January 11, 2012

Data from the most recent audited financial statements of Illinois’ state and local government pension funds shows that the total unfunded liabilities for public employee pensions supported by the taxes of Chicago residents reached $14,896 per capita for fiscal year 2010. That is up from $10,037 per capita in FY2008.

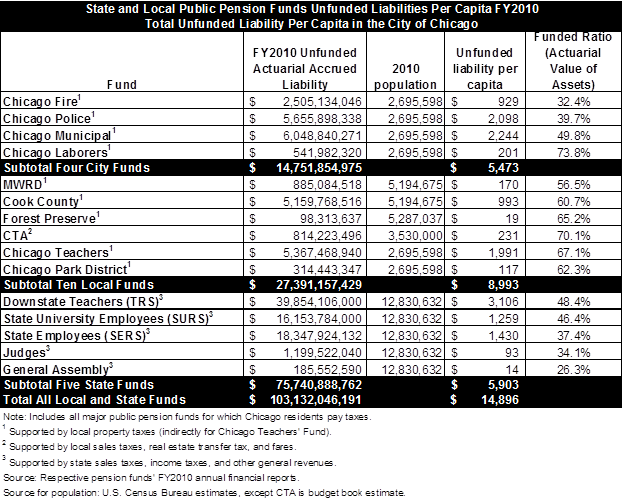

Property taxes paid by Chicago residents (both owners and renters) support the four pension funds for City of Chicago employees as well as the pension funds for employees of the Metropolitan Water Reclamation District, Cook County, Cook County Forest Preserve District, Chicago Public Schools and the Chicago Park District. Chicagoans also pay sales taxes that help to support the Chicago Transit Authority pension fund (CTA does not receive property tax revenue). Recent Civic Federation blog posts have described the deteriorating fiscal health of these funds and the annual Status of Local Pension Funds report provides more detail.

The five State-sponsored pension funds for Illinois government employees are supported by sales taxes, income taxes and other taxes and fees. These revenues are used to pay the state contribution to the Teachers’ Retirement System (covering all teachers except Chicago Public Schools teachers), State University Employees Retirement System, State Employees Retirement System, Judges Retirement System and General Assembly Retirement System. Note that Chicagoans pay taxes to support both the Chicago Public Schools pension fund and the pension fund for all non-Chicago public school teachers.

The total unfunded liabilities of all the five State funds and ten Chicago-area funds reached $103.1 billion in fiscal year 2010.[1] Unfunded liability is the amount owed for both current and future pensions that is not covered by assets (see the Civic Federation’s Status of Local Pensions report for a more technical definition). Put simply, it is the amount of pension promises made for which there is not already money set aside.

If its unfunded liability is zero, a pension fund has enough assets to cover the pension promises that have been made and the funded ratio is 100%. The 2010 funded ratios of the pension funds supported by Chicago taxpayers ranged from a low of 26.3% for the General Assembly fund to a high of 73.8% for the Chicago Laborers’ fund.

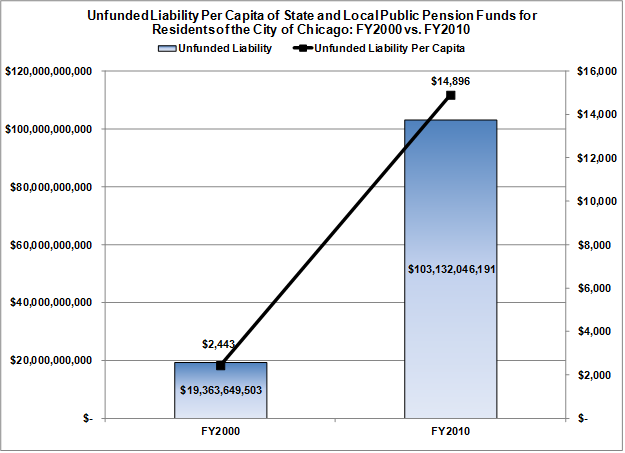

Dividing unfunded liabilities by the population served by each government yields a per capita unfunded liability. The total per capita unfunded liability for the local and state public pension funds supported by Chicago residents was $14,896 in fiscal year 2010, up from $2,443 in fiscal year 2000.

The unfunded liability per capita for the four City of Chicago pension funds alone was $5,473. The figure rises to $8,993 when the other Chicago area local government pension funds are added.

[1] The 2010 fiscal year of the five state pension funds, Chicago Teachers’ fund, and Chicago Park District fund ended June 30, 2010. The 2010 fiscal year of all other funds ended December 31, 2010.