December 15, 2016

On November 16, 2016, Chicago Public Schools (CPS) released an amended FY2017 budget plan based on the contract agreement reached between the District and the Chicago Teachers Union (CTU) on November 1, 2016. The revised budget includes an additional $55 million in spending which CPS plans to fund through $55 million additional tax increment financing (TIF) surplus from the City of Chicago.

The Civic Federation continues to have serious concerns about the CPS FY2017 budget. The budget relies on $215.2 million in additional State funding to help the District make its $721 million pension payment due in June 2017. Governor Rauner vetoed the State funding for CPS teacher pensions on December 1, 2016, and unless the General Assembly votes to override the veto, it is likely that CPS will have to fill the $215.2 million hole through mid-year cuts. The District is already in a precarious financial position with no stabilization fund reserves, a below-investment-grade rating that makes borrowing very costly, the threat of further downgrades and uncertainty about the District’s short-term line of credit. The lack of State funding will only make the situation worse.

Background on the CPS Operating Budget

In late August, the Civic Federation released its analysis of the Chicago Public Schools’ proposed budget for the 2017 fiscal year running from July 1, 2016 through June 30, 2017. The Civic Federation could not support the proposed $5.46 billion operating budget because it relied on uncertain funding sources, one-time revenues and costly short-term borrowing. The CPS budget was based on two assumptions: 1) that CPS would reach a collective bargaining agreement with the Chicago Teachers Union that would generate budgetary savings; and 2) that the State of Illinois would provide $215.2 million to the Chicago Teachers’ Pension Fund (CTPF).

The Civic Federation urged the District to produce a public and transparent contingency plan describing what spending cuts it would need to make in the absence of additional revenue the District was counting on to close the budget deficit. However, the Board approved the budget on August 24, 2016 without a contingency plan. The Board of Education and CPS officials stated at several public meetings that they remained hopeful the State would provide the necessary pension funding.

Teacher Contract

After more than a year of collective bargaining efforts, the Chicago Public Schools and the Chicago Teachers Union reached a new contract agreement in early November. The CTU Big Bargaining Team had previously rejected a contract proposed by the Board of Education in January 2016. That proposal included raises over four years but would have phased out the “pension pick-up” under which CPS pays 7.0% of the 9.0% employee contribution to the Chicago Teachers’ Pension Fund.

Negotiations continued through the spring and summer and the Chicago Teachers Union threatened to strike if CPS moved forward on the elimination of the pension pick-up. In October 2016 the CTU voted to authorize a strike. A strike was avoided, however, after the union’s House of Delegates voted to approve the new contract proposal. The majority of union members also voted in favor of the agreement, thereby ratifying the contract.

The four-year contract, retroactively beginning July 1, 2015 and running through June 30, 2019, includes the following components:

- Continues the 7.0% pension pick-up for current employees, but eliminates the employee pension pick-up for new hires as of January 1, 2017. New employees will now pay the full 9.0% employee pension contribution;

- Includes step and lane raises based on years of service and education level for FY2017 (retroactive to July 2016), FY2018 and FY2019;

- Includes cost of living raises for current teachers of 2.0% in 2018 and 2.5% in 2019, for a total raise of 4.5% over the second two years of the contract. Cost of living raises are not included for the first two years of the contract;

- New teachers hired on or after January 1, 2017 will receive two raises over the base salary of 3.5% each in January 2017 and July 2017;

- Provides support for overcrowded K-2 classrooms by assigning an assistant to classrooms with 32 students or more;

- Includes classroom and operational changes that allow additional time for daily teacher preparation and end of semester paperwork, limiting the work load for special education teachers, and limiting the case management duties of school counselors and special education teachers;

- Reduces the number of available healthcare plans from five to three plans;

- Offers one-time early retirement incentive programs for eligible teachers and support staff, offering a bonus payment based on years of service. At least 1,500 teachers and 600 support personnel must participate in the respective programs; and

- Establishes an Advisory Budget Committee consisting of two elected CTU representatives, two Board of Education members and the CPS Chief Financial Officer to make budget recommendations to the Board.

Cost of the Contract

A CPS fact sheet reported that the total cost across the four years of the contract agreement reached with the Chicago Teachers’ Union is estimated to be $9.45 billion, almost all of which is related to salaries and benefits. The total costs for each year of the contract are listed below. CPS indicates that these figures are estimates only, and could vary based on the workforce and other factors. CPS estimates that the new contract will cost $400 million less over the course of the four-year contract than if the previous 2012-2015 contract were to continue.

Total Estimated Annual Cost:

- $2.30 billion in FY2016

- $2.34 billion in FY2017

- $2.40 billion in FY2018

- $2.41 billion in FY2019

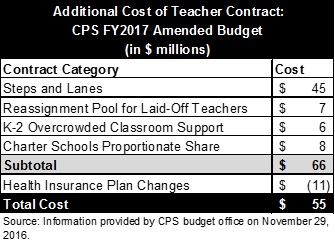

The contract is expected to cost an additional $55.0 million during the current fiscal year (FY2017). This reportedly includes added costs of $66.0 million, offset by $11.0 million in healthcare savings due to a reduction in the number of health insurance plan options. The table below provides a breakdown of the added costs.

