November 13, 2024

On October 30, Chicago Mayor Brandon Johnson introduced the City’s proposed FY2025 budget. The proposed budget included a variety of measures to close a projected $982.4 million budget deficit that was first predicted in last year’s budget forecast.

The Civic Federation released a FY2025 Budget Roadmap report in mid-October as a guide for the City’s budgeting process, outlining the major financial issues facing the City of Chicago and short- and long-term options for securing its finances. The Roadmap highlighted the City’s persistent structural budget deficit, including the propensity to use one-time revenue sources to cover recurring operating expenses and budget gaps and to reflexively increase taxes rather than identify efficiencies. Unfortunately, the City’s proposed FY2025 budget released last month relies on many of the same past practices and does little to put the City in a better structural position in future fiscal years, for which projections forecast even more significant deficits. This is particularly concerning as Corporate Fund revenues decreased by 1.5% from last year, primarily due to a decline in personal property replacement taxes (PPRT). Of added concern is tension between the City’s projected revenue projections for FY2025 and the more conservative economic and revenue projections in the State of Illinois Governor’s Office of Management and Budget Fiscal Year 2025 Economic and Fiscal Policy Report published two days after the introduction of the proposed FY2025 City budget.

This short piece will outline some of the mechanisms proposed by the City to close the City’s $982.4 million budget gap for FY2025 and provide the framework for the Civic Federation’s coming work on the City’s finances.

The City proposes to offset the budget deficit through $593.2 million in savings and efficiencies and $444.5 million in increased revenue (offset by $55.3 million in investments). One of the primary areas of savings and efficiencies include $247.6 million in operational efficiencies largely stemming from the elimination of over 744 full-time vacant positions. Four hundred and fifty-six of these positions come from the Chicago Police Department, and the vast majority of those, as proposed, are civilian positions. Many of these were converted from sworn positions a year ago, but not filled. A substantial number of them may be critically necessary to meet the City’s legal obligations under the ongoing federal Consent Decree, for which compliance is already lagging far behind the mandated schedule. Additional “savings” of $300 million are characterized as a reduction of Corporate Fund subsidies to pension funds. This is generally understood to be constituted of reimbursements from Chicago Public Schools for payments the City makes for non-teacher pension contributions the City is obligated to make under State law even though the CPS non-teachers are not City employees.

The budget also fails to fully account for two critical forthcoming costs: a pending firefighters contract in its third year of negotiation that, with each passing day, results in an increase in the amount of past due wages owed to the members, estimated to likely exceed $300 million, and a fix to Tier 2 pensions. Therefore, unless otherwise accounted for, the budget will require future adjustments in FY2025 that will increase the deficit.

The $444.5 million in increased revenue in the budget proposal derives primarily from an additional $215.4 million in increased revenue projections, $14 million from improved debt collection and $21.4 million in revenue enhancements.

Further exacerbating the structural imbalance, the City also significantly relies on several non-recurring revenue sources, including a record $570.8 million TIF surplus, $131.9 million of which goes to the City’s Corporate Fund (the remaining $298.1 million will go to Chicago Public Schools) and $139.6 million from the City’s prior-year fund balance. While many of these proposals will require further analysis to fully ascertain, the continued use of one-time revenues is concerning, especially with exceedingly high pension and debt burdens.

The proposed budget also calls for a $300 million property tax increase, which the Federation cautioned should be a last resort in the wake of a looming reassessment and a likely property tax increase from other local governments. The Federation believes that there remain other alternatives to this particular outcome. While the Federation understands that the City has limited options for revenue within its own home rule authority, more options would be available had sufficient work been done in the interim to prepare the City for the budget gap predicted more than a year ago.

Below are some other components of the proposed budget that the Federation will be following for further clarification:

- As previously mentioned, the proposed budget includes cutting a total of 743 vacant positions across the City, 456 of which come from the Chicago Police Department. Also included in the cuts are a 45% decrease in the Office of Constitutional Policing and Reform and a host of other recently civilianized slots, which will seriously impair the City’s ability to both reform and mission capacities needed to meet federal court Consent Decree compliance obligations.

- The City is opting to continue its recent practice of making substantial supplemental pension payments, with a proposal of a payment of $272 million in FY2025. The Civic Federation has supported supplemental pension payments in the past as a responsible use of revenues but noted that foregoing the payment in whole or in part should be considered as an option to balance the budget gap. The City has asserted that discontinuing the supplemental payment could have detrimental impacts on the City’s credit rating. That is unquestionably the case standing on its own. However, the Federation contends that if the payment was reduced or eliminated as part of a larger suite of fiscal moves that included expenditure reductions that affected structural changes in the coming year and beyond, rating agencies may view the City less critically for taking measures to improve its financial condition.

