April 22, 2016

The State of Illinois’ budget impasse could cost taxpayers another $138 million due to liabilities associated with its swaps portfolio, if the lack of a spending plan causes its bond ratings to fall much further.

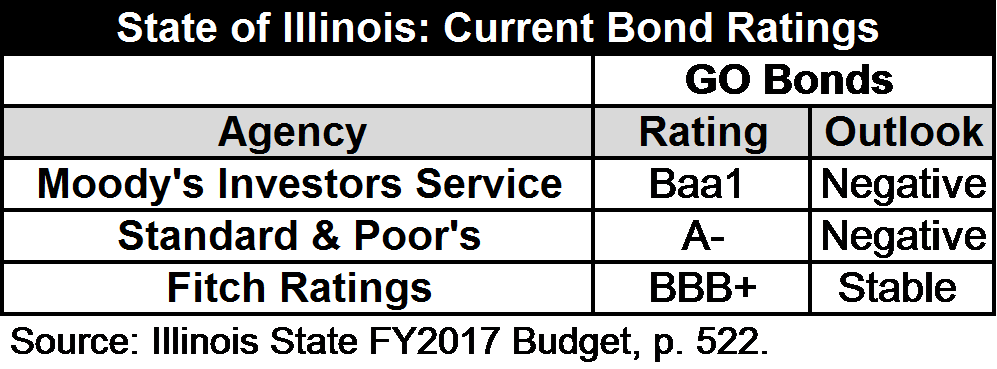

As previously discussed here, two of the three major rating agencies cut Illinois’ bond ratings in October 2015 due to its ongoing budget crisis and worsening financial condition. These downgrades make Illinois the only state credit currently rated below the ‘A’ category and signal a weakened capacity for the government to meet its financial obligations.

The downgrades also put Illinois dangerously close to incurring additional liabilities under its swaps agreements.

The State’s debt portfolio includes five derivative instruments, also known as swaps, tied to its variable rate bonds totaling $600 million that were sold in 2003. Swaps are used to convert the State’s variable rate debt to synthetically fixed rate payments through agreements with counterparties that are intended to offset interest rate risk.

Under the terms of the contract, if the State’s credit rating falls below a certain threshold the deal is terminated and the State must pay the market value of the deals at the time of the termination. The State also then would continue to pay the variable rate interest on the loans as set forth in the original bond sale. If the ratings for the State’s GO Bonds falls below Baa2 with Moody’s or BBB for Fitch and S&P, then the State would owe whatever the current calculated market value of the swaps were at that time.

The following table shows the current bond ratings for Illinois’ General Obligation Bonds including the outlook from each of the three major ratings agencies.

According to the Governor’s FY2017 budget, as of December 31, 2015, the State’s swaps portfolio has a negative value of $138.0 million, which is an increase in its liability exposure from the negative value of $123.7 million reported as of June 30, 2014. The State’s credit rating would trigger its swaps termination clauses if either Moody’s or S&P reduced its credit rating two levels or if S&P reduced its rating by three levels.

The negative outlook from both Moody’s and S&P indicate that additional downgrades are a real risk.

In order to maintain its variable rate debt, the State also maintains letters of credit totaling $600 million. The State’s current letters of credit cost 2.6% interest annually or $15.6 million and must be renewed or replaced each year. These loans are necessary because variable debt allows investors to resell the debt on a weekly basis when the interest rate also resets. If the investors cannot find buyers in the market, the State must buy the notes. The letters of credit are used to cover these costs.

Any amounts of the credit used to reimburse investors must be paid over a three year period according to the terms of the current deals, which expire on November 26, 2016.

The State also pays a synthetically fixed interested rate of 3.89% on the $600 million principal amount of variable rate debt to the counterparties to its swaps. Combined with the letters of credit this makes for an effective interest cost for the variable rate bonds of 6.46%.

If the swaps were terminated the State would not only have to pay for the negative market value of the swaps deals, it would also still need to pay interest on the outstanding principal of $600 million and likely would refinance the bonds into more predictable fixed-rate debt.

Helpful Links

- Blog: Illinois Hit with Downgrades as Budget Stalemate Continues

- For more on the State of Illinois Debt see pages 512-530 of the Governor’s FY2017 Budget recommendation.

- The Government Finance Officers Association’s best practices for use of variable rate debt is available here.