CPS plans to cover this year’s additional cost with an extra $55.0 million in TIF revenue from the City of Chicago. The City of Chicago declares a TIF surplus from funds generated by TIF districts that are not dedicated to a project. CPS receives approximately half of the City’s TIF surplus, with the other half going to the other Chicago governments that levy a property tax. This year, the City declared a larger than normal TIF surplus of $175 million, of which CPS will receive a one-time allocation of $87.5 million. This is $55.0 million more than the District’s projected TIF allocation of $32.5 million originally approved in the FY2017 CPS budget.

State Pension Support

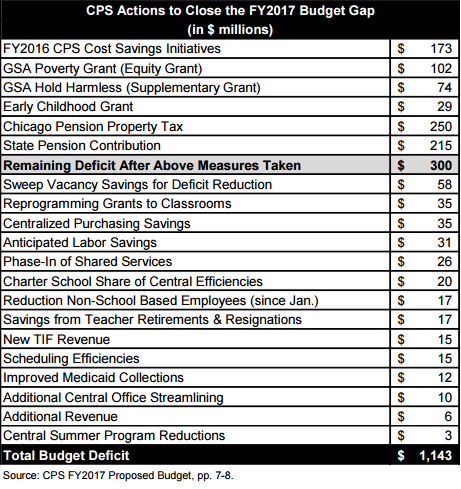

CPS began its 2017 fiscal year with a budget deficit of $1.14 billion. The District outlined numerous measures that would be used close the budget gap, including financial support from the State of Illinois. One of those measures was a pension fund contribution of $215.2 million from the State to cover the employer normal pension cost, appropriated in Senate Bill 2822. The General Assembly passed Senate Bill 2822, House Amendment 3 on June 30, 2016 as part of a larger stopgap spending agreement. However, Governor Rauner indicated he would only sign the bill into law on the condition that the State legislature and Governor could reach an agreement on statewide pension reforms by January. Nonetheless, CPS counted on this funding to balance the budget as shown in the table below.

In its budget analysis, the Civic Federation warned that relying on this appropriation was risky given the difficulty the State has had reaching agreement on pension reform plans. The Civic Federation also recommended that the District provide a plan of recourse if the funding failed to materialize.

On November 7, 2016, Senate President Cullerton sent Senate Bill 2822 to the Governor. Governor Rauner vetoed the bill on December 1, 2016, calling the bill a CPS bailout and stating that Senator Cullerton had broken an agreement to reach comprehensive pension reform. President Cullerton stated in response that he had presented a pension framework to the Governor and expected to continue to negotiate. The Senate voted to override the Governor’s veto but the House adjourned before taking a vote. According to Article IV of the Illinois Constitution, the House has 15 calendar days from the date of the Senate’s vote to hold its own vote to override. An override vote requires a three-fifths supermajority. That makes the deadline for an override December 16, 2016.

If the State does not provide the $215.2 million funding, CPS officials have stated that the Board of Education will consider an additional amended budget at the next board meeting on January 25, 2017.

CPS Amended Capital Plan

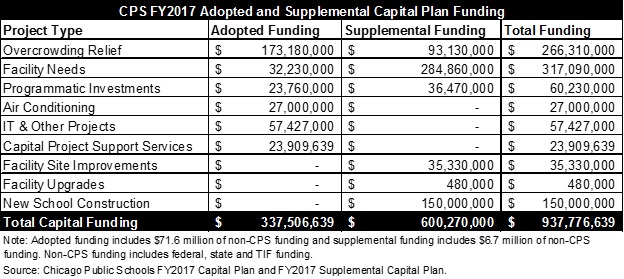

In addition to an amended operating budget, CPS is also proposing an updated capital plan. The original FY2017 budget approved by the Board of Education in August 2016 included $337.5 million in spending on capital projects. The supplemental capital plan calls for an additional $600.3 million in spending on capital projects, reaching a total of $937.8 million for capital projects in FY2017.

On August 16, 2016 CPS announced that it would sell up to $945 million in bonds for construction projects and other expenses. At the time, details of how the funds would be used were not yet available. A supplemental capital plan of $600.3 million in additional projects was released on December 1, 2016. CPS held three public hearings on the evening of December 5, 2016 to receive feedback on the supplemental capital plan from community members and help guide which projects should move forward. The supplemental capital plan was approved by the Board of Education on December 7, 2016. The project types and funding levels for the originally adopted and supplemental capital plans are detailed in the table below.

The Board of Education approved the issuance of Capital Improvement Bonds of up to $840 million at its October 26, 2016 Board Meeting, paid for through the Capital Improvement Tax levy. On December 8, 2016, CPS released a preliminary official statement in anticipation of selling the first $500.0 million of the bonds. Fitch Ratings gave the Capital Improvement Bonds an “A” rating with a stable outlook based on legal opinions that qualified the Capital Improvement Tax as a special revenue source that would be protected if the District were to file for bankruptcy, thus ensuring debt repayment. Fitch maintained its non-investment grade rating of B+ with a negative outlook for CPS as a whole.

According to the preliminary official statement, the District currently has $6.8 billion in total outstanding long-term debt, which includes $140 million in leases with the Public Building Commission. The District is expected to sell the $500.0 million in Capital Improvement bonds this week.

For more on the Civic Federation’s full concerns about the Chicago Public Schools’ budget and recommendations for CPS to improve its financial situation, see the Civic Federation’s analysis of the FY2017 CPS budget.