 98.5% of the total, as of June 30, 2012. An actuarial report for GARS, the smallest system, was not available. The chart excludes contributions to GARS and includes contributions to JRS under current law. Debt service payments on pension bonds—which are expected to total $1.6 billion in FY2013—are not included in the numbers.

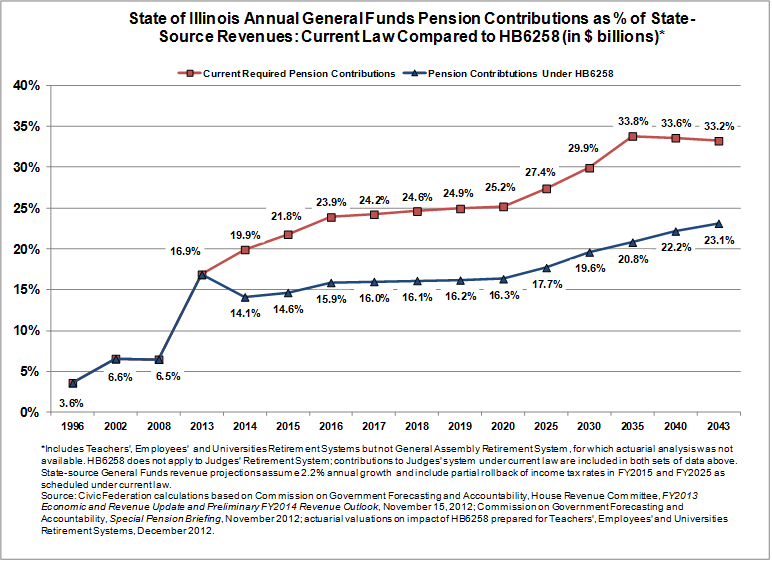

The next chart shows the share of estimated State-source General Funds revenue devoted to pension contributions. The percentage declines from roughly 19.9% in FY2014 under current law to 14.1% under HB6258. In FY2043, the share is 33.2% under current law, compared with 23.1% under HB6258. (Click to enlarge.)

It should be noted that any comprehensive pension reform is likely to face legal challenges that could delay implementation. The Illinois Constitution states that membership in any public pension or retirement system “shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

Under HB6258, automatic annual benefit increases would be limited to $750 a year for those hired before January 1, 2011. Retirees would receive no annual increase until they reach age 67 or five years after they retire. Currently retirees receive annual compounded increases of 3%. Other changes for those hired before January 1, 2011 include a phased-in increase in retirement age; a phased-in two percentage point increase in contributions; and a pensionable salary cap. School districts, community colleges and universities would take over the State’s normal pension cost at a rate of 0.5% of payroll per year for normal costs incurred after July 1, 2013, until costs are fully shifted. New TRS and SURS employees would join a cash balance plan, with contributions by actual employers rather than the State.

At a press conference on January 3, the Civic Federation joined with a group of other civic organizations including the Better Government Association, the Metropolitan Planning Council and the Chicago Urban League to urge State lawmakers to embrace the bipartisan pension reform framework established by House Bill 6258. The groups called on the legislature to take up pension reform during the last days of the 97th General Assembly, which ends when the new legislature convenes on January 9.