November 12, 2024

The City of Chicago currently faces mounting fiscal challenges, with a projected FY2025 budget gap of $982.4 million. A significant contributor to the City’s rising costs is its rising debt burden over time. More information about the City’s current financial challenges can be found here.

This short-form report provides summary information about the historical and current long-term debt burden of the City of Chicago.

The City of Chicago’s 2024-2028 capital improvement program, which is largely financed with debt, totals $16.3 billion. The City’s very diverse municipal infrastructure portfolio includes two airports, libraries, firehouses, police stations, municipal buildings, streets, sidewalks, viaducts, bridges, sewer and water lines, informational technology projects, shoreline improvements and economic development projects.

A summary of the findings of the debt burden analysis is presented below:

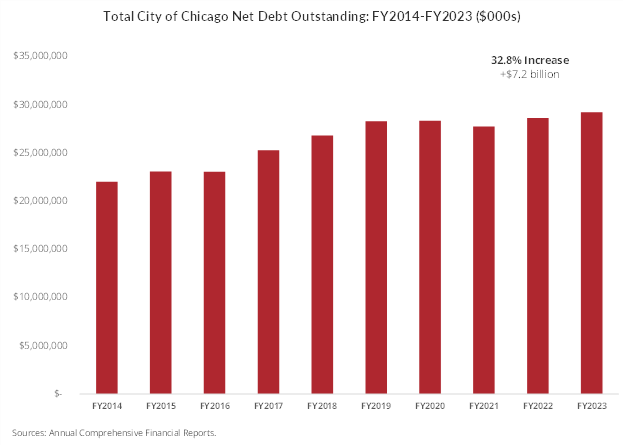

- City of Chicago total net debt outstanding increased by 32.8%, rising from $22.0 billion to $29.2 billion between FY2014 and FY2023. This is a $7.2 billion increase.

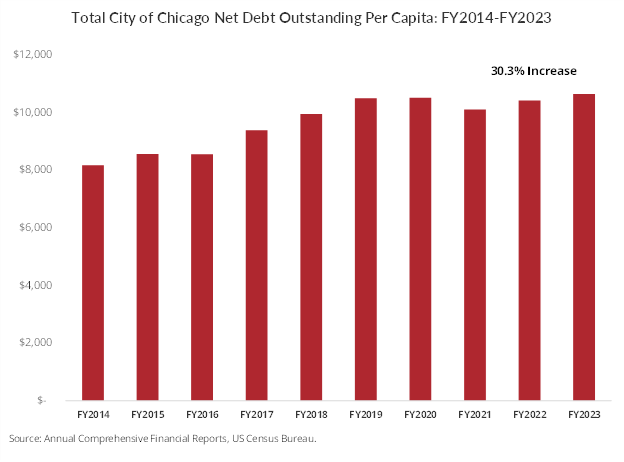

- City of Chicago total debt outstanding per capita increased by 30.3%, rising from $8,166 billion to $10,642 between FY2014 and FY2023.

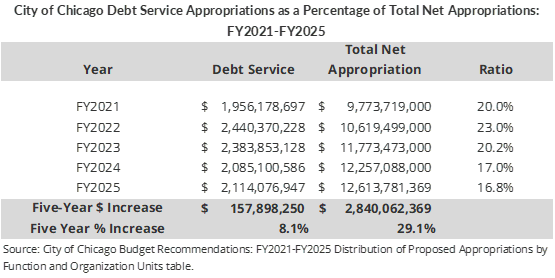

- Chicago’s debt service ratio has averaged 19.4% between FY2021 and FY2025. This exceeds the 15-20% ratio considered high by the rating agencies

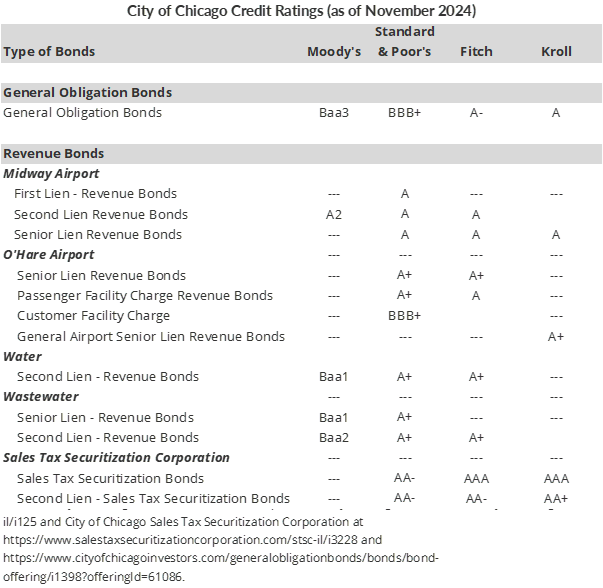

- City of Chicago bonds are currently rated as investment grade issuances by the rating agencies.

Debt Burden Indicators

This analysis uses three commonly used financial indicators of debt burden: trends in the total amount of (1) net debt outstanding, (2) net debt per capita, and (3) ratio of debt service expenditures as a percentage of operating expenditures.

Total Net Debt Outstanding

The City of Chicago has a relatively high amount of net debt outstanding. This is a function of its enormous municipal infrastructure portfolio that includes airports, roads, buildings and water/sewer infrastructure.

Chicago government debt primarily consists of general obligation (GO) and revenue debt.

GO debt is paid for with general taxes, such as the property tax. Governments provide a full faith and credit pledge for this type of debt, an unconditional commitment to pay the debt. Revenue debt is supported by dedicated revenue sources, such as user fees and charges. It is often utilized to construct, maintain or rehabilitate revenue-generating enterprises such as airports or water and sewer networks. The government’s revenue pledge is more limited than the pledge for GO debt, so this type of debt can carry higher interest costs.

