March 11, 2025

By Sarah Wetmore

The Forest Preserve District of Cook County (FPDCC, or “the District”) adopted its FY2025 budget on November 19, 2024, for the fiscal year that began on January 1, 2025. This is the third annual budget supported by a $40 million increase in property tax revenue approved by Cook County voters in a referendum question on the November 2022 ballot. As a result of the referendum, the Forest Preserve District’s annual adopted budget increased from $137 million in FY2022 to $182.2 million in FY2023, an increase of 33%, reflecting the first year of additional property tax funding. The FY2024 budget increased slightly from FY2023 to $188.7 million. The FY2025 budget of $189.2 million is relatively flat compared to the prior year, increasing by only $531,651 (0.3%) from FY2024.

The 2022 property tax referendum increased the Forest Preserve District’s property tax limiting rate by 0.025%, bringing the District’s total rate to 0.076% of the equalized assessed value of taxable property (i.e., taxable value of property) in tax year 2022. Even with the increase in rate, the Forest Preserve District makes up less than 1% of the total property tax bill paid by Cook County property owners.

The Civic Federation supported the referendum question in 2022 based on several factors the Forest Preserve District was able to demonstrate: a need for the additional funds, a history of responsible efforts to control costs and manage district finances, and a specific plan for how the additional property tax revenue would be allocated. The property tax rate increase for the Forest Preserve District ultimately put this government agency on a much more stable footing. Just a few years ago, the Forest Preserve District had limited revenue options and no easy solutions for addressing its pension funding crisis, paying for a $130 million capital projects backlog, and funding for its ambitious Next Century Conversation Plan. The new property tax revenue provides a recurring funding source that will enable the District to fulfill several long-term needs, including increasing pension funding, financing land restoration, and funding capital improvements.

This analysis will review the District’s plans to use its property tax levy in 2025.

Distribution of Property Tax Revenue Since the 2022 Referendum

The approval of the 2022 ballot referendum question was estimated to generate approximately $40 million in additional property tax revenue for the District annually. One reason the Civic Federation supported the property tax rate increase was the District’s publicly laid out plans for how the additional funds would be used. The District earmarked the funds for a variety of needs, including:

- Funding the District’s pensions at an actuarially sound level to address a long-standing pension funding shortfall;

- Deferred maintenance and capital improvements;

- Capital needs at the Brookfield Zoo and Chicago Botanic Garden;

- Land restoration; and

- Acquisition of more natural lands.

The FPDCC Conservation and Policy Council’s Annual Progress Report for the July 2023 through June 2024 period included detailed measures of how the funds from the referendum have been spent in those categories. (see Attachment A).

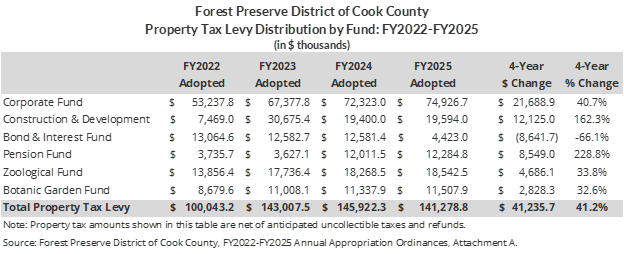

The table below lays out how the District’s property tax revenue between FY2022 and FY2025 has been allocated among six funds. With the approval of the 2022 ballot referendum, the District’s total property tax levy increased from approximately $100 million in FY2022 to $143 million in FY2023, an increase of about $43 million. FY2024 saw a modest increase of $2.9 million before declining by $4.6 million in FY2025, bringing the total to $141.3 million. This decline was primarily due to a significant decrease in the District’s proposed debt service levy of nearly $8.2 million. In FY2024, the FPDCC also retired two bond series issued in 2015, which allowed it to reduce its overall debt service revenue needs. The reduction in the debt service levy was partially offset by a $2.6 million increase in the Corporate Fund levy and smaller increases across the other funds totaling $0.9 million.

It is important to note again that the Forest Preserves’ property tax levy of just under $141.3 million is a very small percentage of the total property taxes billed in Cook County. Total property taxes billed by all government districts across the entire County in tax year 2023 (payable in 2024) totaled $18.3 billion. The FPDCC’s portion of those tax bills accounts for less than 1%.

As shown in the table below, the FY2025 budget shows distinct shifts since FY2022 in the allocation of property tax revenue across the six funds. The largest dollar increase in property tax revenue allocated between FY2022 and FY2025 is seen in the Corporate Fund, the District’s general operating fund. Over the four-year period, the Construction and Development Fund—used for construction, restoration, and improvement of District facilities and land—received an increase of $12.1 million, or 162.3%, and the Pension Fund received an increase of $8.5 million, or 228.8%. Property tax allocated to the Bond and Interest Fund, which supports annual debt service payments, declined significantly for the reasons noted above. As planned, the Brookfield Zoo and Chicago Botanic Garden also received increases in their property tax allocations.

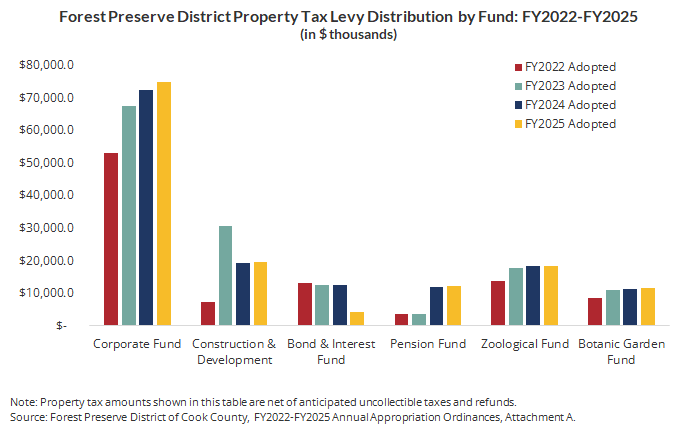

The chart below further illustrates these property tax revenue increases distributed to the six funds identified in the table above during the four-year period between FY2022 and FY2025.