- There have been no detailed briefings regarding the pension service deduction for Chicago Public Schools. While we can assume that part of CPS’s $298.1 million share of the FY2025 TIF surplus will cover the $175 million MBEAF payment, there are no details on where the remaining $125 million would be spent. If our assumption is correct, there must be a refreshing of an agreement between CPS and the City to provide public assurance that the reimbursements will be made. This added assurance is especially needed given CPS’ decision not to follow through on the latest tranche of a multi-year Memorandum of Understanding between the two government bodies that is ultimately unenforceable in its existing form.

In essence, there is insufficient information on the City’s improved revenue projections. Specifically, the City is relying on $215.4 in improved revenues. However, as previously mentioned, the Illinois Governor’s Office of Management and Budget (GOMB) report released last week projects reductions in the revenue forecast for FY2025 based on corporate profit and sales tax declines. The Federation will monitor these disparities.

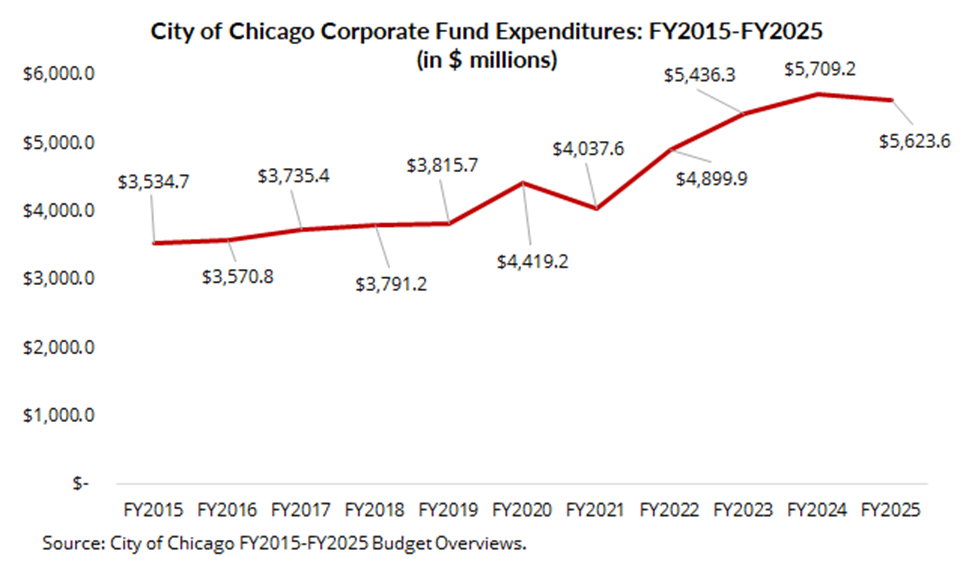

What appears unacknowledged and unexplained in the proposed budget, possibly because it has not been examined, are expenses from operations that could possibly be trimmed. As explained in the Civic Federation’s FY2025 Budget Roadmap report, approximately 40% of the City’s total net operating expenses are devoted to debt service and pension obligations. Yet, operations appropriations have risen steadily over the last ten years. As shown below, Corporate Fund expenditures totaled approximately $3.5 billion in FY2015 (this does not include debt or pension payments). Just prior to the pandemic, it was approximately $3.8 billion. Coming out of the pandemic in 2023, it was over $5.4 billion. Regular wage and benefit increases baked into collective bargaining agreements, much of which can be seen as a cost-of-living offset account, account for a significant portion of the increases. Beyond that, however, it is unquestionably the case that the government has grown and done so without the sustainable increases on the revenue side needed to support them.

The Administration’s budget proposal is not the beginning of the end but rather the end of the beginning of the budget process. With an even larger budget gap predicted for FY2026, it is imperative that the City work to better position itself for fiscal sustainability. This includes undertaking the studies recommended by the Federation to identify additional government efficiencies and any requisite work needed to implement additional revenue measures, either through home rule authority or collaboration with the State. Notwithstanding customary practice that views the City budget as providence of the Mayor, the City operates under what is legally a strong Council, weak mayor system because it is the City Council that passes the budget. This year’s compressed budget season should be a jump-off point for the City Council to more fully inhabit that authority as a co-equal partner with the Mayor in the formulation of the budget and impel through consideration of accompanying ordinances and actions needed to better prepare the City for FY2026. The Federation will monitor the budget process and will be releasing supplemental analyses in the coming weeks.