April 10, 2015

A week after passing legislation to address a $1.6 billion budget deficit before the end of the fiscal year in June, the State swept $300 million into its operating accounts from funds designated to pay for annual transportation construction projects. An additional $200 million sweep of sales tax funds collected by the State to be distributed to local governments has yet to be transferred over to the State’s General Funds.

As previously discussed here, Governor Bruce Rauner and the General Assembly approved House Bill 318 (Public Act 99-002) that authorizes $1.3 billion to be transferred from the State’s Other Funds to the General Funds to pay for ongoing government operations. The remaining FY2015 budget gap was closed through cuts totaling $444 million offset by increases of $187 million for a budget reduction of $257 million. The supplemental budget changes were included in House Bill 317 (Public Act 99-001), which accompanied the sweeps legislation.

Highway Construction Fund Sweeps

The fund sweeps included taking $250 million from the Road Fund and $50 million from the Motor Fuel Tax Fund, which are the largest accounts in the State’s Highway Funds and are not usually considered targets for budgetary relief. The State uses these funds to pay for ongoing capital projects and debt service on previous construction. The Highway Funds also are used to provide the State’s portion of shared projects with the federal government in order to qualify for matching funds.

Based on preliminary estimates included in the Governor’s FY2016 budget, balances in the Highway Funds will be diminished after the sweeps but not completely emptied. The budget shows the Highway Funds maintaining a total balance of $1.1 billion at the end of FY2015 on a cash basis. This includes $968 million in the Road Fund and $115 million in the Motor Fuel Tax Fund. In April, $250 million was swept out of the Road Fund and $50 million was moved out of the Motor Fuel Tax Fund, which was not accounted for in the budget estimate. After adjusting for the $300 million sweeps, the Highway Fund balance is reduced by $27.7% to $783 million.

The cash basis estimate in the budget book shows the amount at the close of the fiscal year on June 30. On a budgetary basis the fund balances were shown much lower due to spending that takes place after the end of the fiscal year but is based on total FY2015 appropriated expenses. According to the FY2016 budget, the Highway Funds are only projected to have a balance of $930 million and less the $300 million sweep the amount would total $630 million, or 32.2% less.

Over the past ten years the Road Fund has more than doubled its year-end balance, which increased from $421.0 billion in FY2007 to $915.1 million in FY2014. The Fund was originally projected to increase by $53 million in FY2015 but after the sweep will decline by $196 million. The total balance in the Road Fund will be reduced by 21.5% to $718.2 million due to the sweeps.

Despite the decline in the Road Fund balance it will still represent 25.0% of the annual expenditures made from the Fund in FY2015 which totals $2.9 billion.

The following table shows the annual Road Fund revenue, expenditures and change in fund balance from FY2007 through the projected FY2016 budget after accounting for the FY2015 fund sweeps.

As shown in the table above, the sweeps will not affect the planned spending in FY2015 but will reduce the balance at the end of the year.

As shown in the table above, the sweeps will not affect the planned spending in FY2015 but will reduce the balance at the end of the year.

Legislators were provided with a memo from the Illinois Department of Transportation, prior to approving the sweeps legislation stating that despite the reduction in fund balance, the department would still be able to continue with the $1.85 billion road construction program for the current year.

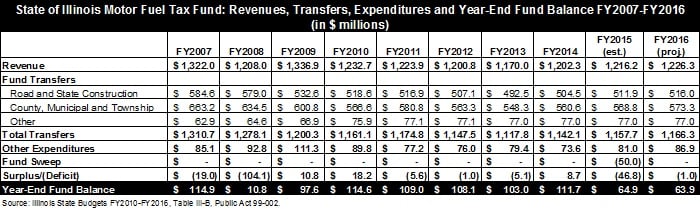

The balance in the Motor Fuel Tax Fund will drop much further proportionally than the Road Fund due to the $50 million sweep in FY2015. Historically, the Motor Fuel Tax Fund has not seen the same amount of increase in its fund balance, which has been relatively flat over the last ten years. The State ended FY2014 with a balance in the Motor Fuel Tax Fund totaling $111.7 million, which is slightly less than the FY2007 total of $114.9 million. The FY2016 budget estimated that the Fund’s balance would increase by $3.2 million at the end of FY2015 but due to the sweep now is expected to decline by $46.8 million, or 41.9%, totaling $64.9 million.

The State expects to take in revenues of $1.2 billion in the Motor Fuel Tax Fund and spend approximately the same amount prior to the sweeps. This includes a series of transfers to the State’s other accounts including the Road Fund and transfers to counties, municipalities and townships to pay for local road projects.

The following table shows Motor Fuel Tax Fund revenues, transfers, expenditures and fund balance from FY2007 through FY2016.

The Transportation Department issued a memo regarding the Motor Fuel Tax Fund sweep stating that the reduction in the balance would delay distribution of funds to local governments in April but that payments would return to normal the following month.

Local Tax and Other Fund Sweeps

The remaining $1.0 billion of sweeps approved in HB318 come from the balances of more than 100 funds in the State’s Other Funds. The State of Illinois has approximately 550 Special Funds that receive earmarked revenues and are used for designated purposes outside of and sometimes to supplement the regular General Funds operating budget. These Funds are expected to have balances totaling $2.7 billion at the end of FY2015 prior to the sweeps.

The State’s Other Funds also include Federal Trust Funds with balances that are estimated to total $322.1 million at the end of FY2015 and State Trust Funds with balances of $182.5 million, on a cash basis.

The second largest sweep authorized in HB318 after the Road Fund is $200 million taken from the Local Government Trust Fund. The budget book does not include details on the Local Government Trust Fund balance for FY2015. The fund is part of the State Trust Funds and is used to deposit sales tax revenues that are collected by the State and passed on to local governments. The fund receives 15% of the proceeds from the sales tax applied to automobile sales and the 1.0% sales taxes collected on food and drugs. According to data on the Illinois Comptroller’s website, the Local Government Tax Fund currently has a balance of only $164.8 million and the sweeps to the General Funds have not yet taken place.

Although the legislation does not use any Federal Trust Fund balances for General Funds spending, it does authorize the transfer of $48.0 million from the Federal High Speed Rail Trust Fund to “improve the stability” of the State’s General Obligation Retirement and Interest Fund (GOBRI). The GOBRI Fund is used to make the State’s annual debt service payments.

The high speed rail account is a part of the State’s Special Funds and is not a Federal Trust Fund. However, the fund does receive funding pursuant to an agreement between the State and federal government for the joint construction of high speed rail lines in the region. The cash balance of the Federal High Speed Rail Trust Fund is not included in the funds listed in the budget book. According to Comptroller’s website, the fund currently has a balance of $26.4 million. It is unclear when this transfer will take place and the effect it would have on the State’s high speed rail projects.

Since the FY2015 budget depends on the full sweeps amount of $1.3 billion any balances not available to be swept before the end of the fiscal year would create a deficit and need to be filled with other resources, cut from other spending or would increase the backlog of unpaid bills that is already expected to total more than $6.0 billion.