March 05, 2025

By Grant McClintock

Following a lengthy political debate, Chicago’s FY2025 enacted budget managed to technically fill a nearly $1 billion projected budget gap. However, as the Civic Federation noted in its City of Chicago FY2025 Roadmap released in October 2024, Chicago has a persistent structural budget deficit that was largely unaddressed in the most recent budget process and resulted in a credit downgrade in January 2025. There will likely be another large budget gap in FY2026 with fewer financial options for mitigation. This short report will outline the factors contributing to Chicago’s structural deficit and how the City reports that the FY2025 budget gap was/will be closed.

Structural Deficit

A structurally balanced budget is one in which recurring revenues equal or exceed recurring expenditures. This provides financial stability for a government in the long term. In contrast, a non-structurally balanced budget is one that uses one-time, non-recurring revenues to fund recurring expenditures. This practice, which has been used in Chicago for at least a generation, masks serious systemic financial problems and is unsustainable. Examples of Chicago’s one-time revenue reliance over the years include:

- The use of federal COVID-19 relief funding from the American Rescue Plan Act (ARPA) to balance budgets and create new programs and initiatives;

- Annual reliance on tax increment financing (TIF) surplus funding;

- The use of prior-year unassigned fund balance (often referred to as reserves); and

- Debt refinancing that produces savings upfront but increases costs down the road or extends the lifetime of bonds, also referred to as “scoop and toss” borrowing.

FY2025 Budget Gap Closure

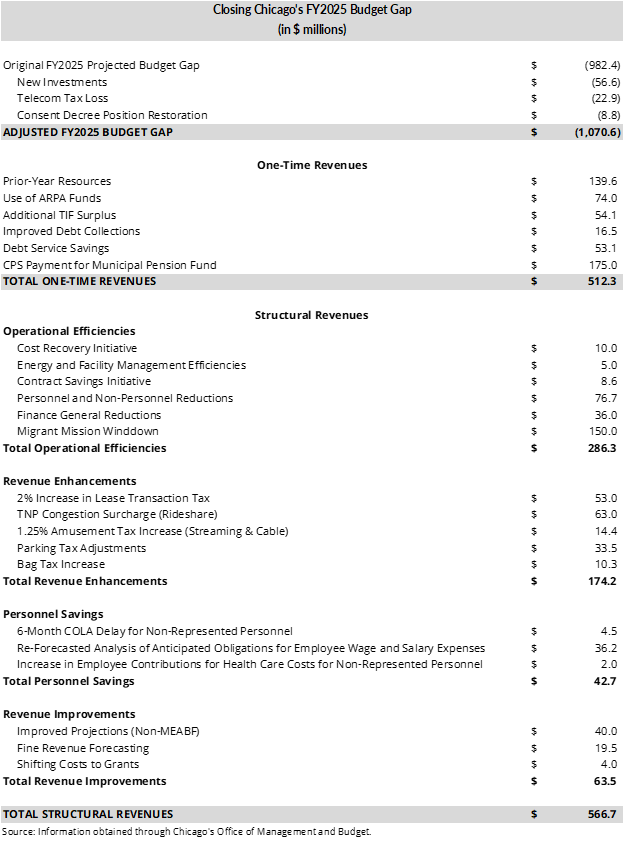

The City initially projected a budget gap of $982.4 million for FY2025. After accounting for $56.6 million in additional investments, a $22.9 million loss in telecommunications tax revenue, and a reinstatement of positions required by the Chicago Police Department Consent Decree that were initially cut in the budget proposal, the adjusted budget gap increased to nearly $1.1 billion.

The Mayor’s initial budget proposal included a plan to close the budget gap and balance the FY2025 budget through a combination of both one-time and recurring sources and included a $300 million property tax increase, which would free up $300 million for use in the general operating fund, also known as the Corporate Fund. When the Mayor’s initial request for a $300 million property tax increase was universally rejected by the City Council, the City turned to several tax rate increases to generate additional revenue to close the deficit. It also relied on Chicago Public Schools (CPS) to contribute $175 million to the City to cover the CPS employees who participate in the Chicago Municipal Employees Annuities and Benefits Fund (MEABF, or “Municipal Pension Fund”).

The table below illustrates how the City’s enacted budget plans to close the $1.1 billion deficit in FY2025. The solutions include $566.7 million in structural—or recurring—fixes and $512.3 million in one-time fixes. The structural solutions include $286.3 million in operational efficiencies (more than half of which is from the elimination of the City’s migrant program), $42.7 million in personnel savings, $40 million in improved revenue projections, $19.5 million in revised revenue forecasting, and $4 million from shifting costs to grants from the General Fund. To help replace the amount that would have been generated by a property tax increase, the City also approved a series of tax increases generating $172.4 million in revenue, including:

- $53 million from a 2% increase from 9% to 11% for the Lease Transaction Tax on cloud computing services;

- $63 million from a congestion surcharge increase on rideshare services;

- $14.4 million from a 1.25% increase in the amusement tax for streaming and cable services;

- $33.5 million from adjustments to the parking tax; and

- $10.3 million from a three-cent ($0.03) increase to the checkout bag tax, bringing the new tax to 10 cents per bag.

The City also used a series of one-time revenues to make up for the remaining $512.3 million revenue shortfall. These one-time revenues include the use of $139.6 million in prior-year fund balance, $74 million in ARPA funds, $16.5 million in improved debt collections, $53.1 million in debt service savings, $54.1 million in additional TIF surplus, and a $175 million pension payment from Chicago Public Schools for non-teacher CPS employees to the Municipal Pension Fund. The City classified this payment as a structural solution, even though CPS has so far declined to make the payment the City assumed in FY2024 and has denied any legal obligation to fulfill the City’s payment request for FY2024 and FY2025. Beginning in 2020, CPS agreed to cover a portion of this pension payment via annual intergovernmental agreements. However, these agreements do not appear to be binding or enforceable, and the City remains legally required to cover this cost. In short, absent a formal enforceable agreement or a change in State law, CPS is not obligated to make this payment. This is one of the many financial entanglements between the City of Chicago and Chicago Public Schools that remain unresolved. If CPS does not make the $175 million payment, the City has publicly indicated that it will need to tap into further reserves to balance last year’s finances.

The fact that nearly half of the City’s FY2025 budget deficit was filled through one-time revenues is concerning and does little to address the City’s persistent structural deficit going forward. Having failed to do the requisite work to right-size the budget for FY2025, the City will need to look for additional efficiencies or revenue increases to better financially position itself for the coming years, alleviate the need for one-time revenues in future budgets, and avoid further credit downgrades.