Types of Debt Issued

Most of the City of Chicago’s debt is revenue debt, reflecting that it operates several large fee-generating enterprises such as airports and the water and sewer system. Revenue bonds have been issued to finance water, airport, and wastewater transmission projects and maintenance. Motor fuel revenue bonds are used to repair streets and pavements.

Sales Tax Securitization Corporation (STSC) debt is issued to pay for certain City obligations. This entity intercepts local share sales tax revenues collected by the State of Illinois and places them in a lockbox to pay the debt service. More information about the STSC can be found here. This type of debt averaged 58.7% of all City debt outstanding between FY2014 and FY2023.

Net general obligation debt averaged 30.9% of all City debt outstanding in the reviewed time period.

Smaller amounts of debt issued include tax increment financing bonds and capital leases. Tax increment financing debt is paid for by taxes on incremental value increases of property values in TIF districts.

Net Debt Outstanding Trends

Increases over time in government-issued long-term debt bear watching as they are a potential sign of escalating financial risk. A rising debt outstanding trend raises concerns that unless a government secures additional revenues or reduces spending at the same time that it increases its debt burden, it may have difficulty making principal and interest payments at some point in the future. Rising expenditures on debt also mean that less funding is available for other public priorities. Data for this indicator comes from governmental audited Annual Comprehensive Financial Reports; FY2023 is the latest year for which complete data are available.

The following chart shows the total net general obligation and revenue debt for the City of Chicago for the 10-year period between FY2014 and FY2023. The figures presented below for general obligation debt are for net debt, which includes unamortized premiums or discounts and capital appreciation bonds accreted interest. In this period, City of Chicago total net debt outstanding increased by 32.8%, rising from $22.0 billion to $29.2 billion. This is a $7.2 billion increase.

Net Debt Outstanding Per Capita

A commonly used measure of the debt burden on residents and taxpayers is net debt outstanding per capita. This indicator divides the amount of debt outstanding (the indicator discussed above) by the total population of the jurisdiction. Increases over time in the ratio bear watching as a potential sign of increasing financial risk in much the same manner as increases in total debt outstanding figures do. Data for this indicator comes from governmentally audited Annual Comprehensive Financial Reports.

The following chart shows net general obligation and revenue debt outstanding per capita for the City of Chicago for the 10-year period between FY2014 and FY2023. In this period, City of Chicago total debt outstanding per capita increased by 30.3%, rising from $8,166 billion to $10,642.

Debt Service Appropriations Ratio

The ratio of debt service expenditures as a percentage of total Governmental Fund or operating expenditures is frequently used by rating agencies to assess debt burden. Debt service payments at or exceeding 15-20% of all appropriations are considered high by the rating agencies. This metric provides a useful “apple to apples” comparison of relative burden. Data for the indicator comes from the City’s annual budget.

Chicago’s total debt service appropriations in FY2025 are projected to be 16.8% of total local fund net appropriations, or $2.1 billion out of expenditures equaling $12.6 billion. The City will appropriate $470.8 million in general obligation debt service alone in FY2025.

Since FY2021, debt service appropriations have risen by 8.1% to $21.1 billion, while total net appropriations have increased by 29.1% or $12.6 billion. The debt service ratio has averaged 19.4% over the five-year period analyzed. The debt service ratio has declined over the five-year period analyzed, declining from 20.0% to 16.8%. However, the FY2025 debt service ratio at 16.8% is high, reflecting the City’s large debt burden.

Credit Ratings

The rating agencies evaluate the creditworthiness or credit quality of government bond issuances based on how well the government manages its debt portfolio, relative debt burden, revenue capacity, financial performance and the underlying economic base. Based on the analysis, they assign a letter grade credit rating, which influences the cost of borrowing for issuers. Higher ratings translate to lower interest rates that the issuer offers to lenders, while lower ratings increase those costs.

Investment grade bonds are given “AAA” to “BBB-" ratings from Standard & Poor's and Fitch, while Moody’s assigns "Aaa" to "Baa3" ratings. Bonds with these ratings are considered relatively safe investments. Lower credit ratings indicate that the debt issues are non-investment grade or “junk” bonds. They carry ratings of “BB+” to “D” for Standard and Poor's and Fitch, and "Ba1" to "C" for Moody’s. They are higher-risk investments. The governments issuing these bonds may have liquidity issues and there may be a risk of default.

The table below shows current City of Chicago credit ratings for general obligation, revenue and Sales Tax Securitization Corporation debt. City of Chicago bonds are currently rated as investment grade issuances.

The City of Chicago has received several upgrades over the past few years from credit rating agencies for both the City’s long-term general obligation debt and other debt. The rating upgrades were primarily due to the City’s improved economic and revenue conditions as it emerged from the depths of the COVID-19 pandemic. The upgrades also reflect the City’s efforts to reduce liabilities by making additional payments for its pension funds.

Fitch Ratings upgraded City of Chicago general obligation debt to an A- rating from BBB+ with a stable outlook and Sales Tax Securitization Corporation senior lien debt to AAA from AA+ with a stable outlook in July 2024. The upgrades were based on several factors: a change in Fitch’s rating methodology, an expectation that reserves would be maintained at 10% or more, that the City would maintain sound fiscal policies, that it would balance its budget through recurring methods with limited reliance on one-time revenues such as fund balance. The rating agency warned that a negative rating action or downgrade could result if the City depleted its reserves to less than 10% of Corporate Fund spending, if it relied on structural methods of balancing its budget or if failed to make its statutorily required pension contributions.1

References

1 Fitch Ratings. Rating Action Commentary. Fitch Rates Chicago, IL's GOs 'A-'; Upgrades IDR and GOs on Criteria Change; Removed from UCO, July 26, 2024.